Cloudflare (NET) to Report Q3 Earnings: What's in Store?

Cloudflare NET is scheduled to report its third-quarter 2023 results after market close on Nov 2.

The company projects third-quarter revenues in the band of $330-$331 million. The Zacks Consensus Estimate for the top line is currently pegged at $330.4 million, indicating an improvement of 30.2% year over year.

Cloudflare expects non-GAAP earnings per share of 10 cents for the third quarter. The consensus mark is pegged at 10 cents per share, implying a robust 66.7% improvement from the year-ago quarter earnings of 6 cents.

The web infrastructure and website security solution provider projects non-GAAP income from operations between $20 million and $21 million. NET’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 64.3%.

Let’s see how things are shaping up for this announcement.

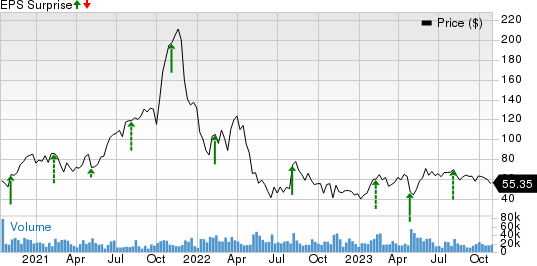

Cloudflare, Inc. Price and EPS Surprise

Cloudflare, Inc. price-eps-surprise | Cloudflare, Inc. Quote

Factors to Note

Cloudflare’s third-quarter performance is likely to have benefited from the solid demand for security solutions amid the growing hybrid working trend and a zero-trust approach.

The to-be-reported quarter’s top line is likely to have witnessed the impact of accelerated global footprint expansion outside the United States. It is worth mentioning that the company had generated approximately 47% of its second-quarter 2023 revenues outside the United States.

Moreover, a diversified customer base is likely to have contributed to NET’s third-quarter top line. It added around 5,970 new paying customers in the last reported quarter, bringing the total count to approximately 174,129 across more than 170 countries.

Cloudflare added 196 new large customers (annual billings of more than $100,000), taking the total count to 2,352 at the end of the second quarter, up from 2,156 recorded at the end of the second quarter of 2023. This uptrend, which has prevailed for the past eight quarters, is likely to have continued in the to-be-reported quarter as well, backed by the elevated demand for its cloud-based solutions amid the ongoing digitalizing trend.

The company's recurring subscription-based business model has been providing relative stability to its top line amid post-pandemic disruptions. However, Cloudflare’s significant exposure to small and medium businesses, the worst-hit cohorts by the pandemic and ongoing geopolitical uncertainties worldwide are likely to have weighed on its performance in the quarter to be reported.

What Our Model Says

Our proven model does not conclusively predict an earnings beat for Cloudflare this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that’s not the case here.

NET has a Zacks Rank #3 and an Earnings ESP of 0.00% at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With the Favorable Combination

Per our model, NVIDIA Corporation NVDA, Palantir Technologies PLTR and Synaptics SYNA have the right combination of elements to post an earnings beat in their upcoming releases.

NVIDIA sports a Zacks Rank #1 and has an Earnings ESP of +6.93%. The company is scheduled to report third-quarter fiscal 2023 results on Nov 21. Its earnings surpassed the Zacks Consensus Estimate thrice in the trailing four quarters while missing on one occasion, the average surprise being 9.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s third-quarter earnings is pegged at $3.34 per share, indicating a year-over-year increase of 475.9%. The consensus mark for revenues stands at $16.12 billion, suggesting a year-over-year surge of 171.7%.

Palantir carries a Zacks Rank #2 and has an Earnings ESP of +4.35%. The company is scheduled to report third-quarter 2023 results on Nov 2. Its earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing on one occasion, with the average surprise being 2.1%.

The Zacks Consensus Estimate for Palantir’s third-quarter earnings stands at 6 cents per share, indicating a year-over-year improvement of 500%. It is estimated to report revenues of $555 million, which suggests an increase of approximately 16.1% from the year-ago quarter.

Synaptics is slated to report first-quarter fiscal 2024 results on Nov 9. The company has a Zacks Rank #2 and an Earnings ESP of +3.54% at present. Synaptics’ earnings beat the Zacks Consensus Estimate thrice in the trailing four quarters while missing on one occasion, the average surprise being 3.6%.

The Zacks Consensus Estimate for first-quarter earnings is pegged at 38 cents per share, suggesting a decrease of 89.2% from the year-ago quarter’s earnings of $3.52. Synaptics’ quarterly revenues are estimated to decline 48.2% year over year to $232 million.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report