A Closer Look at Coupang

Coupang Inc. (NYSE:CPNG) is a leading e-commerce company that is often referred to as the Amazon of South Korea. The business has experienced tremendous growth over the past several years. In 2017, it had captured just 7.4% of the South Korean market, but this had more than doubled to 15.7% by 2021 and now it is approximately 35%, according to data from Bank of America.

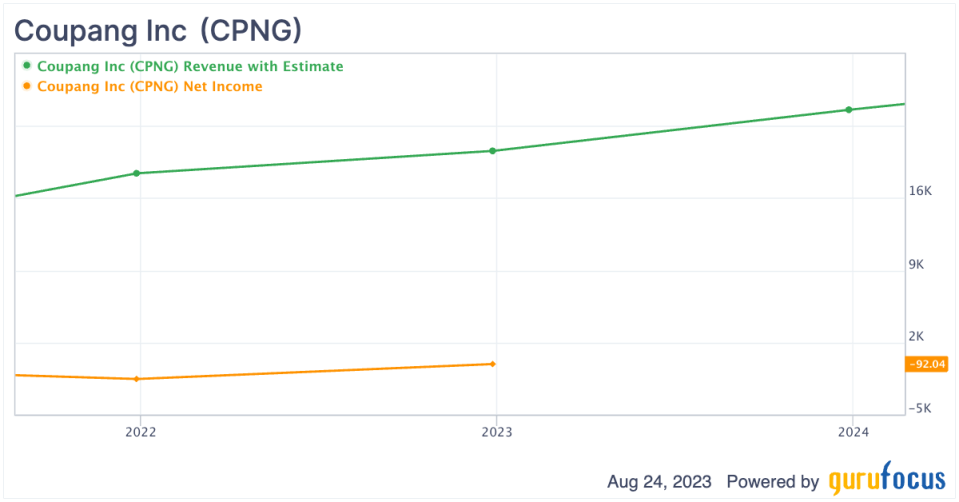

In the second quarter of 2023, the business produced solid financial results, beating both top- and bottom-line growth estimates.

The Amazon of South Korea

Coupang's success has been driven by its customer-centric strategy, which has been inspired by companies such as Amazon.com Inc. (NASDAQ:AMZN). However, the company really does take things one step further.

For example, it offers rocket delivery, which is the equivalent of same-day delivery. Its overall average delivery time is less than 12 hours, which is incredible. The business also can attach personal notes to an item, which is great for gift giving.

This is all possible thanks to Coupang's extensive footprint of over 100 fulfillment centers across the entirety of South Korea. Given the country is fairly small, 70% of the population lives within just 7 miles of a logistics center.

Similar to Amazon, Coupang uses machine learning and artificial intelligence in order to specify which products should be stocked in which fulfillment center based on expected demand.

Coupang also offers a service called Rocket Fresh, which is similar to Amazon Fresh, offering delivery of fresh groceries. However, unlike Amazon, the company has launched a food delivery service called Eats, which was widely popular during the lockdown of 2020.

Global expansion plans

Replicating this business model will be harder in other countries, especially those where Amazon has a strong presence. However, the company is launching in Singapore, which only has a population of 5.7 million people and thus should be easier to penetrate.

Japan is also a key battleground as the business rolls out trial operations in the country. Tokyo specifically is a key area of focus as the population is just 14 million people and has a similar culture to South Korea. Amazon Japan is the current leader in the country, but other players such as Rakuten and Yahoo Japan hold fragmented market share positions.

Another country of focus is Malaysia. Although its population is not as wealthy as the other countries mentioned, its capital, Kuala Lumpur, has a population of 8.2 million people.

Steady financials

Coupang reported total net revenue of $5.84 billion, which beat analyst forecasts by $18.25 million and increased by a steady 16% year over year. On a constant currency basis, the results were even better with 21% year-over-year growth reported. Given the majority of the world is experiencing a cyclical decline in e-commerce revenue, this is a positive result.

The performance was driven by the Product Commerce segment, which reported 16% year-over-year growth, or 21% on a constant currency basis.

Its overall active customers rose by 10% year over year to 19.7 million.

