A Closer Look at Hormel Foods' 58 Years of Uninterrupted Dividend Increases

Hormel Foods Corp. (NYSE:HRL), a distinguished dividend aristocrat known for its impressive track record of increasing dividend payments for 58 consecutive years, has recently experienced a significant drawdown. Its share price plunged by nearly 35% in the past 12 months. Let's delve deeper to find out whether it is a good stock for long-term income investors.

Business snapshot

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Founded in 1891, Hormel Foods is a global food company that has an extensive portfolio of brands, including Hormel, SPAM, Columbus and Skippy, across more than 80 countries. It has three main business segments: Retail, Foodservice and International. Its top five customers represent 36% of total sales, with Walmart (NYSE:WMT) being the largest customer, accounting for 15% of sales. Among the three operating segments, the Retail segment is the main revenue generator, contributing approximately $7.75 billion, or 64% of the company's total sales. The Foodservice segment ranked second, generating $3.64 billion, representing 30% of the total. The International segment contributed only $721.5 million in sales, which is about 6% of the total.

In terms of profitability, the Foodservice segment generated the highest level of profit at $595.7 million with an operating margin of 16.40% in 2023. Although the Retail segment is the largest contributor to revenue, it has the lowest operating margin among the three at just 7.5%. The International segment, on the other hand, achieved a slightly higher margin than the Retail segment at 7.7%.

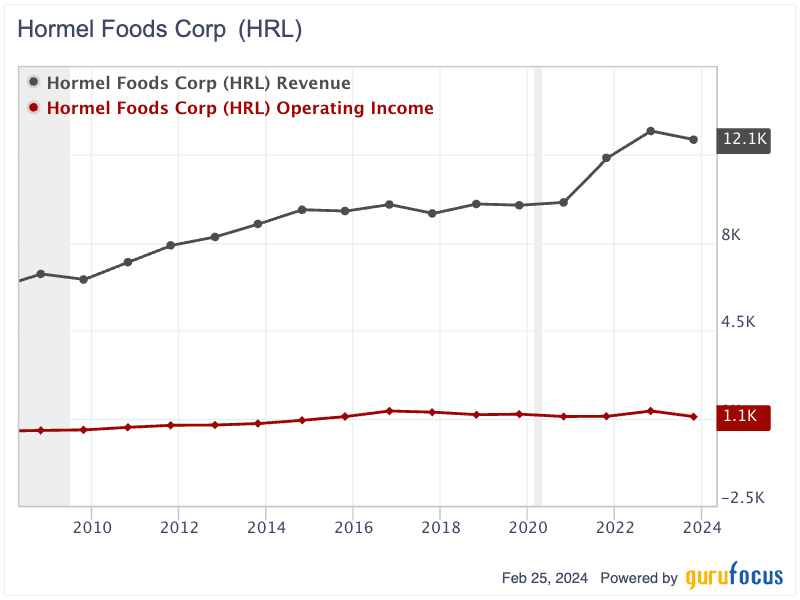

Revenue growth and profitability

After recovering from the global economic downturn of 2008-09, Hormel Foods achieved consistent revenue growth, increasing from $6.53 billion in 2009 to $9.30 billion in 2014. Between 2014 and 2020, the company's revenue fluctuated within the range of $9.17 billion to $9.60 billion. Then it reached a peak of $12.50 billion in 2022 before experiencing a slight decline to $12.11 billion in 2023. Over the span of 14 years, from 2009 to 2023, Hormel Foods' revenue has experienced an annual compounded growth rate of 4.50%.

Hormel Foods' operating income followed a similar trend. In the period of 20092016, the company's operating income experienced a consistent rise, from $532 million to $1.29 billion. In the following seven years, its operating earnings fluctuated between $1.06 billion and $1.29 billion. In 2023, it experienced a 17.70% year-over-year decline to $1.06 billion. This drop in 2023 operating earnings was caused by declining revenue, combined with an increase in selling, general and administrative expenses and a $28.40 million goodwill and intangible impairment of the Justin's trade name.

