Clearway Energy (CWEN) Q2 Earnings Lag Estimates, Sales Beat

Clearway Energy Inc. CWEN reported second-quarter 2021 earnings of 30 cents per share, which lagged the Zacks Consensus Estimate of 42 cents by 28.6%. Earnings were down 26.8% from the prior-year quarter.

Revenues

The company's total revenues for second-quarter 2021 were $380 million, which surpassed the Zacks Consensus Estimate of $371 million by 2.4%. Total revenues also improved 15.5% year over year.

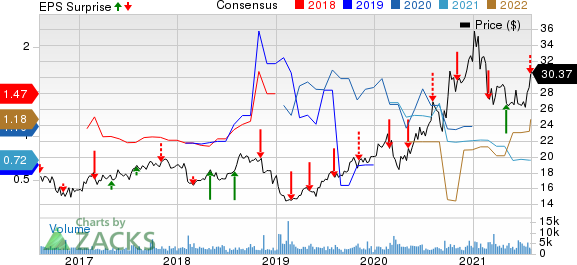

Clearway Energy, Inc. Price, Consensus and EPS Surprise

Clearway Energy, Inc. price-consensus-eps-surprise-chart | Clearway Energy, Inc. Quote

Highlights of the Release

Total operating expenses for second-quarter 2021 amounted to $247 million, increasing 24.1% year over year. Operating income was $133 million, up 2.3% year over year.

Interest expenses for the quarter were $103 million, up 10.8% year over year.

The company’s board of directors approved a 1.7% increase in quarterly dividend rate to 33.45 cents. Clearway Energy is on course to achieve 5-8% annual dividend growth target over the long term.

The company continues to expand renewable assets through partnerships and acquisitions.

Financial Position

It had cash and cash equivalents of $138 million as of Jun 30, 2021, down from $268 million on Dec 31, 2020.

Total liquidity as of Jun 30, 2021 was $810 million, down from the Dec 31, 2020 level of $894 million. The decline was due to execution of growth investments and redemption of the 2025 Senior Notes. This was partially offset by the issuance of the 2031 Senior Notes.

Long-term debt as of Jun 30, 2021 was $7,434 million compared with $6,585 million on Dec 31, 2020.

The company's net cash flow from operating activities for first-half of 2021 was $241 million compared with $184 million in the year-ago period.

Guidance

Clearway Energy reaffirmed its 2021 cash available for distribution guidance of $325 million.

Zacks Rank

The company currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Enphase Energy, Inc. ENPH reported second-quarter 2021 adjusted earnings of 53 cents per share, which surpassed the Zacks Consensus Estimate of 42 cents by 26.2%.

SolarEdge Technologies SEDG came out with second-quarter earnings of $1.28 per share, which surpassed the Zacks Consensus Estimate of $1.12 by 14.3%.

NextEra Energy Partners, LP NEP incurred a loss of 97 cents per unit for second-quarter 2021. The Zacks Consensus Estimate was earnings of 67 cents.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

NextEra Energy Partners, LP (NEP) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Clearway Energy, Inc. (CWEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research