A Closer Look at California Resources' Intriguing Business Profile

California Resources Corp. (NYSE:CRC) is a mid-cap energy and production company that focuses exclusively on the California market. The company explores, produces, processes and markets crude oil, natural gas and natural gas liquids. It consists of two business segments:

Oil and Gas Production: This business is involved in the exploration, development, and production of oil, natural gas, and natural gas liquids.

Carbon Management: This segment is focused on reducing carbon emissions through carbon capture and storage and other emissions-reducing projects. The company plans to eventually separate this segment from the rest of the exploration and production operations.

California Resources' share price has risen 30.94% since the beginning of 2023. Earnings are expected to grow by 18.20% in 2024. The stock has a healthy ratio of return on in invested capital to weighted average cost of capital, indicating the company is creating value for shareholders, and a return on equity of 23%. The stock has high momentum, but GuruFocus has given the company a lackluster Score of 58 and a GF Value Rank of 1, signifying the stock is significantly overvalued. This analysis will attempt to dissect the performance and outlook of this stock in more detail. Please note this is an opinion intended only for information based on my research as an uncredentialed investor and does not constitute investment advice.

Industry

California Resources operates primarily in the oil and gas exploration and production industry. Exploration and production are linked to the early stage of energy production. The process involves four activities that include searching for hydrocarbons, constructing wells, extracting oil and abandoning wells after hydrocarbon resources have been depleted. This early stage in the oil and gas production process is often known in the industry as the upstream versus midstream activities, which involve storage and pipeline transportation of oil and natural gas, and downstream activities, which involve refining raw materials into usable products. The global upstream business is expected to have year-over-year capital expense increases of 11% and generate over $800 billion in free cash flows in 2024.

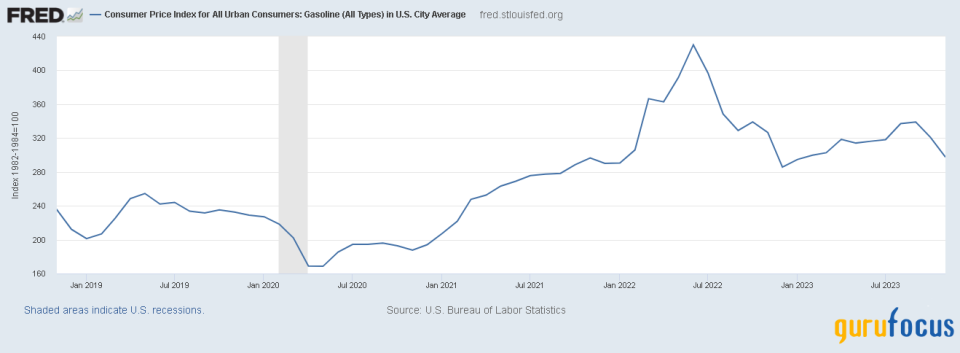

The Covid-19 pandemic caused a sharp drop in demand for petroleum and petroleum products, leading to a collapse in crude oil prices and a supply glut. Many exploration and productions companies, including California Resources, were forced to file for Chapter 11 bankruptcy protection as a result. Companies streamlined and optimized their resource portfolios. Oil prices recovered throughout the next two years and the industry earned record profits in 2022. Oil demand is currently back to 95% of pre-Covid-19 levels, but has slowed in 2023. The FRED CPI graph below depicts a similar pattern to that of the overall oil and gas industry in the last five years:

California Resources' carbon management business is centered around carbon capture and storage. This is a midstream activity that involves capturing carbon dioxide emissions from industrial processes and storing them underground in geological formations. The CCS business can mostly be attributed to regulatory pressures like aggressive net-zero emissions policies and incentives like federal 45Q and California Low Carbon Fuel Standards tax credits. Early CCS adopters benefit from synergies these activities provide to their more profitable exploration and production businesses. Adoption by the wider commercial market depends on key players' abilities to reduce production and storage costs, which currently do not provide sustainable business models. Nonetheless, a 2021 report forecasted a compound annual growth rate of 3.33% for the business until 2030. Additionally, a recent Deloitte & Touche survey revealed that Oil and Gas executives would be more likely to invest in low-carbon projects if they could achieve returns exceeding 12%.

The exploration and production stage of the oil and gas industry is characterized by high government regulation, high uncertainty in determining the feasibility of wells, high initial capital investment to locate and extract reserves and a lengthy process from exploration to production. The market is cyclical, highly volatile and subject to fluctuations in oil and gas prices. Seasonality is a factor in the market's cyclicality with events like weather, wildfires and water scarcity impacting the commodity prices and demand, which typically increase in the winter months.

