A Closer Look at Marriott Vacations

In the next decade, The New York Times reported that $16 trillion will be transferred from boomers to their heirs. That leaves north of $70 trillion to be transferred in the decades after and, of that, timeshares will be a good alternative for the next generation to own and travel. This equates to just over $1 million per retiree. Thats why Marriott Vacations Worldwide Corp. (NYSE:VAC) could continue to be an interesting opportunity as the company boasts a vast portfolio of resorts and properties located in highly desirable vacation destinations around the world. These range from beachfront properties in the Caribbean to mountain retreats in Colorado.

About Marriott Vacations

Marriott Vacations Worldwide offers vacation ownership, exchange, rental and resort and property management. It was formed in 2011 when Marriott International spun off its timeshare operations.

Today, the company has expanded from three to seven iconic brands that own more than 120 resorts, including The Ritz-Carlton, St. Regis and Grand Residences. Currently, it has around 700,000 owners and 1.6 million international members across 90 countries and territories.

More importantly, the vacation ownership market serves households with a median net worth of $1.5 million, better FICO scores, higher annual income and has over 40 million potential buyers. In other words, Marriott Vacations focuses on the high-end vacation ownership market, targets affluent customers and owns properties that live up to that standard.

Scrutiny around timeshares

Like other players in the vacation ownership industry, such as Hilton Grand Vacations Inc. (NYSE:HGV), Marriott Vacations has faced challenges and criticisms, particularly around the long-term contracts and the sales practices associated with timeshare pitches. However, the industry as a whole has made efforts to address some of these concerns over the years. Also, people are still buying them.

The U.S. timeshare industry has about 10 million owners with about half of timeshare owners retired or planing to retire within 10 years. Marriott Vacation Clubs owner demographics show over 60% of owners are 55 years old and older.

Benefits of Marriott Vacations

Marriott Vacations counters some of these negatives by having a points-based system, buyback program and, above all, the high brand reputation. It is not necessarily a dumb idea to have multiple timeshares that allow you to travel as you wish. Of course, that is easy to say while airfare is still relatively cheap.

The company benefits from frequent travelers. Owners have access to condo-style accommodations with more space and amenities than hotel rooms. They can exchange timeshare points for stays at resorts around the world. For some, it results in lower overall vacation costs long term compared to paying for hotels annually. And, Marriotts high-end branded timeshares offer superior quality and service.

Financial performance

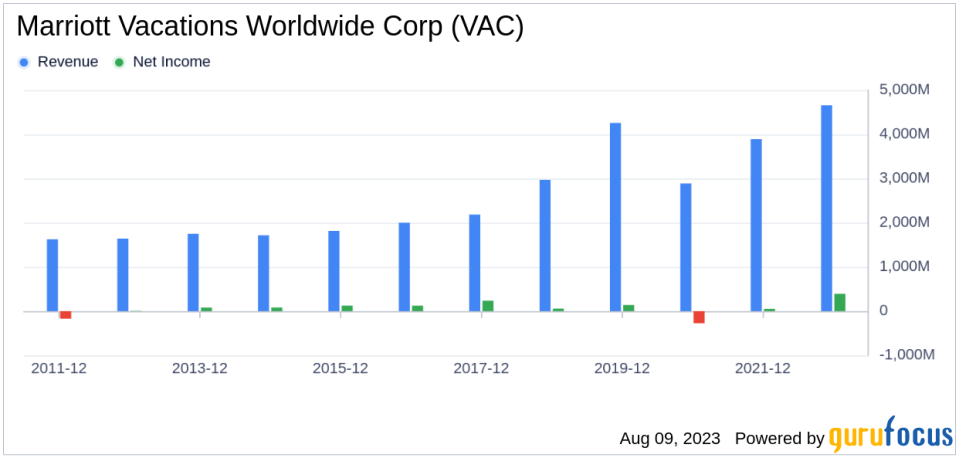

In 2011, Marriott Vacations had a market capitalization around $600 million. At market close on Tuesday, the company was priced at $4.1 billion, a tidy 17% annual compounded return. Of course, the interest rate environment helped a lot; however, considering the companys target market is wealthier than 95% of Americans, it is likely that interest rates will not matter as much.

