CNO Financial Group Inc (CNO) Reports Earnings: A Mixed Bag of Growth and Challenges

Net Income: Q4 net income decreased to $36.3 million from $38.0 million in the prior year.

Operating Income: Q4 net operating income increased to $133.9 million from $82.9 million year-over-year.

Annualized Premiums: Total new annualized premiums rose by 9% for the full year.

Shareholder Returns: CNO returned $233.2 million to shareholders in 2023.

Book Value: Book value per diluted share, excluding AOCI, increased to $33.94 from $31.89.

Capital Position: Strong capital position with a statutory risk-based capital ratio of 402%.

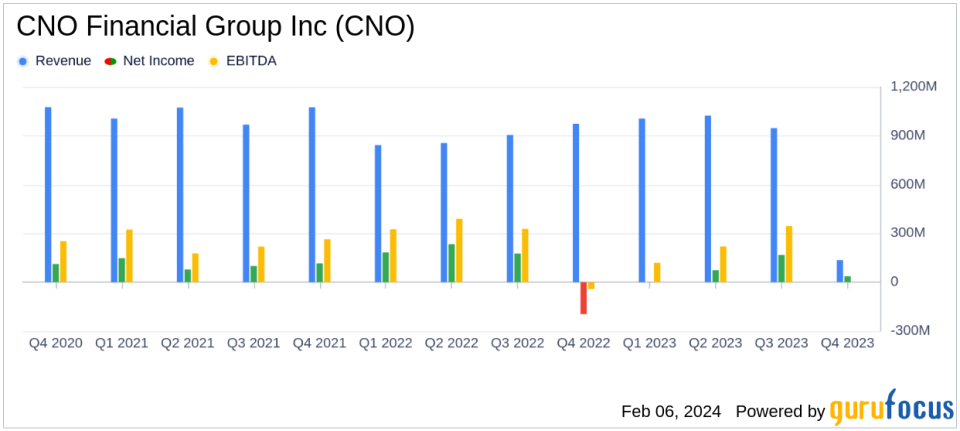

On February 6, 2024, CNO Financial Group Inc (NYSE:CNO) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. The company, which provides insurance and financial services to middle-income American consumers, reported a decrease in net income for the fourth quarter to $36.3 million, or $0.32 per diluted share, compared to $38.0 million, or $0.33 per diluted share, in the same quarter of the previous year. However, net operating income for the quarter showed a significant increase to $133.9 million, or $1.18 per diluted share, up from $82.9 million, or $0.71 per diluted share, in the fourth quarter of 2022.

CNO's performance in 2023 was marked by strong sales momentum, with total new annualized premiums (NAP) increasing by 9% for the year. The company's Consumer Division and Worksite Division both reported substantial growth in NAP, up 16% and 29% respectively. This growth was supported by a growing agent force, with the Consumer Division's producing agent count up by 9% and the Worksite Division's by 27% in the fourth quarter.

Despite the positive sales trends, net income for the full year ended December 31, 2023, was $276.5 million, or $2.40 per diluted share, a decrease from $630.6 million, or $5.36 per diluted share, in 2022. This decline was attributed to non-economic market impacts which decreased earnings by $(18.8) million in 2023, compared to an increase of $334.9 million in the previous year.

CEO Gary C. Bhojwani commented on the company's resilience and operational strength, highlighting the diverse distribution channels and record growth across multiple product categories. He emphasized the company's solid earnings results, driven by stable insurance product margins and improved investment portfolio yield. Bhojwani also noted the return of over $230 million to shareholders and expressed confidence in the company's sales momentum and growing agent force heading into 2024.

CNO delivered strong earnings growth in the quarter and exceptional full-year operating performance," said Gary C. Bhojwani, chief executive officer. "Our diverse, integrated distribution generated four consecutive quarters of sales momentum, increased agent counts and record growth across multiple product categories. This high level of operating performance underscores the health and strength of our business model and will contribute to sustained profitable growth."

The company's capital position and free cash flow generation remained robust, bolstered by a new Bermuda reinsurance structure. CNO's return on equity (ROE) was 14.0%, and operating ROE, as adjusted, was 9.8% for the full year.

From a balance sheet perspective, CNO's book value per share was $20.26, with a book value per diluted share, excluding accumulated other comprehensive loss (AOCI), of $33.94. The company's investment portfolio remained strong, with 94% of fixed maturities rated as investment grade.

As CNO Financial Group Inc (NYSE:CNO) moves forward, it continues to focus on strong capital management and profitable growth, aiming to deliver enduring value to its stakeholders.

Explore the complete 8-K earnings release (here) from CNO Financial Group Inc for further details.

This article first appeared on GuruFocus.