Cleveland-Cliffs (CLF) to Report Q3 Earnings: What's in Store?

Cleveland-Cliffs Inc. CLF is slated to release third-quarter 2023 results after the closing bell on Oct 23.

The company beat the Zacks Consensus Estimate for earnings in two of the last four quarters, while missed once and posted in-line result on the other occasion. It has a trailing four-quarter earnings surprise of roughly 5.3%, on average.

Cleveland-Cliffs is likely to have gained from healthy overall volumes and lower steelmaking unit costs in the third quarter. However, weaker selling prices are likely to have hurt its margins.

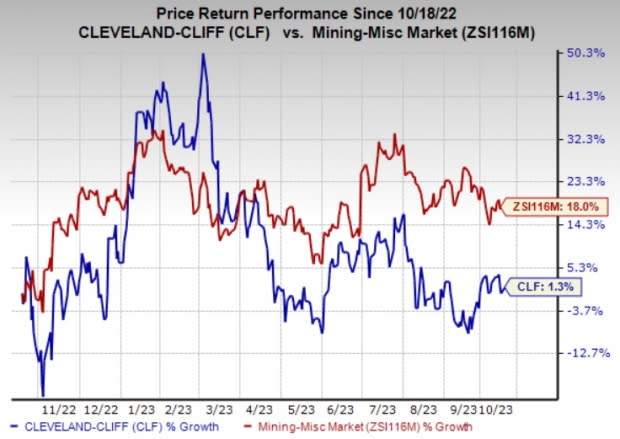

The stock has gained 1.3% in a year’s time compared with the industry’s 18% rise.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for the upcoming announcement.

What do the Estimates Say?

The Zacks Consensus Estimate for third-quarter consolidated revenues for Cleveland-Cliffs is currently pegged at $5,480 million, which suggests a year-over-year decline of 3.1%.

Some Factors to Watch For

The company is likely to have witnessed lower sales volumes in the automotive market in the September quarter due to outages at OEMs. However, healthy overall demand in its end markets is likely to have supported its total volumes in the quarter. Our estimate for external sales volumes for steel products stands at 4.204 million net tons, suggesting a 15.6% year-over-year rise and essentially flat sequentially.

Meanwhile, U.S. steel prices have witnessed a sharp downward correction. The benchmark hot-rolled coil (HRC) prices have retracted from their April 2023 peak of around $1,200 per short ton. Prices have fallen more than 40% from the highs hit in April, currently hovering around $700 per short ton. The downward drift partly reflects shorter lead times. The UAW's strike against General Motors, Ford and Stellantis also weighed on HRC prices of late.

Weaker year-over-year average selling prices are likely to have impacted the company’s performance in the quarter to be reported. Our estimate for average net selling price per net ton of steel products is pegged at $1,257 for the third quarter, indicating a 7.6% year-over-year decline.

Cleveland-Cliffs is also expected to have benefited from actions to lower unit costs. Lower steelmaking unit costs are likely to have supported margins in the third quarter. The company, in its second-quarter call, said that it sees an additional $40 per net ton saving on steel unit costs from the second to the third quarter.

Cleveland-Cliffs Inc. Price and EPS Surprise

Cleveland-Cliffs Inc. price-eps-surprise | Cleveland-Cliffs Inc. Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for Cleveland-Cliffs this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for Cleveland-Cliffs is -4.76%. This is because the Most Accurate Estimate is currently pegged at 44 cents while the Zacks Consensus Estimate stands at 46 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Cleveland-Cliffs currently carries a Zacks Rank #4.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Element Solutions Inc ESI, scheduled to release earnings on Oct 25, has an Earnings ESP of +1.94% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for ESI’s earnings for the third quarter is currently pegged at 34 cents.

CF Industries Holdings, Inc. CF, slated to release earnings on Nov 1, has an Earnings ESP of +0.73% and carries a Zacks Rank #3 at present.

The consensus mark for CF’s third-quarter earnings is currently pegged at 97 cents.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +8.70%.

The Zacks Consensus Estimate for Kinross' earnings for the third quarter is currently pegged at 9 cents. KGC currently carries a Zacks Rank #3.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Cleveland-Cliffs Inc. (CLF) : Free Stock Analysis Report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report