Co-CEO Leagh Turner Sells 6,000 Shares of Ceridian HCM Holding Inc (CDAY)

On September 7, 2023, Co-CEO Leagh Turner sold 6,000 shares of Ceridian HCM Holding Inc (NYSE:CDAY). This move comes as part of a series of transactions by the insider over the past year, during which Turner has sold a total of 63,084 shares and purchased none.

Leagh Turner is the Co-CEO of Ceridian HCM Holding Inc, a global human capital management software company. Ceridian provides solutions for managing and engaging the entire workforce, from recruitment to retirement. Their flagship cloud HCM platform, Dayforce, provides human resources, payroll, benefits, workforce management, and talent management functionality.

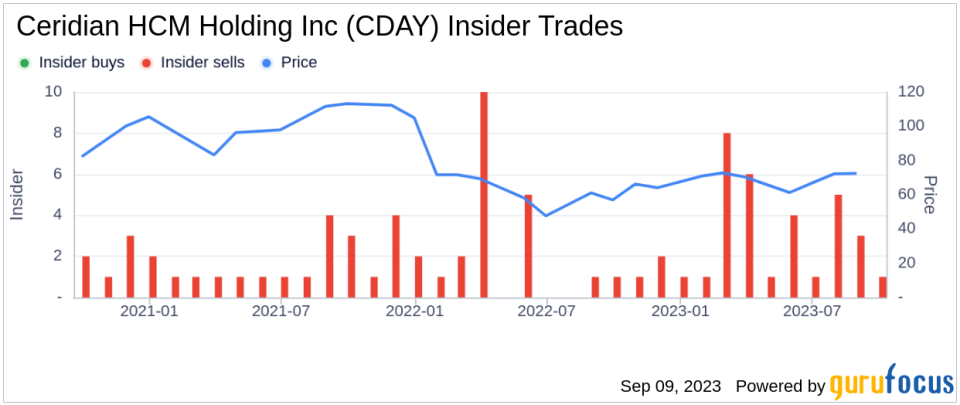

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been 35 insider sells and no insider buys. This trend is illustrated in the following chart:

On the day of the insider's recent sell, shares of Ceridian HCM Holding Inc were trading at $72.68, giving the company a market cap of $11.38 billion. This price represents a significant discount to the GuruFocus Value of $112.28, resulting in a price-to-GF-Value ratio of 0.65. This suggests that the stock may be a possible value trap, and investors should think twice before buying.

The GF Value is a proprietary estimate of intrinsic value developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

The relationship between insider selling and stock price can be complex. While it's not uncommon for insiders to sell shares for personal reasons, such as diversifying their portfolio or meeting financial obligations, a high volume of insider selling can sometimes signal a lack of confidence in the company's future prospects. However, given the stock's current valuation, it's also possible that the insider simply believed that the stock was overvalued and decided to take profits.

In conclusion, while the recent insider selling at Ceridian HCM Holding Inc is noteworthy, it's important for investors to consider the broader context. The stock's current valuation suggests that it may be a possible value trap, and investors should carefully consider their investment strategy before buying shares.

This article first appeared on GuruFocus.