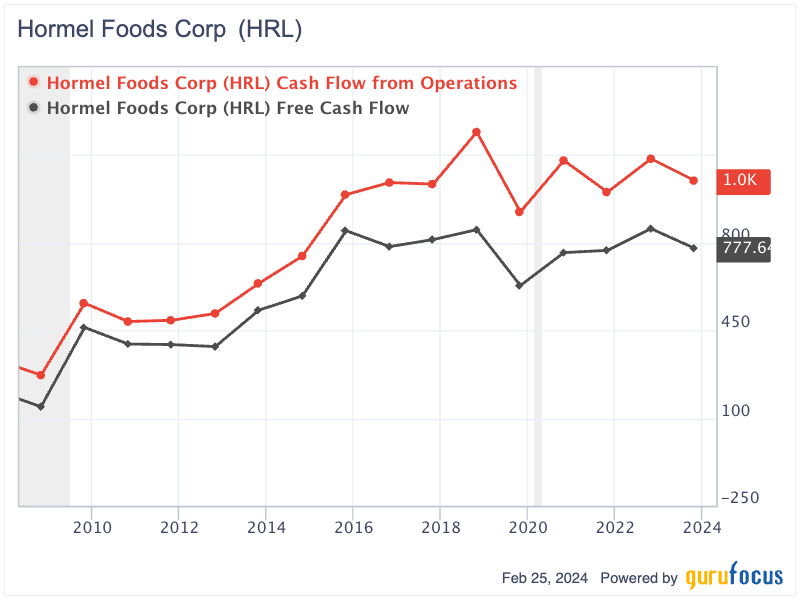

Consistent cash flow generator

Despite the fluctuating revenue and operating income, Hormel Foods has consistently managed to produce positive operating cash flow and free cash flow every single year over the past 15 years. The operating cash flow has grown from $271.6 million in 2008 to $1.05 billion in 2023, while free cash flow increased from $145.7 million to $777.64 million over the same period.

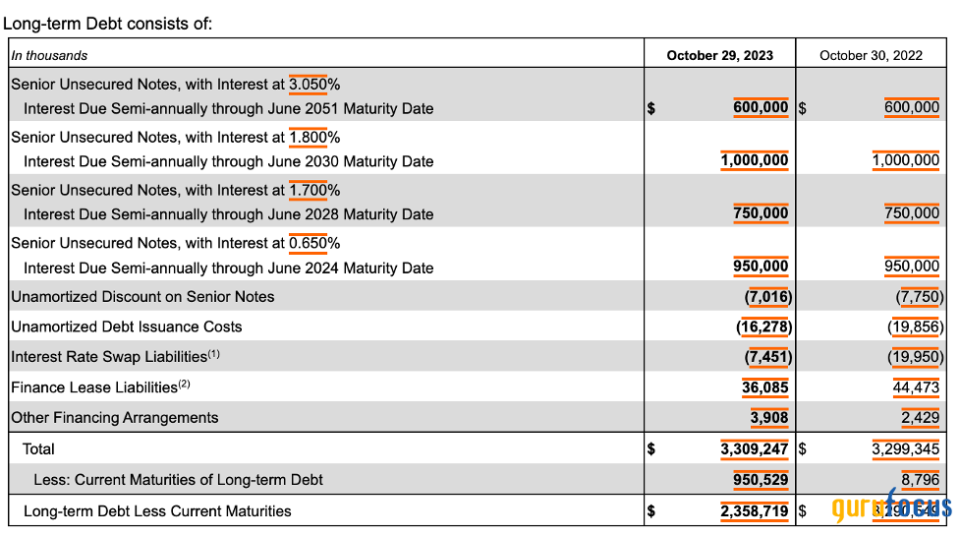

Prudent balance sheet

Hormel Foods has a quite conservative balance sheet structure. As of October 2023, the company had $7.73 billion in shareholders' equity, including $753 million in cash and short-term marketable securities. Its interest-bearing debt stood at approximately $3.3 billion. Hormel Foods has taken advantage of low interest rates, borrowing most of its debt at rates between 0.65% and 3.05%, with these loans having long-term maturities. The nearest debt maturity loan is scheduled for June 2024, with a principal value of $950 million, whereas the remaining debts have maturities extending from 2028 to 2051. With its current solid cash position and strong operating cash flow, Hormel should have no difficulty paying interest and debt obligations.