The California market is particularly challenging as real estate for prospective drilling operations is extremely expensive and California has very stringent environmental and safety regulations targeted toward oil and gas production. The process for applying for drilling permits and well operations can be extremely time-consuming and costly due to regulatory scrutiny.

Regulatory considerations

Exploration and Production businesses are affected by regulatory policies on the global, national and statewide levels. In 2020, the U.S. rejoined the United Nations Paris Agreement to combat climate change and has adopted a goal to achieve net zero emissions and carbon removal targets by 2050. Several national and California regulatory agencies and policies have been created to support these net zero goals. Regulatory agencies are required to perform impact studies before exploration, drilling and storage activities that delay exploration and production project implementation.

California policy is controlled by the California Department of Conservation, more specifically its Geologic Energy Management Division (CalGem), which oversees production and underground injection activities The California Environmental Protection Agency (CalEPA) monitors how greenhouse gas emissions affect air quality.

Competitive landscape

California Resources competes directly with pure-play exploration and prodution companies and integrated oil companies that have operations in California. More broadly, it competes with foreign oil and gas providers, which provide approximately 75% of California's consumable oil. The company also competes indirectly with green energy providers. Green energy, which is currently a more viable business model than CCS, is often viewed by both governments and climate advocates as a preferred method of energy production to CCS since the latter still relies on fossil fuels.

The company's carbon management business competes indirectly with third-party, pure-play CCS companies, small privately funded companies that include companies like Global Thermostat, Carbon Clean Solutions and Climeworks. As mentioned above, these companies are in the developmental stages and are not likely to have current sustainable business models. Integrated mega-cap companies like Exxon Mobil Corp. (NYSE:XOM) and Chevron (NYSE:CVX) also compete in the E&P carbon management space and have operating facilities in California. These companies have vast resources and can deploy revenue generated from midstream and downstream activities in both exploration and production and carbon management operations if needed.

The following table compares California Resources' key 2022 fundamentals with those of two other mid-cap exploration and production companies with projects in California:

Company | Market Capitalization | Business Description | Company Moats and Strengths | Challenges & Concerns | GF Score | PE Ratio | FCF Yield | Current Ratio | Return on Equity (ROE) |

California Resources Corp. (NYSE:CRC) | $3.2 billion | California-based E&P company focused exclusively on the California market The company emphasizes decarbonization and has projects in San Joaquin, Los Angeles, Ventura, and Sacramento oil and gas basins. | Exclusive California niche. Wide moat due to its focus on low-carbon intensity products | CRC must reduce costs for its carbon management business to create an economically viable segment. The former bankruptcy filing in 2020 may cause concerns for investors. | 58 | 6.1 | 9.7% | 0.97 | 31.4% |

Black Stone Minerals (NYSE:BSM) | $3.8 billion | Texas-based oil and natural gas mineral company with California E&P projects. The company's asset base is focused on oil and natural gas mineral interests. | Largest publicly traded mineral and royalty company in the US, focus on these areas allows the company to hone efficiencies in this space. | A heavy focus on nonparticipating royalty interests gives the company less control over how resources are deployed. Black Stone Minerals appears to be weak in addressing ESG concerns. | 85 | 8.3 | 11.2% | 5.64 | 57.3% |

Berry Corp. (NASDAQ:BRY) | $614 million | A Texas-based energy company with a focus on oil reserves in the San Joaquin basin of California. The company also has operations in Utah. | Touts that it has solid and robust core values and culture. Has a renewable energy strategy. | Continued investigation by the former Louisiana Attorney General for a possible breach of the company's fiduciary duties to its shareholders when launching its IPO in 2018 raises management ethical concerns. | 64 | 2.5 | 36.2% | 0.93 | 35.2% |

Based on 2022 Data from Stock Analysis.

Company background

California Resources was created in 2014 as a spinoff of Occidental Petroleum (NYSE:OXY), so the latter company could focus on its core competencies. The company, saddled with a leveraged capital structure from the spinoff and experiencing the pandemic price collapses, was forced to file for Chapter 11 bankruptcy protection under CEO Todd Stevens in July 2020. The company was bogged down by debt and had trouble meeting funding obligations. Other exploration and production companies filing for bankruptcy at that time included Chesapeake Energy Corp. (NASDAQ:CHK), Whiting Petroleum (WLL) and Diamond Offshore Drilling (NYSE:DO).