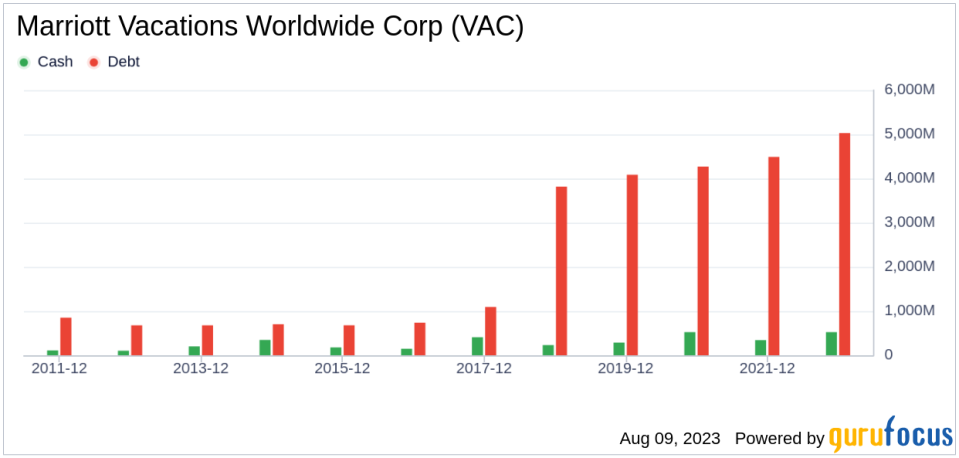

Marriott Vacations generates a large portion of its revenue from recurring sources like management and exchange and financing. Currently, it has around $1 billion in liquidity with $240 million in cash and $685 million in revolving credit. On $2.8 billion in net corporate debt, the company only pays $131 million in interest expense and generates $331 million in cash from operations. It also posted an incredible 59.82% gross profit margin and 11.2% net margin as the debt load is attached to income-generating assets.

In fact, these numbers have increased over the years. In 2014, Marriott Vacations produced $575 million in gross profit on $1.36 billion in revenue. In 2018, those rates increased from 42% to 55% with the company producing $1.1 billion in gross on just over $2 billion in revenue. In the last 12 months, the company has generated nearly $2 billion in gross profit on $3.3 billion in sales, good for $374 million in net income. These numbers are expected to grow considerably over the decade to come, with a range of $4.8 billion to $5.2 billion on the top line and earnings per share to break $10 annually.

Thoughts on valuation

Given some of the controversies historically associated with the timeshare industry, building and maintaining consumer trust is paramount. And, in the case of Marriott Vacations, the company's reputation stands to be a significant asset. The attractiveness and accessibility of its properties are essential for sales and customer satisfaction. Thus, maintaining high-quality accommodations and amenities is crucial for repeat business and referrals. It is estimated that 10,000 baby boomers are reaching retirement age daily in the United States. The market for vacation ownership is valued at $19 billion currently and expected to surpass $29 billion by 2029.

As for Marriott Vacations, its market cap reached a peak of $7.7 billion in 2021 and has since dropped 47%. This includes the stock price being down 10% since the company's latest earnings release, which missed estimates on both the top and bottom lines. With such lackluster performance, it seems like the vacation ownership market is already in recession. However, when looking at the numbers void of the "expectations," they are still quite good. Revenue for the quarter hit $1.18 billion and non-GAAP earnings care in at $2.19 per share. Adjusted earnings are expected to fall between $9.75 and $10.22 for the full year.

Even during the worst pandemic in a generation, people wanted to travel. Fractional ownership of real estate is only growing and it is a good business to be in. Considering the high level that Marriott's brands operate, the future looks increasingly brighter.

This article first appeared on GuruFocus.