Clorox (CLX) Unveils Preliminary Q1 Results, Hurt by Cyber Attack

The Clorox Company CLX revealed its preliminary financial results for first-quarter fiscal 2024, which reflects the impacts of the recently faced cybersecurity attack. The company’s operation update indicates soft top and bottom-line results in the to-be-reported quarter due to the significant financial impacts of the cybersecurity attack, which was first disclosed in August 2023.

CLX earlier revealed that the cyber-attack resulted in order processing delays and significant product shortages, which are expected to have affected its sales performance in the fiscal first quarter.

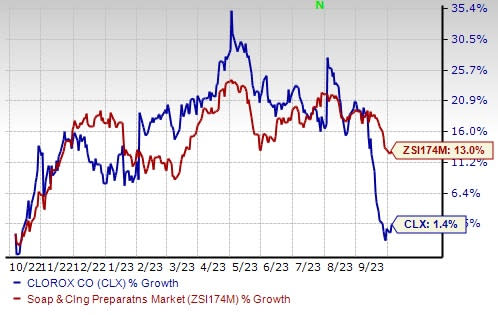

Image Source: Zacks Investment Research

Inside the Headlines

Clorox expects its first-quarter fiscal 2024 net sales to decrease 28-23% year over year. The decline is primarily attributed to the disruptions caused by the cybersecurity attack. This is a significant deviation from the company's prior expectation of mid-single-digit sales growth.

Organic sales are expected to decrease 26-21% for the quarter, in contrast to the earlier stated mid-single-digit growth.

Clorox originally anticipated an increase in the gross margin. However, the company’s preliminary expectations for the gross margin indicate a decline from the year-ago quarter’s reported figure. The impacts of the cybersecurity attack, including lower cost absorption due to reduced volume, have more than offset the benefits of pricing, cost savings and supply-chain optimization.

The company expects adjusted EPS between a loss of 40 cents and break even. The cybersecurity attack's impacts, including lower cost absorption and fixed operating expenses, offset the benefits of pricing, cost savings and supply-chain improvements. On a GAAP basis, the company anticipates a loss of 35-75 cents per share.

Clorox anticipates ongoing operational impacts to continue in second-quarter fiscal 2024 as it recovers from the cybersecurity attack. The company plans to provide an updated outlook during its fiscal first-quarter earnings call in November 2023. It also expects benefits from the restocking of retailer inventories as fulfillment operations ramp up in the second quarter.

Wrapping Up

Clorox is actively working on restoring its systems and operations. Starting from Sep 25, the company has begun the process of transitioning back to automated order processing. The majority of its orders are now being handled automatically, allowing it to increase output and shipments to rebuild retailer inventories. Clorox expects this restocking process to occur gradually as it ships products above consumption levels.

Shares of this Zacks Rank #2 (Buy) company have gained 1.4% in the past year compared with the industry’s growth of 13%.

Three Other Solid Picks

A few other top-ranked stocks in the same space are Celsius Holdings CELH, Church & Dwight Co. CHD and Flowers Foods FLO.

Celsius Holdings, which offers functional drinks and liquid supplements, currently flaunts a Zacks Rank #1 (Strong Buy). CELH delivered an earnings surprise of 100% in second-quarter 2023. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 88.9% and 170.3%, respectively, from the year-ago reported numbers.

Church & Dwight develops, manufactures and markets a broad range of household, personal care and specialty products. The company currently has a Zacks Rank #2. CHD has a trailing four-quarter average earnings surprise of 12.1%.

The Zacks Consensus Estimate for Church & Dwight’s current financial-year earnings and sales indicates growth of 6.7% and 8.3% from the year-ago period’s reported figures.

Flowers Foods emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2. FLO has a trailing four-quarter earnings surprise of 7.6%, on average.

The Zacks Consensus Estimate for Flowers Foods’s current financial-year sales suggests growth of 6.7% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Clorox Company (CLX) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report