Clearway Energy (CWEN) Q2 Wind Production Down, Hurts Revenues

Clearway Energy, Inc. CWEN has announced a concerning decline in wind production from its assets in the second quarter of 2023. The company's wind fleet performed nearly 25% below internal median production estimates, with the Alta Wind Complex's production falling even further at around 20% below expectations.

This unprecedented drop in wind production has resulted in an estimated decrease in the company's second-quarter revenues, ranging between $25 and $30 million. This incident highlights the inherent challenges and uncertainties faced by renewable energy companies, particularly those relying on wind power. Wind production can be influenced by various factors, such as weather patterns, regional conditions and occasional anomalies.

Despite the near-term setback, Clearway remains optimistic about its long-term prospects and is committed to its dividend growth objectives. CWEN remains committed to achieving the upper range of its 5% to 8% annual dividend growth objective through at least 2026 while maintaining a long-term payout ratio of 80-85%.

The Role of Renewables in Energy Transition

Dependence on weather, which is unpredictable, is a major drawback for renewable energy generation. Despite this, renewable energy usage is on the rise globally as it assists in lowering emissions.

Per the International Energy Agency (“IEA”) report, renewables will become the largest source of global electricity generation by early 2025, surpassing coal, and their share of the power mix will reach 38% in 2027. Out of the renewable power usage, wind and solar energy are expected to increase at a faster pace, contributing 20% of global power generation in 2027.

As evidenced by the IEA report, renewable sources are going to play a crucial role and assist utilities in their energy transition. Companies from the Zacks Utilities sector are setting targets to reduce their emissions. Among them are Alliant Energy LNT, Xcel Energy XEL and Duke Energy DUK. These companies will make substantial investments and have decided to add more renewable energy sources to their generation portfolio and exit from polluting sources to achieve zero-emission targets.

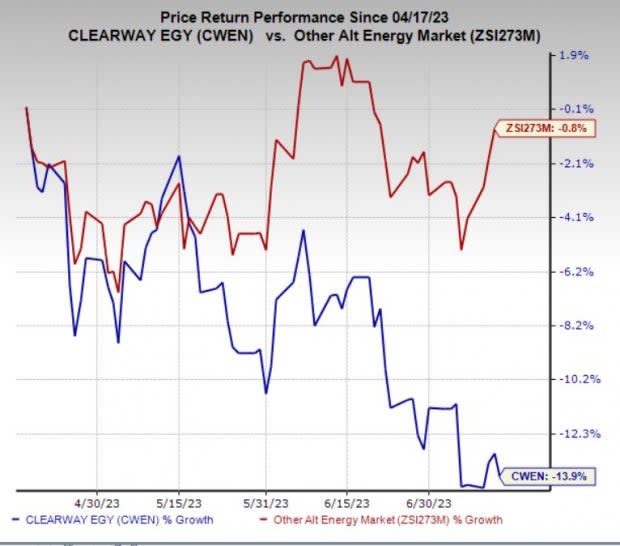

Price Performance

Over the past three months, shares of Clearway Energy have dropped 13.9%, wider than the industry’s 0.8% decline.

Image Source: Zacks Investment Research

Zacks Rank

Clearway Energy currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

Clearway Energy, Inc. (CWEN) : Free Stock Analysis Report