Clorox's (CLX) IGNITE Strategy to Evolve Portfolio Bodes Well

The Clorox Company CLX is making strategic initiatives to streamline its operating model, which aims at improving efficiency. In the latest developments, the company has announced the sale of its certain wholly-owned subsidiaries (collectively called "Clorox Argentina") to Apex Capital, which is a private equity fund in connection with Grupo Mariposa. This includes the company’s operations in Argentina, Uruguay and Paraguay.

This sale is in sync with CLX's IGNITE strategy to evolve its portfolio so that it can mainly focus on its core business and deliver sustainable growth. However, the financial terms of the deal remained under cover.

The aforesaid transaction comprises the company’s two production plants in Argentina, along with rights to certain brands in Argentina, Uruguay and Paraguay and shared intellectual property within such brands. However, the deal excludes the company’s Latin America research and development, and corporate hubs. These hubs will remain in Argentina to aid CLX's ongoing operations in other Latin American markets and offer transitional services to Clorox Argentina under the new ownership.

Clorox Argentina's employees with the entire production staff will continue their employment under Clorox Argentina, which is to be renamed and operate under the name of "Grupo Ayudin." This excludes employees dedicated to the R&D and corporate hubs, who will remain with the company under a new corporate structure in Argentina.

We note that Clorox Argentina accounts for nearly 2% of the company's fiscal 2024 net sales guidance, which is provided in its latest earnings release. Owing to the aforesaid transaction, the company will incur a one-time, after-tax charge of about $233 million in the third quarter of fiscal 2024, which is likely to lower earnings per share (EPS) by approximately $1.87. A significant part of this charge is driven by the non-cash release of $222 million of accumulated currency translations that were earlier recorded in equity. Also, the deal will lower sales by about half a point and adjusted EPS by 0-2 cents in fiscal 2024.

What Else?

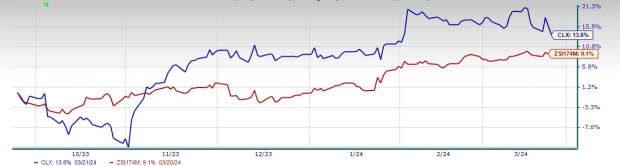

Clorox’s shares have gained 13.8% in the past six months, outperforming the industry’s 9.1% growth. This Zacks Rank #2 (Buy) company’s performance is benefiting from a solid innovation pipeline and digital transformation. Also, significant gains from pricing actions and cost-saving initiatives have been aiding its margins for a while.

Image Source: Zacks Investment Research

Clorox is on track with the IGNITE strategy, its integrated strategy, formulated on a sturdy foundation of its 2020 Strategy. This initiative mainly focuses on the expansion of the key elements under the 2020 Strategy to pace up innovation in each area of business. The IGNITE strategy encompasses the long-term financial targets of achieving net sales growth of 3-5%, EBIT margin expansion of 25-50 basis points and free cash flow generation of 11-13% of sales.

The company’s streamlined operating model is expected to enhance its ability to respond more quickly to changing consumer behaviors, innovate faster and increase cash flows as a result of cost savings that will be generated primarily in the areas of selling and administration, supply chain, marketing, and research and development.

Three Staple Bets Worth Grabbing

Post Holdings POST, a consumer-packaged goods holding company, currently sports a Zacks Rank #1 (Strong Buy). POST has a trailing four-quarter earnings surprise of 52.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current financial-year sales and EPS indicates growth of 15.2% and 3.4%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently has a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 155.4%, on average.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales suggests growth of 18.6% from the year-ago reported figure.

Celsius Holdings CELH, a functional energy drink and liquid supplement company, currently carries a Zacks Rank of 2. CELH has a trailing four-quarter earnings surprise of 67.4%, on average.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal year sales and earnings suggests growth of 41.6% and 41%, respectively, from the year-ago period's numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Clorox Company (CLX) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report