Clear Secure (NYSE:YOU) shareholders have earned a 15% return over the last year

We believe investing is smart because history shows that stock markets go higher in the long term. But if when you choose to buy stocks, some of them will be below average performers. Unfortunately for shareholders, while the Clear Secure, Inc. (NYSE:YOU) share price is up 13% in the last year, that falls short of the market return. We'll need to follow Clear Secure for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Check out our latest analysis for Clear Secure

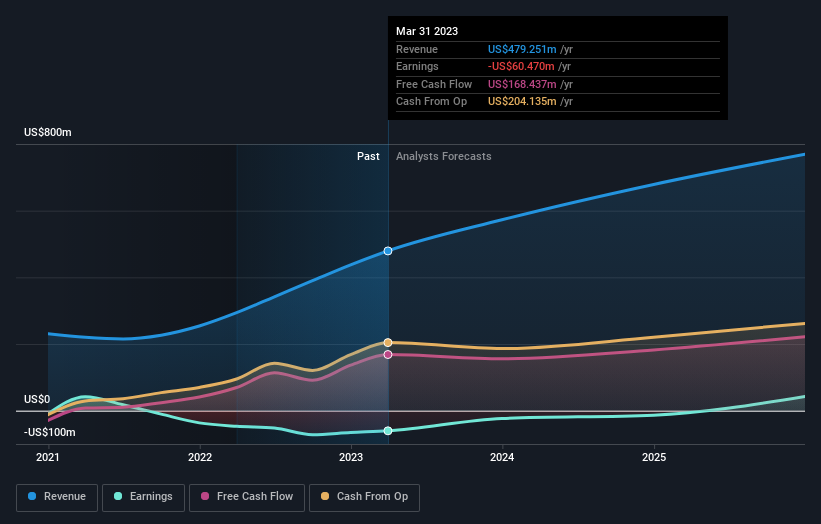

Given that Clear Secure didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Clear Secure grew its revenue by 63% last year. That's a head and shoulders above most loss-making companies. Let's face it the 13% share price gain in that time is underwhelming compared to the growth. It could be that the market is missing what growth investor Matt Joass calls 'the hidden power of inflection points'. It could be that the stock was previously over-hyped, or that losses are causing concern for the market, but this could be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Clear Secure stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

With a TSR of 15% over the last year, Clear Secure shareholders would be reasonably content, given that's not far from the broader market return of 16%. However, the share price has actually dropped 7.1% over the last three months. It may simply be that the share price got ahead of itself, although you might want to check for any weak results. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Clear Secure you should be aware of.

Of course Clear Secure may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here