Cleveland-Cliffs Inc (CLF) Reports Mixed Full-Year and Q4 Earnings Amidst Market Challenges

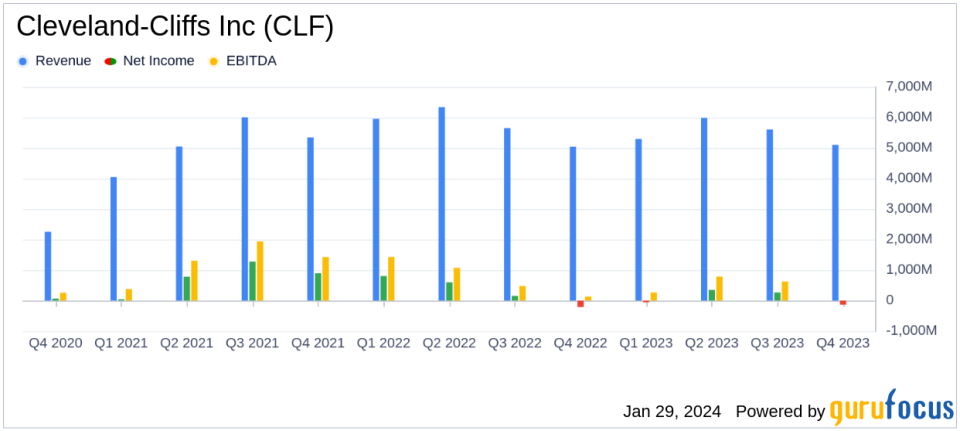

Full-Year Revenue: Declined slightly to $22.0 billion from $23.0 billion in the previous year.

Net Income: Full-year GAAP net income of $450 million, down from $1.4 billion in the prior year.

Steel Shipments: Record steel shipments of 16.4 million net tons, with robust automotive sector performance.

Free Cash Flow: Generated $1.6 billion, including approximately $500 million in Q4.

Debt Reduction: Year-end net debt reduced to $2.9 billion, surpassing the target of $3.0 billion.

Adjusted EBITDA: $1.9 billion for the full year, a decrease from $3.2 billion in 2022.

Cleveland-Cliffs Inc (NYSE:CLF), a leading flat-rolled steel producer in North America, released its 8-K filing on January 29, 2024, detailing its financial results for the full year and fourth quarter ended December 31, 2023. Despite a slight decline in annual revenue from $23.0 billion to $22.0 billion, the company achieved record steel shipments of 16.4 million net tons, including record automotive shipments, highlighting its strong position in the automotive industry.

The company's full-year GAAP net income stood at $450 million, or $0.78 per diluted share, a significant decrease from the previous year's $1.4 billion, or $2.55 per diluted share. Adjusted net income was $545 million, with adjusted EPS of $1.07 per diluted share. The reduction in net income and Adjusted EBITDA, which was $1.9 billion compared to $3.2 billion in 2022, was primarily driven by lower steel index pricing in 2023.

Operationally, Cleveland-Cliffs demonstrated robust cash flow management, generating $2.3 billion in cash flow from operations and achieving a free cash flow of $1.6 billion. The company strategically used the majority of this free cash flow to reduce its net debt by $1.3 billion, surpassing its publicly stated target by ending the year with a net debt of $2.9 billion.

Financial Performance and Strategic Focus

During the fourth quarter, Cleveland-Cliffs reported consolidated revenues of $5.1 billion, a slight increase from $5.0 billion in the same quarter of the previous year. However, the company recorded a GAAP net loss of $139 million, or $0.31 per diluted share, with an adjusted net loss of $25 million or $0.05 per diluted share. This compares favorably to the prior-year fourth-quarter net loss of $204 million, or $0.41 per diluted share. The fourth-quarter Adjusted EBITDA was $279 million, more than double the $123 million from the same period in 2022.

Chairman, President, and CEO Lourenco Goncalves highlighted the company's achievements, including significant reductions in unit costs and the expectation of further decreases in 2024. He also emphasized the company's strong liquidity position, with a record $4.5 billion at year-end, and the strategic focus on aggressive share buybacks given the company's undervalued shares.

Our position as an American leader in the steel industry has never been stronger, and that is particularly relevant in turbulent periods for the world, like the one we are living through right now. We remain committed to all stakeholders of Cleveland-Cliffs," said Mr. Goncalves.

Balance Sheet and Cash Flow Highlights

The company's balance sheet shows a healthy liquidity position with $198 million in cash and cash equivalents, and a total equity of $8.122 billion. The reduction in net debt is a testament to the company's commitment to financial discipline and its ability to generate free cash flow even in a challenging market environment.

Looking ahead, Cleveland-Cliffs expects steel shipment volumes to slightly increase to 16.5 million net tons in 2024, with steel unit cost reductions of approximately $30 per net ton. Capital expenditures are projected to be between $675 to $725 million. The company also anticipates its Adjusted EBITDA performance in the first quarter of 2024 to meaningfully exceed the performance in the fourth quarter of 2023.

Cleveland-Cliffs' focus on reducing costs, improving operational efficiency, and maintaining a strong balance sheet positions the company well for the future, despite the ongoing challenges in the steel industry. Investors and stakeholders can look forward to continued strategic initiatives aimed at enhancing shareholder value and maintaining the company's industry leadership.

Explore the complete 8-K earnings release (here) from Cleveland-Cliffs Inc for further details.

This article first appeared on GuruFocus.