CNH Industrial (CNHI) Beats on Q3 Earnings, Ups Sales View

CNH Industrial CNHI posted third-quarter 2022 adjusted earnings per share of 41 cents, which increased from 36 cents in the prior-year quarter and topped the Zacks Consensus Estimate of 32 cents. Higher-than-anticipated revenues across the Agricultural and the Financial Services segments resulted in this outperformance.

In the third quarter, consolidated revenues rose 23.9% from the year-ago level to $5,881 million and topped the consensus mark of $5,327 million. The company’s net sales from industrial activities came in at $5,396 million, up 24.4%, led by favorable pricing.

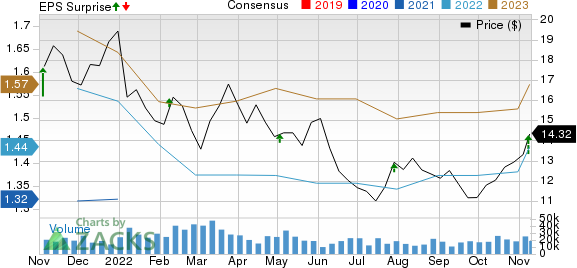

CNH Industrial N.V. Price, Consensus and EPS Surprise

CNH Industrial N.V. price-consensus-eps-surprise-chart | CNH Industrial N.V. Quote

Segmental Performance

In the September quarter, net sales in the Agricultural segment grew 26% year over year to $4,501 million due to a favorable price realization and improved mix, mainly driven by the North America and South America regions. The metric also topped the Zacks Consensus Estimate of $4,060 million. The segment’s adjusted EBIT came in at $666 million, jumping 60.4% year over year and topping the consensus mark of $529 million. The adjusted EBIT margin increased to 14.8% from 11.6%.

The Construction segment’s sales grew 16% year over year to $895 million in the quarter, led by price realization and contribution from the Sampierana business. But revenues beat the Zacks Consensus Estimate of $844 million. Adjusted EBIT came in at $24 million, gaining 14.3% on the back of favorable volume and a positive price realization. Nonetheless, the figure lagged the consensus mark of $35 million. The adjusted EBIT margin was the same as the prior-year level of 2.7%.

The Financial Services segment revenues went up 19% to $482 million and topped the consensus mark of $460 million on higher used equipment sales, improved volumes and better base rates across all regions, especially in South America. Net income from the segment declined 10.4% to $86 million in the quarter under review.

Financial Details

CNH Industrial had cash and cash equivalents of $3,154 million as of Sep 30, 2022, down from $5,044 million as of Dec 31, 2021. The company’s debt totaled $20,922 million at the end of the third quarter of 2022, up from $20,897 million as of Dec 31, 2021. The firm had available liquidity of $8,645 million as of Sep 30, 2022.

CNH Industrial’s net cash provided by operating activities was $272 million, down from $673 million in the year-ago period. Free cash flow from industrial activities was $202 million in the quarter versus negative FCF of $70 million in the third quarter of 2021.

CNH Industrial currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2022 Guidance

CNH Industrial revised its estimates for net sales from industrial activities (including currency-translation effects) for 2022. Sales are now expected to increase year over year in the band of 16-18% instead of 12-14% guided earlier. Its projections for free cash flow remain unchanged. The company continues to expect to generate more than $1 billion in free cash flow from industrial activities in 2022. R&D expenses and capex projections also remain the same at around $1.4 billion. SG&A expenses continue to be projected at lower than 7.5% of net sales.

Peer Releases

Lindsay Corporation LNN: Lindsay reported fourth-quarter fiscal 2022 results on Oct 20. The company came out with quarterly earnings of $1.62 per share, missing the Zacks Consensus Estimate of $1.67 per share. This compares to earnings of 94 cents per share recorded in the year-ago period. LNN posted revenues of $190.2 million for the quarter ended August 2022, surpassing the Zacks Consensus Estimate by 3.35%. This compares to year-ago revenues of $153.65 million.

The Zacks Consensus Estimate for fiscal 2023 sales and earnings per share implies year-over-year growth of 3.8% and 9.3%, respectively. The company pulled off earnings beat in three out of four trailing quarters, and missed on the other, the average surprise being 21.5%.

AGCO Corp AGCO: AGCO reported third-quarter 2022 results on Nov 1. The company came out with quarterly earnings of $3.18 per share, beating the Zacks Consensus Estimate of $3.12 per share. This compares to earnings of $2.41 per share recorded a year ago. It posted revenues of $3.12 billion for the quarter ended September 2022, missing the Zacks Consensus Estimate by 4.89%. This compares to the year-ago revenues of $2.73 billion.

The Zacks Consensus Estimate for AGCO’s 2022 sales and earnings per share implies year-over-year growth of 12.3% and 14.3%, respectively. The company pulled off an earnings beat in the trailing four quarters, the average surprise being 29.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lindsay Corporation (LNN) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

CNH Industrial N.V. (CNHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research