CNX Resources (CNX) Cuts 2024 Production & Capital Investment

CNX Resources Corporation CNX, to accommodate continued lower outlook for near- term natural gas prices, decided to lower its 2024 production volumes and also reduce planned capital expenditure. The strategic move of the company will allow it from pushing incremental natural gas volumes into the current oversupplied market.

Reduction in Annual Guidance

CNX Resources now expects its 2024 annual production volumes in the range of 540-560 billion cubic feet equivalent (Bcfe), down from the previous expectation of 570-590 Bcfe. The company has decided to delay completion activities on three upcoming Marcellus Shale pads consisting of 11 wells, which will account from the drop in production volumes.

Despite the planned delay to bring wells online, CNX has the flexibility to achieve its previously stated long term production volume target of nearly 580 Bcfe in 2025.

CNX Resources now expects its 2024 capital expenditure in the band of $525-$575 million, down from the prior expectation in the range of $575-$625 million.

Despite a recent drop in natural gas prices, CNX Resources remains well-poised to navigate through price fluctuation as a low-cost producer in Appalachia with one of the strongest hedge books in the industry.

Stable Performance

CNX Resources has been performing steadily over the past few years and is generating free cash flow. In the past 16 consecutive quarters the company has been generating free cash flow, which is being utilized by management to return capital to shareholders and pay down outstanding debt to strengthen balance sheet and reduce interest burden.

The company is expected to continue with its free cash flow generation in 2024 as well. CNX expects to generate nearly $300 million in free cash flow in 2024.

The company utilized its free cash flow to repurchase 74 million shares or 33% reduction in outstanding shares since third-quarter 2020. CNX still has $1.1 billion remaining from its $2.9 billion share repurchase program, which will allow it to buyback more shares. The ongoing repurchases are having a positive impact on earnings per share of the company.

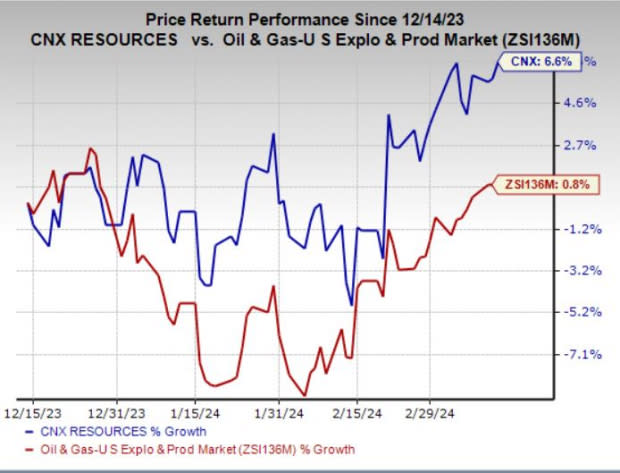

Price Performance

In the past three month, shares of CNX Resources have gained 6.6% compared with the industry’s 0.8% rally.

Image Source: Zacks Investment Research

Zacks Rank

CNX Resources currently has a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the same sector are MUSA USA MUSA, Talen Energy TLNE and Sunoco LP SUN. MUSA currently sports a Zacks Rank #1 (Strong Buy), and TLNE and SUN are carrying a Zacks Rank of 2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MUSA’s 2024 earnings per share (EPS) indicates an increase of 4.3% in the past 60 days. It reported average earnings surprise of 13.63% in the last four quarters.

The Zacks Consensus Estimate for TLNE’s 2024 EPS has moved up 77.6% in the past 90 days.

The Zacks Consensus Estimate for SUN’s 2024 earnings per unit has moved up 27.1% in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sunoco LP (SUN) : Free Stock Analysis Report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Talen Energy Corporation (TLNE) : Free Stock Analysis Report