Clorox (NYSE:CLX) Reports Bullish Q2, Stock Soars

Consumer products giant Clorox (NYSE:CLX) announced better-than-expected results in Q2 FY2024, with revenue up 16% year on year to $1.99 billion. It made a non-GAAP profit of $2.16 per share, improving from its profit of $0.98 per share in the same quarter last year.

Is now the time to buy Clorox? Find out by accessing our full research report, it's free.

Clorox (CLX) Q2 FY2024 Highlights:

Revenue: $1.99 billion vs analyst estimates of $1.80 billion (10.3% beat)

EPS (non-GAAP): $2.16 vs analyst estimates of $1.10 (95.8% beat)

Gross Margin (GAAP): 43.5%, up from 36.2% in the same quarter last year

Organic Revenue was up 20% year on year

Market Capitalization: $18.02 billion

"Our second quarter results reflect strong execution on our recovery plan from the August cyberattack," said Chair and CEO Linda Rendle.

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Sales Growth

Clorox is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

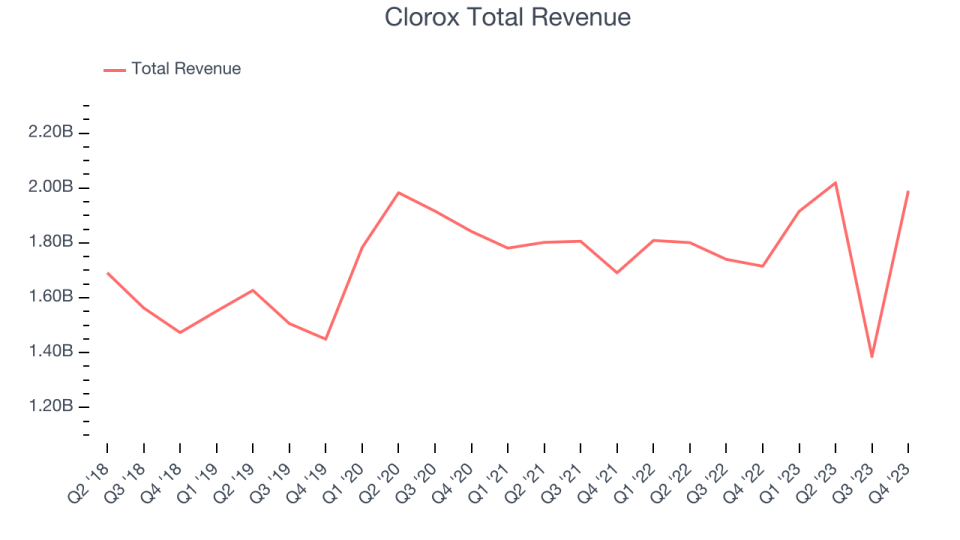

As you can see below, the company's revenue was more or less flat over the last three years.

This quarter, Clorox reported robust year-on-year revenue growth of 16%, and its $1.99 billion in revenue exceeded Wall Street's estimates by 10.3%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Key Takeaways from Clorox's Q2 Results

We were impressed by how significantly Clorox blew past analysts' EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 6.1% after reporting and currently trades at $156.99 per share.