Cloudflare Inc CFO Thomas Seifert Sells 34,329 Shares: An Analysis of Insider Activity and ...

Thomas Seifert, the Chief Financial Officer of Cloudflare Inc (NYSE:NET), has recently sold a significant number of shares in the company. On December 13, 2023, the insider executed a sale of 34,329 shares. This transaction has caught the attention of investors and market analysts, as insider trading activity, particularly from high-ranking executives, can provide valuable insights into a company's financial health and future prospects.

Who is Thomas Seifert?

Thomas Seifert is a seasoned executive with a wealth of experience in the technology sector. As the CFO of Cloudflare Inc, Seifert is responsible for the company's financial strategy, including accounting, financial planning and analysis, treasury, tax, and investor relations. His role is crucial in guiding the company through its financial operations and ensuring that Cloudflare remains on a path of sustainable growth. Seifert's background includes various leadership positions in finance and operations, making him a key figure in Cloudflare's executive team.

Cloudflare Inc's Business Description

Cloudflare Inc is a global company that provides a broad range of services to help secure and accelerate Internet applications. The company's cloud platform functions as a reverse proxy, offering content delivery network (CDN) services, DDoS mitigation, Internet security, and distributed domain name server services. Cloudflare's solutions are designed to enhance the performance and security of websites, APIs, SaaS services, and other properties connected to the Internet. With a focus on reliability and security, Cloudflare has become a trusted partner for businesses looking to protect their online presence and improve user experience.

Analysis of Insider Buy/Sell and Relationship with Stock Price

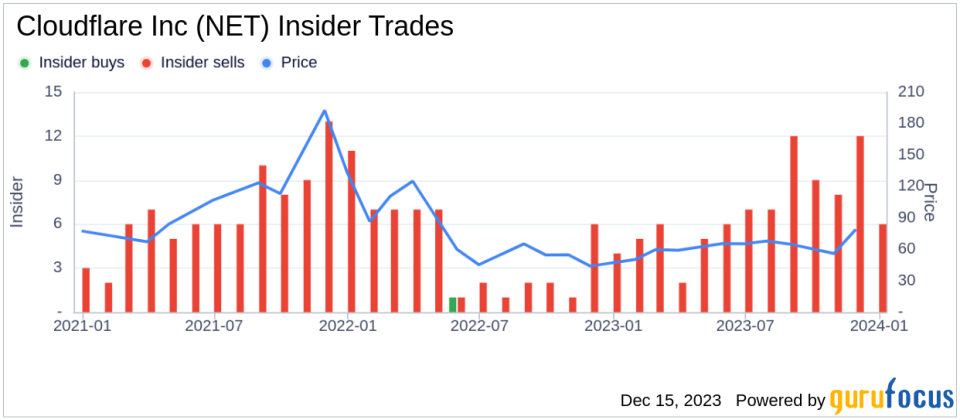

Insider trading activity, such as the recent sale by Thomas Seifert, can be a powerful indicator of a company's internal perspective on its stock's value. Over the past year, Seifert has sold a total of 495,911 shares and has not made any purchases. This one-sided activity may raise questions among investors about the insider's confidence in the company's future performance.

When analyzing insider trends, it's important to consider the broader context of insider transactions. For Cloudflare Inc, there have been no insider buys over the past year, while there have been 87 insider sells. This pattern suggests that insiders may believe the stock is fully valued or that they are taking profits off the table, possibly due to personal financial planning or diversification reasons.

On the day of Seifert's recent sale, Cloudflare Inc's shares were trading at $80.21, giving the company a market cap of $28.43 billion. This valuation is a critical piece of information when assessing the significance of the insider's sell decision.

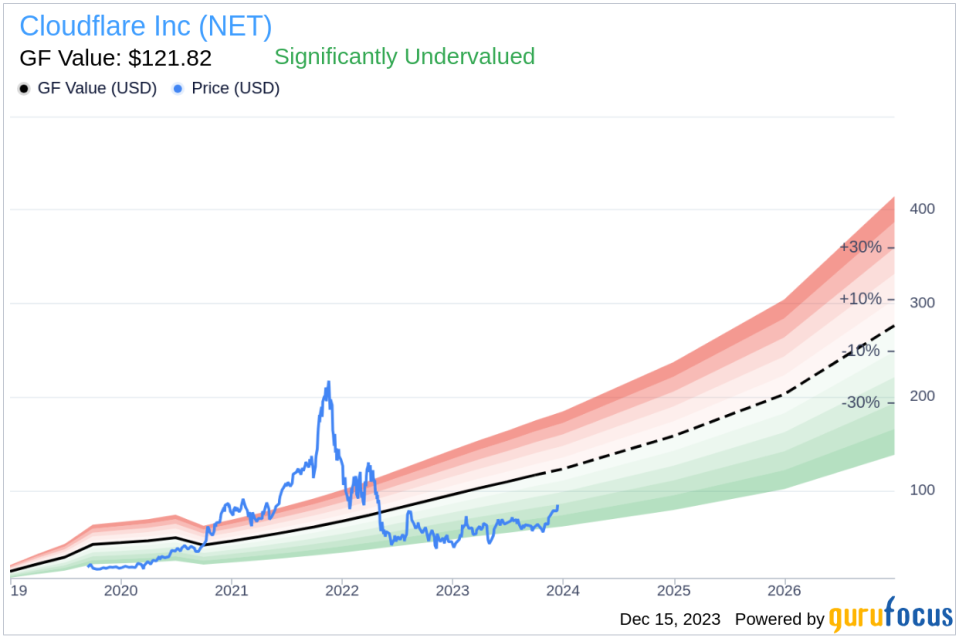

Considering the stock's price relative to its intrinsic value is also essential. With a price of $80.21 and a GuruFocus Value of $121.82, Cloudflare Inc has a price-to-GF-Value ratio of 0.66, indicating that the stock is significantly undervalued based on its GF Value. This discrepancy between the market price and the estimated intrinsic value could suggest that the market has not fully recognized the company's potential, or there may be other factors at play that are affecting the stock's price.

The GF Value is determined by considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. These factors combine to provide a comprehensive view of what the stock might be worth.

Conclusion

The sale of 34,329 shares by CFO Thomas Seifert is a significant event that warrants attention from Cloudflare Inc's investors. While the insider's actions may initially seem bearish, considering the stock's undervaluation based on the GF Value, it's important to look at the broader picture, including the company's strong business model and growth prospects. Investors should weigh insider trading activity as one of many factors in their investment decisions and continue to monitor Cloudflare Inc's performance and market valuation for a more comprehensive understanding of the stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.