Clorox's (CLX) Growth Strategies Seem Encouraging: Here's Why

The Clorox Company CLX appears to be doing well on the bourses, thanks to its strategic initiatives, including innovation pipeline, digital transformation, and pricing and cost-saving efforts. The company has been on track with its streamlined operating model, which aims to improve efficiency. In addition, its IGNITE strategy is progressing well.

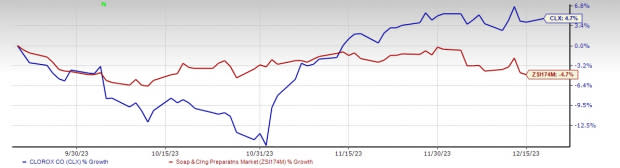

Buoyed by such positives, shares of this Zacks Rank #3 (Hold) company have risen 4.7% over the past three months against the industry’s 4.7% decline. A VGM Score of B further adds to the strength.

Let’s Delve Deeper

Clorox is gaining from pricing and cost-saving initiatives. Also, its streamlined operating model has been boosting efficiency and, in turn, margins. The streamlined operating model is expected to enhance the company's ability to respond quickly to changing consumer behaviors, innovate faster and increase future cash flow as a result of cost savings that will be generated primarily in the areas of selling and administration, supply chain, marketing, and research and development.

This led to a gross margin expansion of 240 basis points year over year to 42.7% during the first quarter of fiscal 2024. It marked the fourth consecutive quarter of gross margin expansion. As a result, adjusted earnings of 49 cents per share beat the Zacks Consensus Estimate of a loss of 20 cents per share.

For fiscal 2023, the gross margin is projected to be flat year over year due to the combined benefits of pricing actions, cost savings and supply-chain optimization efforts. These positives are likely to be offset by input cost inflation and cyberattack impacts.

Image Source: Zacks Investment Research

Clorox’s IGNITE initiative is an integrated strategy, which focuses on the expansion of the key elements under the 2020 Strategy to pace up innovation in each area of the business. This strategy encompasses the long-term financial targets of achieving net sales growth of 3-5%, EBIT margin expansion of 25-50 basis points and free cash flow generation of 11-13% of sales.

Management announced a streamlined operating model to create a faster, simpler company through the Reimagine Work under its IGNITE strategy. The operating model helps increase efficiency and transforms the company's operations in the areas of supply chain, digital commerce, innovation and brand building over the long term. CLX expects the operating model to generate ongoing annual savings in the band of $75-$100 million.

Clorox previously announced plans to invest $500 million in the next five years in transformative technologies and processes. The investments began in the first quarter of fiscal 2022 and include the replacement of the company's enterprise resource planning system, its transition to a cloud-based platform and the implementation of a suite of other digital technologies.

Furthermore, Clorox has been experiencing strong progress in the core International business as it continues to build on the success of the segment's Go Lean strategy. These efforts will help in accelerating profitable growth for the International segment. Management continues to explore international opportunities. In first-quarter fiscal 2024, organic sales for the International segment improved 9%. The segment’s adjusted EBIT surged 48% on gains in pricing.

Given the aforesaid strengths, we believe that Clorox will continue to perform well in the future. For fiscal 2025, the Zacks Consensus Estimate for CLX’s sales and earnings per share (EPS) is currently pegged at $7.5 billion and $5.83, respectively, reflecting an increase of 7.5% and 27.4% from the year-ago quarter's reported numbers.

Some Solid Staple Bets

Lamb Weston LW, which offers frozen potato products, currently sports a Zacks Rank #1 (Strong Buy). LW delivered an earnings surprise of 49.5% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Lamb Weston’s current financial-year sales and earnings implies growth of 28.3% and 24.8%, respectively, from the year-ago reported numbers.

The J. M. Smucker Company SJM, a branded food and beverage product company, currently carries a Zacks Rank #2 (Buy). SJM has a trailing four-quarter earnings surprise of 6.1%, on average.

The Zacks Consensus Estimate for J. M. Smucker’s current fiscal-year earnings indicates growth of 7% from the year-ago reported figure.

Celsius Holdings CELH, which offers functional drinks and liquid supplements, currently carries a Zacks Rank of 2. CELH delivered an average earnings surprise of 110.9% in the trailing four quarters.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings indicates growth of 98.5% and 185.2%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Clorox Company (CLX) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Lamb Weston (LW) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report