Coeur Mining Inc (CDE) Reports Q4 and Full-Year 2023 Financial Results

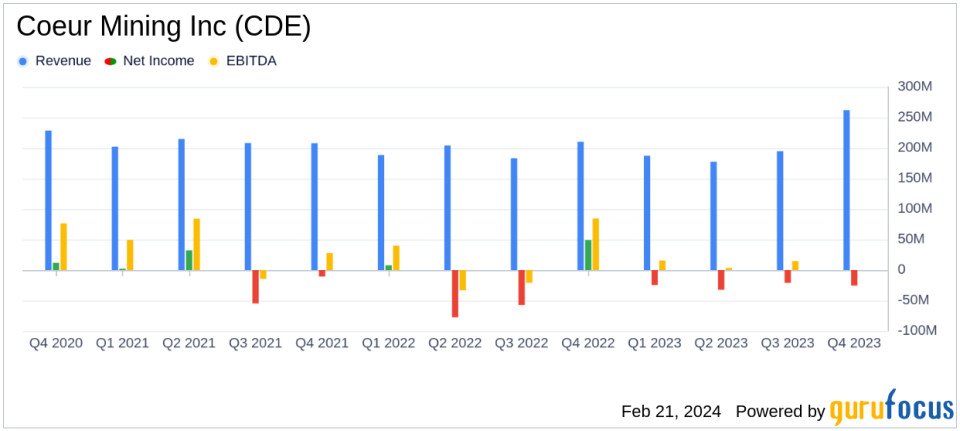

Revenue: Q4 revenue jumped 35% to $262.1 million; full-year revenue reached $821.2 million.

Net Loss: Q4 GAAP net loss was $25.5 million; full-year net loss stood at $103.6 million.

Production: Achieved full-year 2023 gold and silver production guidance with significant quarterly increases.

Free Cash Flow: Wharf mine delivered a record annual free cash flow of $82 million.

Expansion: Rochester expansion ramp-up is progressing, with full-year 2024 guidance reflecting strong anticipated growth.

Exploration: Silvertip project drills one of its highest grade intercepts ever, with continued exploration planned for 2024.

On February 21, 2024, Coeur Mining Inc (NYSE:CDE) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, a metals producer focused on mining precious minerals in the Americas, reported a 35% increase in quarterly revenue driven by strong performances at its Rochester and Wharf mines. Despite the revenue surge, Coeur Mining Inc (NYSE:CDE) experienced a GAAP net loss from continuing operations of $26 million for the quarter and $104 million for the full year.

Financial and Operational Performance

Coeur Mining Inc (NYSE:CDE) achieved its full-year 2023 gold and silver production guidance, with gold production totaling 317,671 ounces and silver production reaching 10.3 million ounces. The fourth quarter saw a significant increase in production, particularly at the Rochester mine in Nevada, which is currently ramping up following an expansion. The Wharf mine in South Dakota ended the year with record annual free cash flow, generating $82 million, which is more than four times the company's original investment in the mine.

The company's adjusted EBITDA more than doubled quarter-over-quarter to $64.3 million, reflecting the increased revenue and production. However, costs applicable to sales also rose, both quarterly and annually, due to higher production levels and inflationary pressures on consumables.

Challenges and Outlook

Despite the positive production and cash flow results, Coeur Mining Inc (NYSE:CDE) faced challenges, including a GAAP net loss and a negative free cash flow for the year. The net loss was attributed to several factors, including increased costs and an LCM adjustment at the Rochester mine due to lower market values of ounces under leach.

Looking ahead, the company expects significant production growth in 2024, driven by the completion of the Rochester mine expansion. The ramp-up activities for the new crushing circuit are anticipated to be completed in the first half of 2024, which is expected to lead to strong production growth, lower costs, and sharp increases in cash flow.

Strategic Developments

Throughout 2023, Coeur Mining Inc (NYSE:CDE) advanced several key initiatives across its operations. At Kensington in Alaska, the company is in the last full year of elevated levels of development and drilling investment, which is expected to significantly extend the mine's life. The Palmarejo mine in Mexico is entering a revitalized development phase, and the Silvertip project in British Columbia continues its exploration program.

The company's financial position includes total liquidity of approximately $247 million, with $62 million in cash and $185 million of available capacity under its revolving credit facility. Coeur Mining Inc (NYSE:CDE) also completed a new agreement to extend and enhance its revolving credit facility, increasing its borrowing capacity and adding new banks to the syndicate.

For detailed financial tables and further discussion of Coeur Mining Inc (NYSE:CDE)'s performance, readers are encouraged to view the full 8-K filing.

Conference Call and Further Information

Coeur Mining Inc (NYSE:CDE) will host a conference call to discuss its fourth quarter and full-year 2023 financial results on February 22, 2024. Interested parties can access the call using the provided dial-in numbers and conference ID.

For additional information about Coeur Mining Inc (NYSE:CDE), including details on its operations, exploration efforts, and financial results, please visit the company's website or contact the Director of Investor Relations.

Value investors and potential GuruFocus.com members interested in the metals and mining sector may find Coeur Mining Inc (NYSE:CDE)'s full-year guidance and strategic developments particularly noteworthy as they consider the company's potential for growth and value creation.

Explore the complete 8-K earnings release (here) from Coeur Mining Inc for further details.

This article first appeared on GuruFocus.