Climb Global Solutions Inc (CLMB) Achieves Record Net Sales and Earnings in Q4 and FY 2023

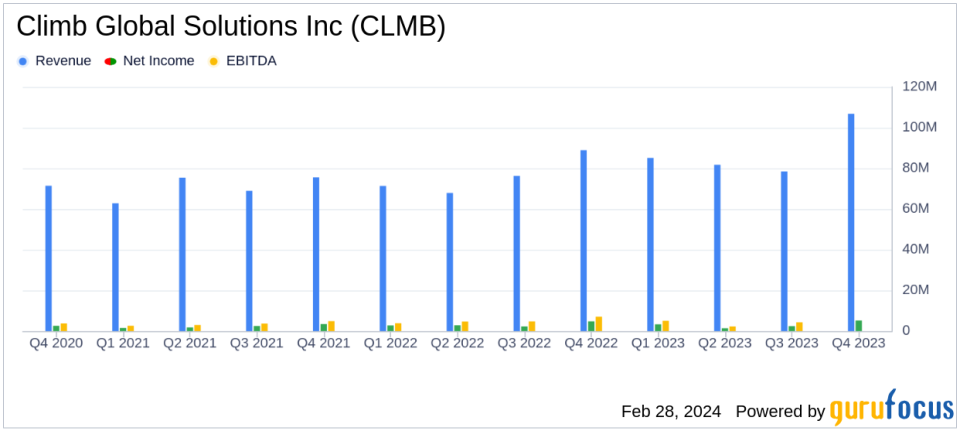

Net Sales: Q4 net sales surged 20% to $106.8 million; FY 2023 net sales climbed 16% to a record $352.0 million.

Net Income: Q4 net income rose 10% to $5.2 million; FY 2023 net income reached $12.3 million, with adjusted net income of $14.1 million excluding one-time items.

Earnings Per Share (EPS): Q4 EPS increased to $1.15; FY 2023 EPS was $2.72, with adjusted EPS of $3.13 excluding one-time CEO stock grant.

Adjusted EBITDA: Q4 adjusted EBITDA grew 24% to $9.2 million; FY 2023 adjusted EBITDA up 16% to $24.6 million.

Dividend: CLMB declared a quarterly dividend of $0.17 per share, payable on March 15, 2024.

On February 28, 2024, Climb Global Solutions Inc (NASDAQ:CLMB) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading cloud-based, value-added IT distribution and solutions provider, reported record levels of net sales, net income, adjusted EBITDA, and EPS for both the quarter and the fiscal year.

Climb Global Solutions Inc operates through various business units across the USA, Canada, and Europe, including Climb Channel Solutions and Grey Matter. The company specializes in distributing technical software and providing cloud solutions and value-added services.

Financial Performance and Challenges

The company's impressive performance in Q4 and FY 2023 was driven by organic growth and the successful integration of DataSolutions, acquired in October 2023. The acquisition was immediately accretive to earnings, contributing to the company's growth in the U.S. and Europe. Despite these achievements, the company's earnings per diluted share in Q4 were negatively impacted by foreign exchange rates and acquisition fees related to DataSolutions.

CEO Dale Foster commented on the company's strategy, emphasizing the leverage of global infrastructure to drive organic growth and the execution of M&A initiatives.

Looking ahead, our strategy remains unchanged: leverage our global infrastructure to drive organic growth while executing our M&A initiatives. We will continue to evaluate opportunities to expand our geographic footprint, as well as our service and solutions offerings. Between our robust balance sheet, a growing pipeline of prospective vendors and a demonstrated track record of accretive M&A, we are well positioned to continue driving shareholder value."

Key Financial Metrics

CLMB's financial achievements are particularly important in the IT distribution and cloud solutions industry, where innovation and strategic acquisitions play a crucial role in maintaining competitive advantage. The company's ability to increase net sales and adjusted EBITDA significantly reflects its effective business model and market positioning.

Key details from the financial statements include:

Gross profit for Q4 increased 31% to $21.1 million.

SG&A expenses for Q4 were $12.4 million, representing 3.1% of adjusted gross billings.

Cash and cash equivalents stood at $36.3 million as of December 31, 2023.

The company had minimal debt with $1.3 million outstanding and no borrowings under its $50 million revolving credit facility.

These metrics are crucial as they demonstrate the company's profitability, operational efficiency, and strong liquidity position, which are key indicators of financial health for investors.

Analysis of Company's Performance

CLMB's performance in the fourth quarter and full fiscal year 2023 indicates a robust growth trajectory, with strategic acquisitions like DataSolutions enhancing its market presence and product offerings. The company's focus on both organic growth and M&A activities suggests a proactive approach to scaling operations and diversifying its revenue streams.

The declaration of a dividend signals confidence in the company's financial stability and commitment to returning value to shareholders. With a solid balance sheet and a clear strategic direction, Climb Global Solutions Inc appears well-positioned for continued growth and profitability.

For more detailed information on Climb Global Solutions Inc's financial performance, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Climb Global Solutions Inc for further details.

This article first appeared on GuruFocus.