Clearwater Paper Corp Reports Solid Q4 and Full Year 2023 Results Amid Strategic Shifts

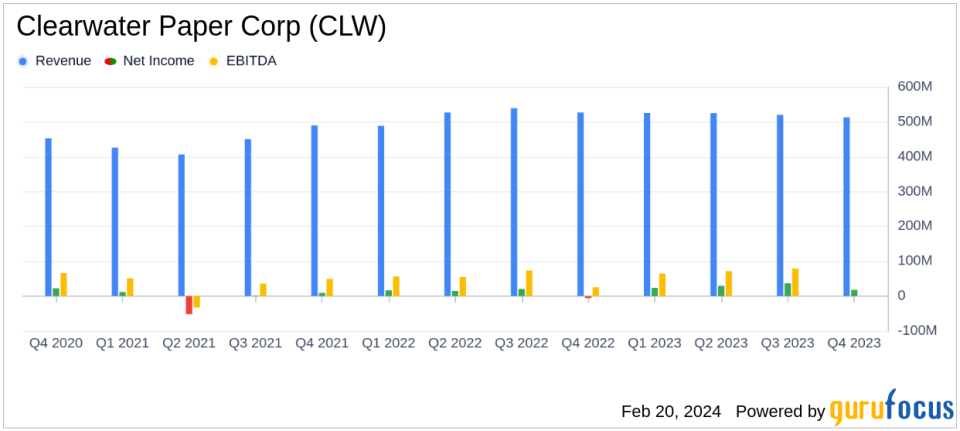

Net Income: Q4 net income of $18 million, full-year net income of $108 million.

Adjusted EBITDA: Q4 Adjusted EBITDA of $63 million, full-year Adjusted EBITDA of $281 million.

Net Sales: Q4 net sales of $513 million, full-year net sales of $2.1 billion.

Debt Reduction: Net debt reduced by $89 million in 2023, with over $450 million reduced since 2020.

Share Repurchase: $18 million of shares repurchased in 2023.

Strategic Acquisition: Definitive agreement to acquire Graphic Packaging's Augusta facility for $700 million.

On February 20, 2024, Clearwater Paper Corp (NYSE:CLW) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading manufacturer and seller of private label tissue, paperboard, and pulp-based products, reported a net income of $18 million, or $1.04 per diluted share, for the fourth quarter, and a net income of $108 million, or $6.30 per diluted share, for the full year. Adjusted EBITDA for the fourth quarter was $63 million, and $281 million for the full year, marking a significant improvement from the previous year.

Clearwater Paper's net sales for the fourth quarter were $513 million, a slight decrease from the $527 million reported in the fourth quarter of 2022. However, full-year net sales remained steady at $2.1 billion. The company's strong performance was particularly evident in the tissue segment, where demand remained robust, and favorable input costs contributed to improved margins. Conversely, the paperboard segment experienced softness, but the company effectively managed supply and demand to control inventories.

The company also made a strategic move by signing a definitive agreement to acquire Graphic Packaging's Augusta, Georgia bleached paperboard manufacturing facility for $700 million. This acquisition is expected to contribute $140-150 million in Adjusted EBITDA annually by the end of 2026, including volume and cost synergies. Clearwater Paper anticipates the transaction to close in the second quarter of 2024, subject to regulatory approvals and other customary conditions.

Clearwater Paper's Pulp and Paperboard segment reported net sales of $251 million for the fourth quarter, down 8% from the previous year, with operating income of $27 million. The Consumer Products segment, however, saw a 3% increase in net sales to $262 million for the fourth quarter, with operating income of $31 million. Retail tissue volumes sold increased by 1% for the fourth quarter and 3% for the full year, with average net selling prices also rising.

The company's balance sheet reflects a continued focus on debt reduction, with net debt decreasing by $89 million in 2023. Clearwater Paper has reduced its net debt by more than $450 million since 2020, demonstrating a strong commitment to improving its financial position. Additionally, the company repurchased $18 million of outstanding shares in 2023, signaling confidence in its future prospects.

Looking ahead to 2024, Clearwater Paper anticipates continued strength in the tissue business and a recovery in paperboard demand in the second half of the year. The company's strategic focus will be on completing the Augusta acquisition and integrating the new facility into its operations.

Clearwater Paper's financial tables highlight key data, including a decrease in net sales for the Pulp and Paperboard segment and an increase for the Consumer Products segment. The company's strategic updates and outlook suggest a shift towards growth in paperboard, leveraging the upcoming acquisition to enhance its market position.

For value investors and potential GuruFocus.com members, Clearwater Paper Corp's latest earnings report and strategic moves indicate a company that is not only managing its current segments effectively but also positioning itself for future growth. The acquisition of the Augusta facility could be a transformative step for the company, offering potential for significant EBITDA contributions and a stronger competitive stance in the paperboard industry.

Investors and analysts can access further details and discuss these results during Clearwater Paper's earnings conference call, which will be held at 2:00 p.m. Pacific Time on Wednesday, February 21, 2024. The live webcast and supplemental information will be available on the company's website, with a replay also accessible for those unable to attend the live event.

Clearwater Paper's commitment to shareholder value, quality, and service remains central to its operations, as evidenced by its financial results and strategic initiatives. The company's focus on cash flow generation and inventory management, alongside its pursuit of strategic opportunities, positions it well for continued success in the Forest Products industry.

Explore the complete 8-K earnings release (here) from Clearwater Paper Corp for further details.

This article first appeared on GuruFocus.