Cloudflare Stock Could Float to Fresh Highs

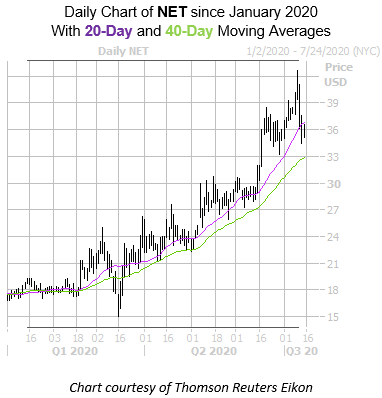

The shares of website-security company Cloudflare Inc (NYSE: NET) are down 2.6% at $35.80 this afternoon, though the equity is still enjoying a 110.7% year-to-date lead. And while the stock's 20-day moving average has recently emerged as resistance, a historically bullish trendline lower down the charts could help topple this ceiling in the coming weeks.

Specifically, Cloudfare stock pulled back to its 40-day moving average, after several weeks floating far above the trendline in June and early July. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, two similar signals have occurred during the past three years. NET enjoyed positive returns one month after each signal, averaging a 30.2% gain. A similar move from its current perch would put the equity just above the $46 level, which marks previously unseen territory on the charts.

Meanwhile, short sellers have been coming out in droves. In fact, short interest rose an astounding 117.2% in the last two reporting periods, and the 13.27 million shares sold short make up a healthy 12% of NET's available float. In other words, it would take almost three days at the the security's average pace of trading to buy back these bearish bets. Should some of these shorts start to lay off the stock, it could help propel NET even higher.

Sentiment in the options pits, however, is much more bullish. Calls are immensely popular right now, per NET's 10-day call/put volume ratio of 19.52 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX).