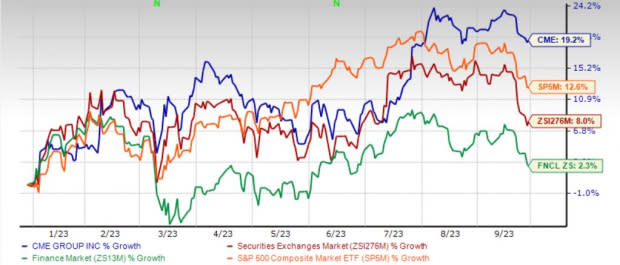

CME Group (CME) Rises 19% YTD: Can It Retain the Bull Run?

CME Group’s CME shares have gained 19.1% year to date, outperforming the industry’s increase of 8%. The Finance sector increased 2.3% and the Zacks S&P 500 composite gained 12.6% in the same period. With a market capitalization of $72.1 billion, the average volume of shares traded in the last three months was 1.3 million.

Global presence, a compelling product portfolio, a focus on over-the-counter clearing services and a solid capital position continue to drive this Zacks Rank #3 (Hold) company.

CME has a solid history of delivering earnings surprises in the last 11 reported quarters. Its earnings grew 8.2% in the last five years.

Image Source: Zacks Investment Research

Can it Retain the Momentum?

The consensus estimate for 2023 and 2024 earnings has moved up 2 cents and 5 cents, respectively, in the past 60 days, implying analysts’ optimism.

The Zacks Consensus Estimate for CME Group’s 2023 earnings is pegged at $9.06, indicating an increase of 13.7% on 8.7% higher revenues of $5.5 billion. The consensus estimate for 2024 earnings is pegged at $9.18, indicating an increase of 1.3% on 2.3% higher revenues of $5.6 billion.

The long-term earnings growth rate is currently pegged at 8.5%, better than the industry average of 7.9%. We estimate the bottom line to increase at a three-year (2022-2025) CAGR of 4.2%.

CME is the largest futures exchange in the world in terms of trading volume as well as notional value traded. Increased volatility aids higher trading volumes, which, in turn, fuels clearing and transaction fees that contribute the lion’s share to the top line. We estimate clearing and transaction fees to increase at a three-year CAGR (2022-2025) of 4.5%.

CME Group’s solid market presence with a 90% market share of global futures trading and clearing services, increasing electronic trading volume and increased adoption of a greater number of crypto assets with increased interest across the entire crypto-economy should fuel volumes.

The top line is also poised to benefit from an increase in non-transactional revenues. We estimate the top line to increase at a three-year (2022-2025) CAGR of 4.6%.

CME Group has a solid balance sheet and financial flexibility that support strategic growth initiatives, including organic market data growth, new product extensions and offerings as well as capital deployment.

CME Group has hiked dividends at a five-year CAGR (2019-2023) of 8%. The dividend yield is 2.2%, better than the industry average of 1.6%, making the stock an attractive pick for yield-seeking investors. Also, CME Group pays five dividends per year, with the fifth being variable and based on excess cash flow in the year.

Stocks to Consider

Some better-ranked stocks from the finance sector are Axis Capital Holdings Limited AXS, Chubb Limited CB and Cincinnati Financial Corporation CINF. While Axis Capital sports a Zacks Rank #1 (Strong Buy), Chubb and Cincinnati Financial carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axis Capital has a solid track record of beating earnings estimates in three of the last four quarters and missing in one, the average being 9.75%. In the past year, AXS has gained 13.1%.

The Zacks Consensus Estimate for AXS’ 2023 and 2024 earnings per share is pegged at $8.41 and $9.31, indicating a year-over-year increase of 44.7% and 10.7%, respectively.

Chubb has a solid track record of beating earnings estimates in three of the last four quarters and missing in one, the average being 3.36%. CB has climbed 15.2% in the past year.

The Zacks Consensus Estimate for CB’s 2023 and 2024 earnings per share is pegged at $18.18 and $19.86, indicating a year-over-year increase of 19.2% and 9.2%, respectively.

Cincinnati Financial has a solid track record of beating earnings estimates in three of the last four quarters and missing in one, the average being 25.25%. In the past year, CINF has gained 14%.

The Zacks Consensus Estimate for CINF’s 2023 and 2024 earnings per share is pegged at $5 and $5.88, indicating a year-over-year increase of 17.9% and 17.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CME Group Inc. (CME) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report