Coeur Mining, Inc.'s (NYSE:CDE) P/S Is Still On The Mark Following 32% Share Price Bounce

Coeur Mining, Inc. (NYSE:CDE) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

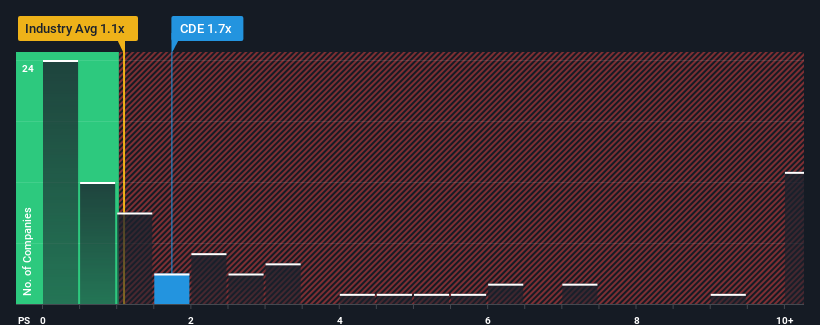

Since its price has surged higher, when almost half of the companies in the United States' Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Coeur Mining as a stock probably not worth researching with its 1.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Coeur Mining

What Does Coeur Mining's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Coeur Mining's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying to much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Coeur Mining will help you uncover what's on the horizon.

What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as Coeur Mining's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 5.7% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 10% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 16% per year over the next three years. That's shaping up to be materially higher than the 1.6% each year growth forecast for the broader industry.

In light of this, it's understandable that Coeur Mining's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The large bounce in Coeur Mining's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Coeur Mining's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Coeur Mining (1 is a bit unpleasant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here