Its Eats business has also continued to perform well with regard to unit economics, which is usually a challenge for most delivery companies. Its contribution margin is so good that Coupang is plowing a 10% discount back to its WOW members for unlimited orders. This is a similar model to Amazons scaled economics shared philosophy, which plows investments back to help improve the customer value proposition. Coupang has calculated the result of this initiative to be positive so far with a 500 basis point market share gain in the regions where it has implemented the program.

From an ecosystem perspective, its customers who purchase via Eats have also been shown to have higher e-commerce spend and retention.

Its fintech solution, Coupang Pay, has also continued to generate solid financial results.

Taiwan market entry

Taiwan is a key market Coupang is aggressively entering. In the second quarter, the company had the most downloaded app in the country. Its launch of the Rocket Delivery program also scaled faster than its South Korean version during the first 10 months.

Coupang plans to continually invest into Taiwan with capital expenditures expected to be around $400 million in 2023.

The only major risk I see as an external analyst is the tensions between China and Taiwan. If a conflict did occur in the future, this would impact Coupangs investments. Even heated political tension could impact consumer demand from a psychological perspective.

Margins and balance sheet

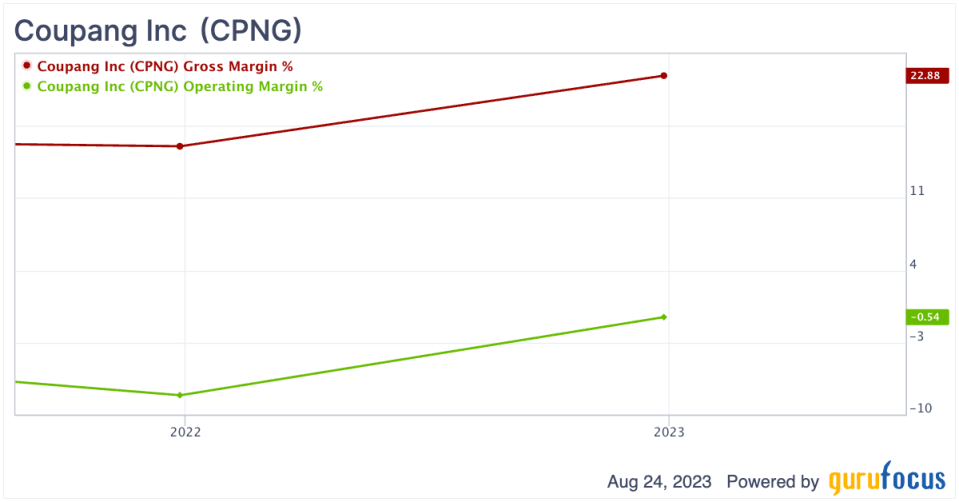

Moving on to gross profit, the company reported a record $1.5 billion in the second quarter, which rose by 32% year over year and 7% since the prior quarter. Its gross profit margin expanded by 320 basis points to 26.1%. Approximately 100 basis points of this increase was caused by accounting regulation changes. However, it is still a positive result given many e-commerce companies are currently having their margins squeezed.

Operating income came in at $147.6 million, up from the $67.1 million loss reported in the prior-year quarter. This was driven by operating leverage improvements in general and administrative expenses as they declined by 66 basis points as a percentage of revenue.

CPNG Data by GuruFocus

Overall earnings per share were 8 cents, which topped analysts' expectations by 3 cents.

Coupang has a strong balance sheet with $4.5 billion in cash and short-term investments and total debt of $2.7 billion.

Valuation

Coupang trades with a price-sales ratio of 1.5, which is close to its historic median of 1.52. However, this is substantially lower than its maximum ratio of above 6.

Guru interest

Stanley Druckenmiller (Trades, Portfolio) purchased 620,100 shares of Coupang during the second quarter, increasing his stake by 3.06%. The stock traded for an average price of $16.30 per share, which could be an indication of where he sees value.

As of the end of the second quarter, the guru held a total of 20.9 million shares of Coupang. This makes it the second-largest position in his portfolio with a 12.65% weight.

Final thoughts

Coupang is a tremendous company that can be compared to Amazon with regard to its business model. Its focus on the Asian markets gives it a local advantage over its competitors, and its growth is a testament to this. Its Eats and fintech businesses also looks fairly lucrative.

Druckenmiller has made the stock a substantial portion of his portfolio and, therefore, it appears to have all the ingredients of a potentially great long-term investment, assuming the company can replicate its success.

This article first appeared on GuruFocus.