CNA Financial Corp Reports Record Core Income and Strong Premium Growth in Q4 and Full Year 2023

Net Income: Q4 net income rose to $367 million, full-year net income reached $1,205 million.

Core Income: Record Q4 core income of $362 million, full-year core income surged to $1,284 million.

Dividends: Quarterly dividend increased by 5% to $0.44 per share, with a special dividend of $2.00 per share.

Premium Growth: Gross written premium growth of 10% for both Q4 and the full year, excluding third party captives.

Combined Ratio: P&C underlying combined ratio improved to a record low of 90.9% for the year.

Book Value: Book value per share excluding AOCI rose by 10% to $46.39 after adjusting for dividends.

Investment Income: Net investment income increased by 21% in Q4 and 25% for the full year.

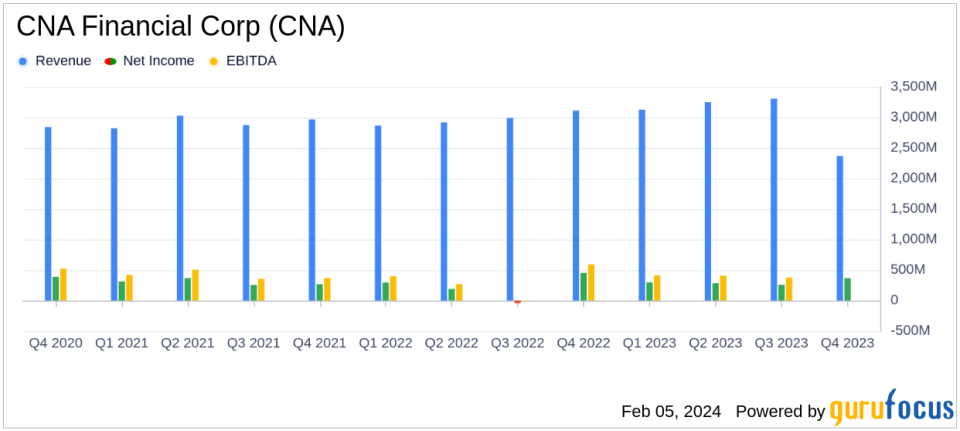

On February 5, 2024, CNA Financial Corp (NYSE:CNA) released its 8-K filing, announcing a significant uptick in both quarterly and annual financial metrics. The insurance holding company, which specializes in commercial property and casualty insurance, reported a 54% increase in net income for Q4 2023, reaching $367 million, and a 77% increase for the full year, totaling $1,205 million. Core income for Q4 hit a record $362 million, up 37%, and $1,284 million for the full year, a 54% increase. This performance was bolstered by a 25% rise in pretax net investment income and record levels of underlying and all-in underwriting income.

CNA Financial Corp's Property & Casualty (P&C) segments were particularly strong, with core income of $434 million for Q4 and $1,505 million for the full year, reflecting higher investment income and record high underwriting income. The company's P&C segments, excluding third party captives, saw gross written premium and net written premium growth of 10% for the quarter and the year, driven by new business growth and strong retention rates.

The company's financial achievements are significant as they reflect the strength and resilience of CNA's core operations, particularly in a competitive insurance market. The increased net investment income, driven by favorable limited partnership returns and higher income from fixed income securities, underscores the company's adept investment strategies amid a rising interest rate environment.

CNA Financial Corp's balance sheet remains robust, with stockholders equity improving by 16% from year-end 2022, primarily due to net income and an improvement in net unrealized investment losses, partially offset by dividends paid to stockholders. The book value per share excluding Accumulated Other Comprehensive Income (AOCI) increased by 10% to $46.39, adjusting for $2.88 of dividends per share.

The company's performance is further exemplified by the P&C underlying combined ratio, which improved to a record low of 90.9% for the year, indicating efficient underwriting and expense management. This metric is crucial as it reflects the profitability of the company's insurance operations before considering the impact of catastrophe losses and reserve developments.

"We ended the year strong, with core income up 37% to a record high of $362 million in the fourth quarter capping off a record level for the year of $1,284 million, a 54% increase driven by a 25% increase in pretax net investment income and record levels of underlying and all-in underwriting income," said Dino E. Robusto, Chairman & Chief Executive Officer of CNA Financial Corporation.

CNA Financial Corp's earnings report also highlighted the company's commitment to returning value to shareholders, with a 5% increase in the regular quarterly dividend to $0.44 per share and a special dividend of $2.00 per share. This reflects the company's strong cash flow and confidence in its financial stability.

The company's solid performance in Q4 and throughout 2023 sets a positive tone for the upcoming year, with management expressing optimism about the opportunities ahead, given the broad-based profitability across operating segments and a track record of double-digit growth levels in recent years.

In conclusion, CNA Financial Corp's latest earnings report paints a picture of a company that is not only growing but also managing its operations effectively to maximize profitability. The record core income and strong premium growth, coupled with a disciplined approach to underwriting and investment, position CNA as a leader in the insurance industry. For value investors and potential GuruFocus.com members, CNA Financial Corp's performance demonstrates the company's potential for sustained growth and profitability.

For a more detailed analysis of CNA Financial Corp's earnings and to stay updated on the latest financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from CNA Financial Corp for further details.

This article first appeared on GuruFocus.