A Cleaner Way To Access Crypto

Two investing themes that are popular with younger investors—ESG and cryptocurrency—are seemingly at odds. Bitcoin mining is an energy-intensive process, and one that only grows more so as the necessary calculations get more complex over time.

Current estimates put bitcoin mining as responsible for 0.5% of all electricity consumption worldwide. While that doesn’t sound like a lot, consider that this means bitcoin mining consumes more electricity than some entire countries, including Finland or Norway.

One ETF, the Viridi Cleaner Energy Crypto-Mining & Semiconductor ETF (RIGZ), seeks to marry these two popular themes.

The fund is an actively managed fund that offers exposure to crypto-miners and semiconductor companies that use clean energy sources or have pledged to switch to environmentally friendly energy sources in the future.

The ETF also allows for the use of carbon offsets, meaning companies can pay money to “offset” their emissions rather than rely on clean sources of energy.

Growing Focus

Bitcoin’s reliance on fossil fuels came under scrutiny in May after Elon Musk tweeted that Tesla suspended vehicle purchases using bitcoin, just months after tweeting that the company was accepting the cryptocurrency as payment.

There has also been much speculation about how China’s ban on cryptocurrency mining and transactions could affect bitcoin mining’s reliance on fossil fuels.

According to Cameron Collins, CFA, investment analyst at Viridi funds, China’s reliance on coal was part of the impetus for the fund.

“Bitcoin mining is an enormous waste of energy. There are a lot of Chinese operators historically that were deriving their energy from coal and other dirty energies,” he said. “We saw an opportunity in the marketplace to align ESG values with cryptocurrency mining.”

While the fund’s track record is only a few months long, performance since the July 2021 launch has been impressive.

RIGZ has nearly doubled the return of the Amplify Transformational Data Sharing ETF (BLOK), which is currently the only blockchain-related ETF to have over $1 billion in AUM.

Diversification Vs. Concentration

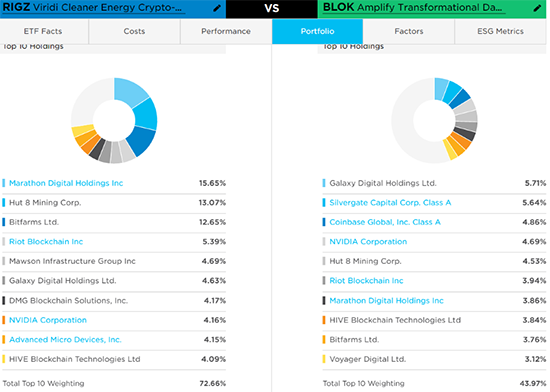

RIGZ is heavily concentrated, with only 19 holdings within the ETF, the majority of which are also found within BLOK. But BLOK’s broader mandate lends itself to more diversification and less single-stock risk.

Michael Venuto, portfolio manager on the BLOK ETF, notes that “BLOK is focused on all segments of blockchain companies including miners, transactions, venture, private blockchain applications, conglomerates, and exposure to bitcoin through the Canadian spot ETFs. Generally we have up to 25% in each segment, and approximately 5-6% in any single holding.”

These differences in portfolio construction are clearly seen by using the ETF Comparison Tool.

Courtesy of FactSet

(For a larger view, click on the image above)

RIGZ’s top holding, Marathon Digital Holdings Inc., has gained 86.3% in the trailing three months. And its second largest holding, Hut 8 Mining Corp., is up 124.0% over the same time period.

While concentration within these names has been an advantage for RIGZ over recent months, ETFs that have high single-stock risk could see this work against them if performance of these larger holdings faces a rough patch.

Growing Pressure

China’s ban on cryptocurrency mining has shifted more mining operations onto U.S. soil. This is creating headaches for some utilities companies.

Idaho Power is asking the Idaho Public Utilities Commission to create a new customer class for commercial and industrial cryptocurrency mining operations. The utility company argues that the high energy demands of the activity could lead to the need for new gas plants or solar farms to keep up with the increased demand.

While this is a problem that can’t be solved by changing the source of the energy, the utility company’s proposition of a new customer class does underscore the high energy demands of industrial mining operations.

With climate risk a growing concern for many, RIGZ’s focus on mining fueled by clean energy could be a more palatable way for green-minded investors to get access to these types of investments.

Contact Jessica Ferringer at jessica.ferringer@etf.com or follow her on Twitter

Recommended Stories