Clear Channel Outdoor Holdings, Inc.'s (NYSE:CCO) Subdued P/S Might Signal An Opportunity

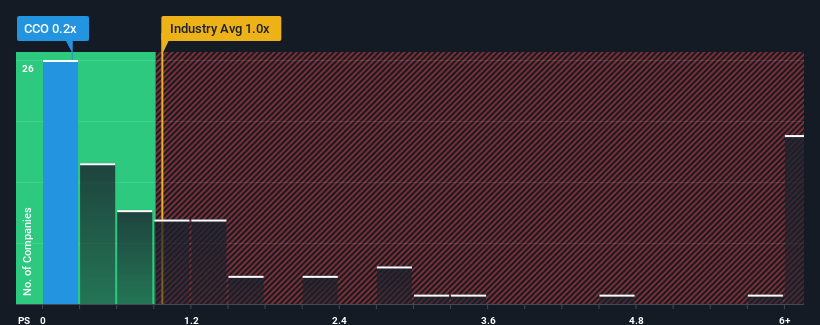

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Clear Channel Outdoor Holdings, Inc. (NYSE:CCO) is a stock worth checking out, seeing as almost half of all the Media companies in the United States have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Clear Channel Outdoor Holdings

How Has Clear Channel Outdoor Holdings Performed Recently?

With revenue growth that's superior to most other companies of late, Clear Channel Outdoor Holdings has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clear Channel Outdoor Holdings.

Is There Any Revenue Growth Forecasted For Clear Channel Outdoor Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Clear Channel Outdoor Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Still, lamentably revenue has fallen 7.6% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 4.2% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.5% per year, which is not materially different.

In light of this, it's peculiar that Clear Channel Outdoor Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Clear Channel Outdoor Holdings' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Clear Channel Outdoor Holdings currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 3 warning signs we've spotted with Clear Channel Outdoor Holdings (including 1 which is a bit unpleasant).

If you're unsure about the strength of Clear Channel Outdoor Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here