Source: Hormel Foods' 10-K filing

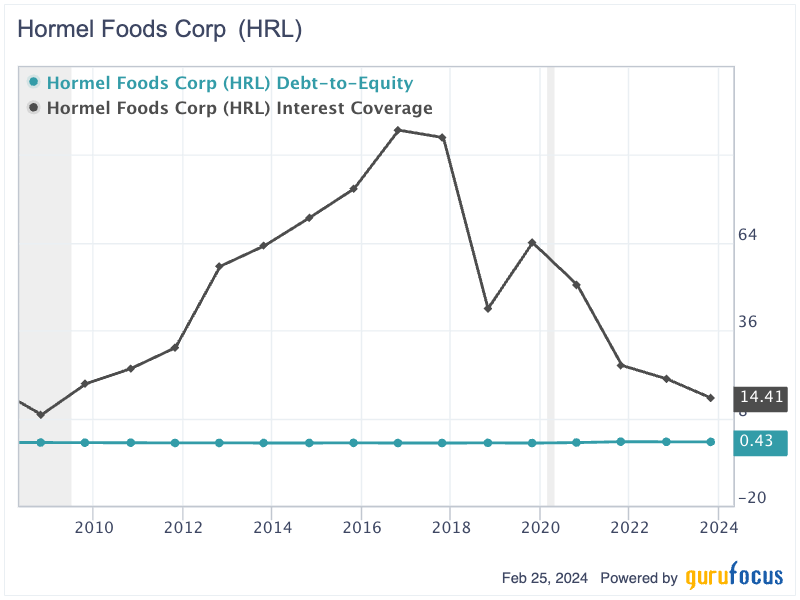

Hormel Foods has a history of maintaining a strong balance sheet. Its debt-to-equity ratio fluctuated between 0.04 and 0.11 from 2013 to 2019 before increasing to 0.43 in 2023. Although the debt-to-equity ratio has been rising, a ratio of 0.43 is still regarded as relatively conservative. Moreover, the company's interest coverage ratio had been impressively high in the past, ranging from 43 to 100 during the period from 2013 to 2019. Although there has been a downward trend in the interest coverage ratio due to increases in borrowings, it remains at the high level of 14.40.

58 years of uninterrupted, increasing dividend payments

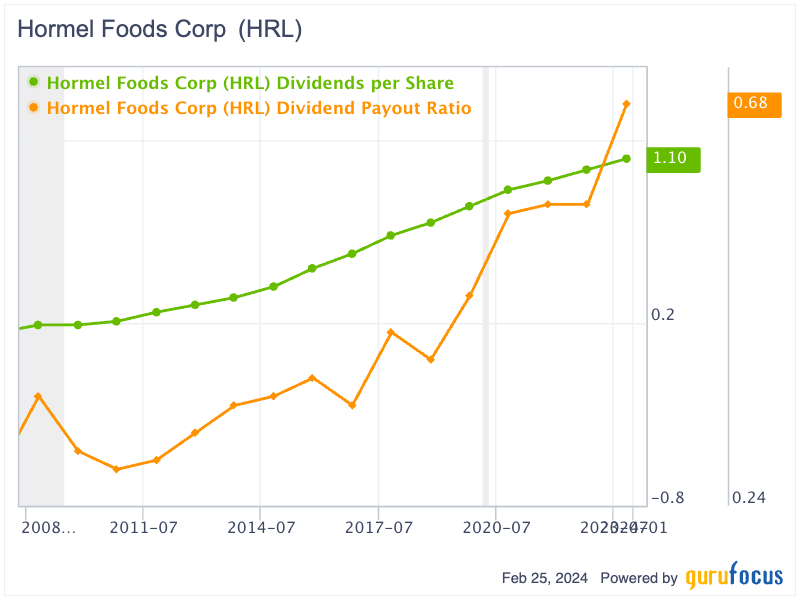

Hormel Foods is well-known for being a dividend aristocrat, raising dividends consistently for the past 58 years. Since 1993, the dividend per share has grown from 6 cents to $1.10, marking a substantial annualized compounded growth rate of 10.18% over the last 30 years. The dividend payout ratio, a measure of the dividends paid to shareholders relative to the company's net income, has remained at a reasonable level, fluctuating between 0.27 and 0.68. This consistent dividend growth and prudent payout management underscore Hormel Foods' commitment to shareholder value and dividend sustainability.

Potential upside

The Gordon Growth Model, ideal for companies with consistent dividend growth, fits well with Hormel Foods, considering its remarkable history of nearly six decades of uninterrupted dividend increases. Assuming Hormel Foods will grow its dividend at the reduced rate of 8% per year, with a discount rate of 10%, the intrinsic value is calculated as follows:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= 1.10 *(1+8%) / (10%-8%)

= $59.40

The Gordon Growth Model suggests the intrinsic value of Hormel Foods is approximately $59.40 per share, which is significantly higher than its current trading price of $28.70 per share. This indicates Hormel Foods is substantially undervalued, suggesting a potential upside of 100%.

Key takeaway

Hormel Foods presents a compelling case for long-term income investors. The company not only has a remarkable track record of consistent dividend increases over the past 58 years, but also exhibits a robust balance sheet and prudent payout management. The company's conservative debt profile, coupled with its capacity to generate consistently positive cash flow, underpins its financial health. My intrinsic value calculation suggests Hormel Foods is significantly undervalued with a potential 100% upside. Thus, Hormel Foods is an attractive stock for investors seeking stable, long-term returns.

This article first appeared on GuruFocus.