Coeur Mining, Inc. (NYSE:CDE) Stock Rockets 40% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Coeur Mining, Inc. (NYSE:CDE) shares have been powering on, with a gain of 40% in the last thirty days. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

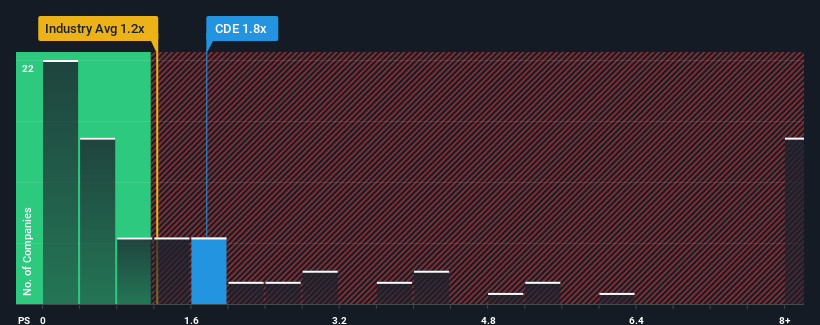

Following the firm bounce in price, when almost half of the companies in the United States' Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Coeur Mining as a stock probably not worth researching with its 1.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Coeur Mining

What Does Coeur Mining's P/S Mean For Shareholders?

Recent times have been more advantageous for Coeur Mining as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting the company to continue to outperform the industry, which has propped up the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if revenue continues to dissolve.

Want the full picture on analyst estimates for the company? Then our free report on Coeur Mining will help you uncover what's on the horizon.

What Are Revenue Growth Metrics Telling Us About The High P/S?

Coeur Mining's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.8%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 6.7% each year over the next three years. With the industry predicted to deliver 533% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Coeur Mining's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Coeur Mining's P/S

Coeur Mining's P/S is on the rise since its shares have risen strongly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Coeur Mining currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Coeur Mining that you need to be mindful of.

If you're unsure about the strength of Coeur Mining's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.