Clean Harbors (CLH) Snaps Up HEPACO for $400 Million Cash

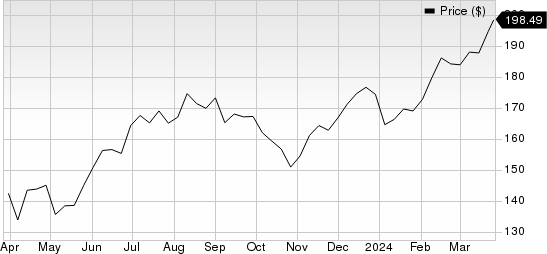

Clean Harbors, Inc. CLH shares have gained 50% over the past year, significantly outperforming the 33.6% growth of the industry it belongs to and the 31% rally of the Zacks S&P 500 composite.

The company has finalized its purchase of HEPACO, a leading provider of specialized environmental and emergency response services. The acquisition from Gryphon Investors was valued at $400 million in cash, funded by the proceeds from a recent $500 million Term Loan facility expansion.

HEPACO employs around 1,000 people, serves over 2,000 clients and operates across more than 40 regional sites in 17 states.

Clean Harbors, Inc. Price

Clean Harbors, Inc. price | Clean Harbors, Inc. Quote

Strategic Acquisition Offers Diverse Growth Prospects

This acquisition aligns with Clean Harbors’ Vision 2027 long-term strategic plan, targeting growth by consistently delivering value across its business spectrum. It is poised to enhance the company's Environmental Services segment, significantly boosting customer acquisition and retention efforts.

Adding HEPACO is projected to augment Clean Harbors' waste volumes across its disposal and recycling facilities and unlock cross-selling avenues, especially in industrial services and hazardous waste management.

The addition is set to bolster Clean Harbors’ Field Services business with complementary offerings and foster synergies in subcontracting, branch network, asset rentals, transportation and procurement.

HEPACO's expert personnel and specialized equipment will enhance Clean Harbors' rail and marine service offerings.

Clean Harbors foresees approximately $20 million in cost synergies within the first full operational year post-acquisition. The company also projects that HEPACO will contribute around $30 million in adjusted EBITDA for 2024.

Eric Gerstenberg, co-chief executive officer of Clean Harbors, said, "HEPACO is an ideal cultural fit with our existing Field Services business, and we are confident that this will be a highly synergistic deal with strong margin improvement potential.”

Zacks Rank and Stocks to Consider

Clean Harbors currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are HNI HNI and PagSeguro Digital PAGS.

HNI currently sports a Zacks Rank of 1 (Strong Buy). HNI has a long-term earnings growth expectation of 12%. You can see the complete list of today’s Zacks #1 Rank stocks here.

HNI delivered a trailing four-quarter earnings surprise of 54.8%, on average.

PagSeguro Digital sports a Zacks Rank of 1 at present. PAGS has a long-term earnings growth expectation of 14.3%.

PAGS delivered a trailing four-quarter earnings surprise of 10.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

HNI Corporation (HNI) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report