CMS Energy Corp (CMS) Reports Solid 2023 Earnings and Uplifts 2024 Guidance

Adjusted EPS Growth: CMS Energy Corp (NYSE:CMS) reported an increase in adjusted earnings per share (EPS) from $2.89 in 2022 to $3.11 in 2023.

Dividend Hike: The company announced an 11 cents per share increase in its annual dividend, raising it to $2.06 for 2024.

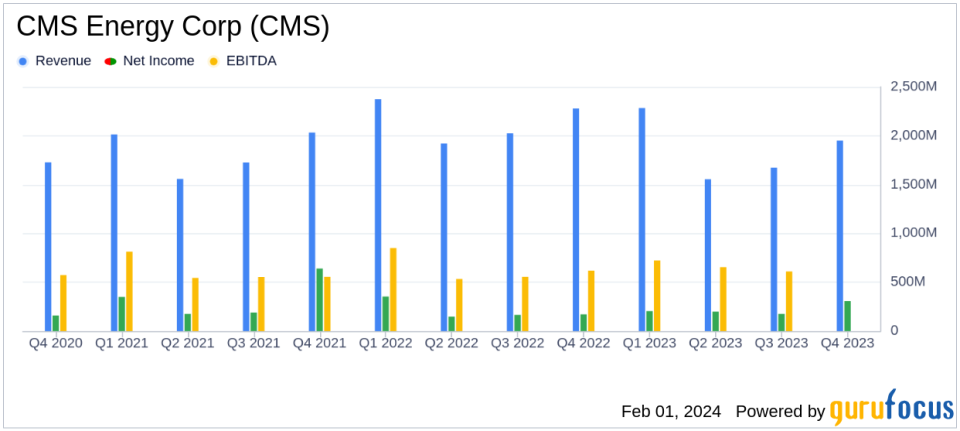

Revenue and Net Income: Operating revenue for 2023 stood at $7.462 billion with net income available to common stockholders at $877 million.

Balance Sheet Strength: Total assets increased to $33.517 billion as of December 31, 2023, from $31.353 billion the previous year.

Cash Flow Operations: Net cash provided by operating activities was significantly higher at $2.309 billion for 2023, compared to $855 million in 2022.

2024 Adjusted EPS Guidance: CMS Energy raised its 2024 adjusted EPS guidance to a range of $3.29 to $3.35.

On February 1, 2024, CMS Energy Corp (NYSE:CMS) released its 8-K filing, marking the 21st consecutive year of strong financial results. The company, a Michigan-based energy provider, operates primarily through its regulated utility, Consumers Energy, and owns independent power generation businesses.

CMS Energy reported a solid performance for the fiscal year 2023, with reported earnings per share of $3.01, up from $2.85 in 2022. The adjusted earnings per share also saw an increase from $2.89 in 2022 to $3.11 in 2023. This consistent growth trajectory is particularly noteworthy given the challenges faced during the year, including unfavorable weather conditions and significant storms.

Financial Highlights and Achievements

The company's financial achievements are critical in the Utilities - Regulated industry, where stable and predictable earnings are valued by investors. The increase in the annual dividend to $2.06 per share for 2024 underscores CMS Energy's commitment to delivering shareholder value and its confidence in the company's financial health.

From the income statement, CMS Energy's operating revenue for the year was $7.462 billion, with operating income at $1.235 billion. The balance sheet shows a robust financial position with total assets increasing to $33.517 billion as of December 31, 2023. The company's cash and cash equivalents also grew to $227 million, up from $164 million at the end of 2022.

The cash flow statement reveals a strong operational performance, with net cash provided by operating activities reaching $2.309 billion for the year, a significant increase from the previous year. This reflects the company's efficient operations and ability to generate cash.

"In a challenging year with unfavorable weather and significant storms, we responded and delivered for our customers, communities, and investors," said Garrick Rochow, President and CEO of CMS Energy and Consumers Energy. "Im proud of the teams efforts in 2023 and our success positions CMS Energy well for the long-term."

Looking ahead, CMS Energy has raised its 2024 adjusted earnings guidance to a range of $3.29 to $3.35 per share, reaffirming its long-term adjusted EPS growth of 6 to 8 percent. This optimistic outlook reflects the company's confidence in its ability to continue delivering strong financial results.

Analysis of Performance

CMS Energy's performance in 2023 demonstrates resilience and adaptability in the face of external challenges. The company's ability to not only maintain but also increase its dividend amidst such conditions is a testament to its operational strength and prudent financial management. The raised guidance for 2024 further indicates a positive trajectory for CMS Energy, making it an attractive prospect for value investors and potential GuruFocus.com members seeking stable investments in the utility sector.

For more detailed information and to participate in the webcast discussing these results, investors are encouraged to visit CMS Energy's website.

As CMS Energy continues to navigate the evolving energy landscape, its focus on delivering consistent results and shareholder value remains clear. The company's latest earnings report solidifies its position as a reliable performer in the regulated utilities industry.

Explore the complete 8-K earnings release (here) from CMS Energy Corp for further details.

This article first appeared on GuruFocus.