Cogent Communications Holdings Inc: A Telecommunication Stock with Good Outperformance Potential

Cogent Communications Holdings Inc (NASDAQ:CCOI) is a prominent player in the Telecommunication Services industry. As of August 10, 2023, the company's stock price stands at $65.39, with a market cap of $3.16 billion. The stock has seen a gain of 12.05% today and a 1.95% increase over the past four weeks. In this article, we will delve into the company's GF Score and various ranks to provide a comprehensive analysis of its performance and potential.

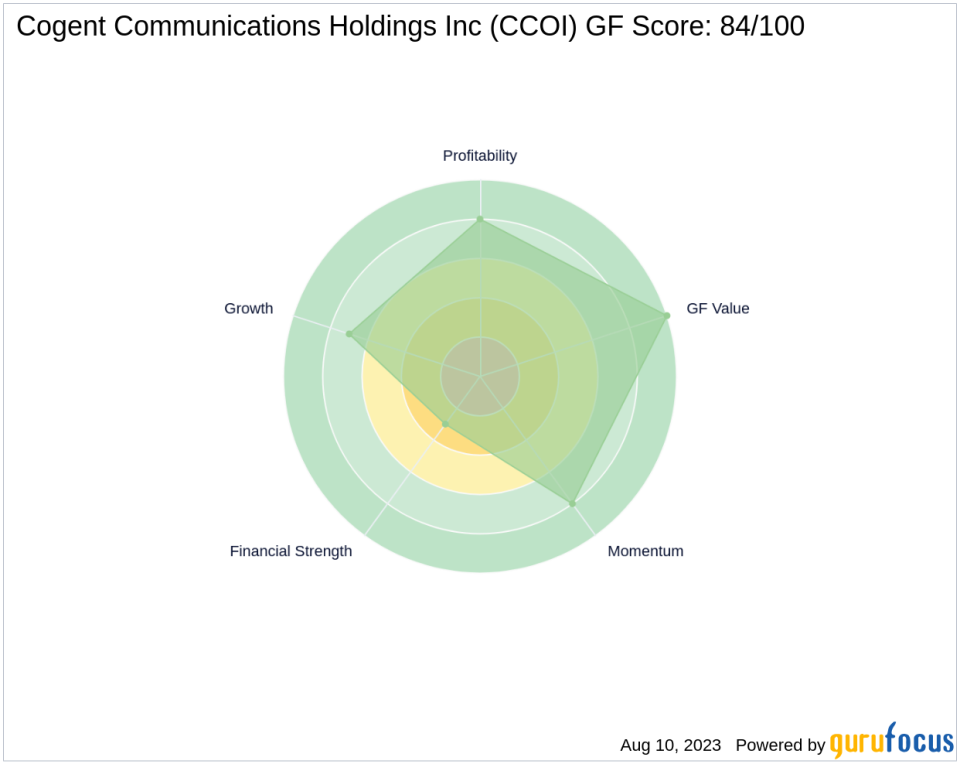

GF Score Analysis

The GF Score is a stock performance ranking system developed by GuruFocus. It uses five aspects of valuation and has been found to be closely correlated to the long-term performances of stocks. CCOI's GF Score is 84/100, indicating good outperformance potential. This score places CCOI in the second-highest category of performance potential, suggesting that the stock is likely to generate higher returns than those with lower GF Scores.

Financial Strength Analysis

The Financial Strength Rank measures how strong a company's financial situation is. CCOI's Financial Strength Rank is 3/10, indicating a relatively weak financial situation. This is based on factors such as its interest coverage of 1.55, a debt to revenue ratio of 2.27, and an Altman Z score of 0.73.

Profitability Rank Analysis

The Profitability Rank ranks how profitable a company is and how likely the company's business will stay that way. CCOI's Profitability Rank is 8/10, indicating a high level of profitability and consistency. This is based on factors such as its Operating Margin of 18.63%, a Piotroski F-Score of 4, and a consistent profitability of 10 years over the past decade.

Growth Rank Analysis

The Growth Rank measures the growth of a company in terms of its revenue and profitability. CCOI's Growth Rank is 7/10, indicating good growth in terms of revenue and profitability. This is based on its 5-year revenue growth rate of 3.40%, a 3-year revenue growth rate of 2.30%, and a 5-year EBITDA growth rate of 3.20%.

GF Value Rank Analysis

The GF Value Rank is determined by the price-to-GF-Value ratio, a proprietary metric calculated based on historical multiples along with an adjustment factor based on a company's past returns and growth and future estimates of the business' performance. CCOI's GF Value Rank is 10/10, indicating that the stock is undervalued.

Momentum Rank Analysis

The Momentum Rank is determined using the standardized momentum ratio and other momentum indicators. CCOI's Momentum Rank is 8/10, indicating a strong momentum in the stock price.

Competitor Analysis

CCOI's main competitors in the Telecommunication Services industry include IHS Holding Ltd (NYSE:IHS) with a GF Score of 19, Millicom International Cellular SA (NASDAQ:TIGO) with a GF Score of 79, and InterDigital Inc (NASDAQ:IDCC) with a GF Score of 81. Compared to its competitors, CCOI's GF Score of 84 indicates a competitive position in the industry. For more details, please visit the competitors page.

In conclusion, Cogent Communications Holdings Inc (NASDAQ:CCOI) presents a good outperformance potential with a high GF Score, strong profitability, and growth ranks. However, investors should be cautious about the company's relatively weak financial strength. As always, it's crucial to conduct thorough research and consider various factors before making investment decisions.

This article first appeared on GuruFocus.