The company has changed leadership twice since it resumed operations in late October 2020. Mark McFarland, who served as Interim CEO after the bankruptcy proceedings, was appointed in March of 2021. Francisco Leon, California Resources' former chief financial officer since 2020, assumed the CEO role in February 2023 after an announced company restructuring. Leon had previously been with the company since its initial spinoff and had a role focused on Occidental Petroleum's operations in California before the creation of CRC. Manuela Molina joined in May 2023 to fill the CFO role. The company's recent restructuring efforts focused on reducing costs to align with slowing 2023 demand. It delevered its capital structure by repurchasing $35 million notes at a slight premium. The company also hopes to focus more on its carbon management solutions by running the E&P segment and the carbon management segment as separate entities.

Projects

In November 2021, California Resources launched the Carbon TerraVault initiative, a carbon capture and storage facility to assist te buildout of its carbon management business. The company has five vaults as part of the initiative with 191 million metric tons of potential capacity.

In August 2022, the company formed a partnership between its Carbon TerraVault subsidiary and Brookfield Renewable Partners (NYSE:BEP). It owns 51% of the joint venture with Brookfield Renewable owning the remaining 49% interest. Brookfield's investment is allocated through the Brookfield Global Transition Fund (BGTF), a fund dedicated to facilitating the global transition to a net zero-carbon economy.

Through these endeavors, California Resource has carbon dioxide management agreements to explore renewable energy options as well as enhanced CCS opportunities.

Recent performance

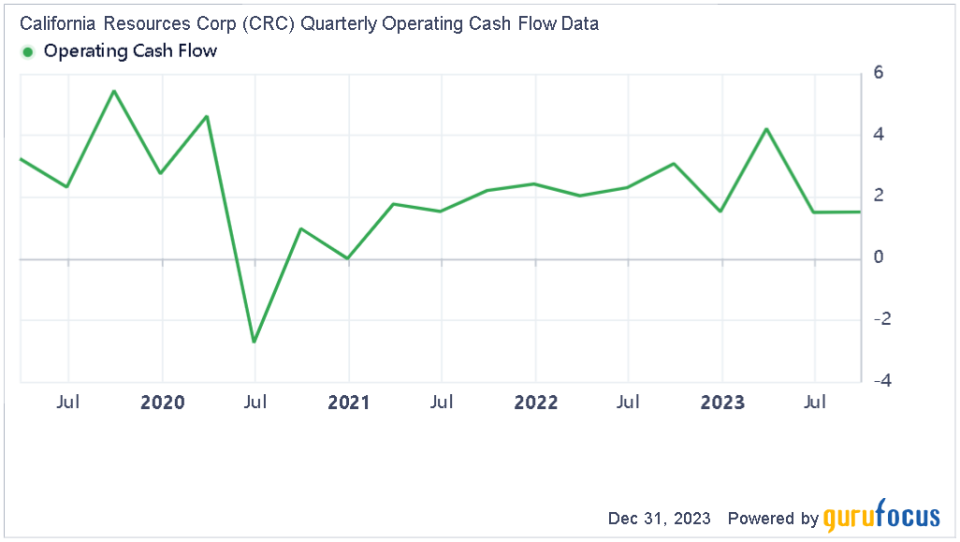

California Resources incurred a net loss of $22 million and free cash flow of $71 million in the third quarter. Free cash flow spiked to $358 million in the first quarter of this year after the restructuring. Current cash levels are currently at $479 million. The company implemented additional organizational changes by laying off 75 employees and streamlining operations. The company is prioritizing shareholder value by increasing dividends and stock buybacks despite its recent lackluster performance.

Key observations and takeaways

California Resources' positioning as an exclusive California oil and gas provider with aggressive net zero goals appeals to investors in the following ways:

A California focus has helped the company to capitalize on clean energy incentives and build efficiencies when navigating the state's complex regulatory environment.

Its positioning as an industry leader in the pursuit of reduced carbon and clean energy initiatives gives it a distinct competitive advantage over comparable-sized exploration and production players.

The CTV joint venture and other partner relationships have helped the company build out its capital-intensive carbon management business while minimizing the costs associated with doing so.

The company has less exposure to global geopolitical and supply chain concerns versus those of global energy companies.

The company's main challenge in 2024 is to preserve operating cash flow in a softening and uncertain economic environment. The company appears to have taken some preemptive steps to ensure that it does not wind up in the same situation it was in 2020. The company also has relatively level quarter-over-quarter cash balances; however, I would like to see the company retain additional earnings to ensure these levels stay healthy throughout the build-out of new projects.

This article first appeared on GuruFocus.