Cogent's (CCOI) Q2 Earnings Miss Despite Higher Revenues

Cogent Communications Holdings, Inc. CCOI reported soft second-quarter 2023 results, wherein both the bottom and the top lines missed the respective Zacks Consensus Estimate. The Washington, DC-based leading Internet service provider witnessed a top-line improvement year over year, driven by the commercial expansion of its NetCentric business.

Net Income

Net income in the June quarter was $1,123.9 million or $23.65 per share compared with $11.2 million or 24 cents per share in the prior-year quarter. The year-over-year improvement was primarily driven by the gain on the bargain purchase of Sprint assets. Non-GAAP loss in the reported quarter was 13 cents per share, which missed the Zacks Consensus Estimate by 19 cents.

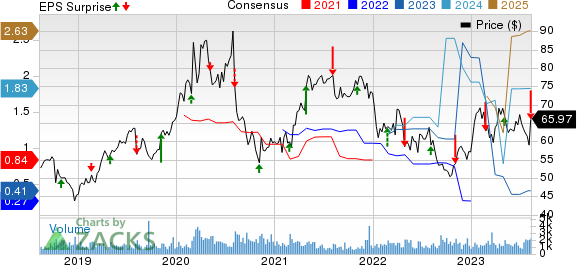

Cogent Communications Holdings, Inc. Price, Consensus and EPS Surprise

Cogent Communications Holdings, Inc. price-consensus-eps-surprise-chart | Cogent Communications Holdings, Inc. Quote

Revenues

Quarterly Service revenues increased to $239.8 million from $148.5 million in the year-ago quarter, driven by higher Off-net revenues. The top line missed the consensus estimate of $260 million.

On-net revenues in the reported quarter increased to $127.7 million from $112 million in the year-ago quarter. On-net customer connections increased 12.8% year over year to 92,846. Net-centric business experienced healthy demand, driven by continued growth in video, traffic and streaming. The company witnessed a 31.6% year-over-year increase in Net-centric customer connections to 66,711. Its on-net ARPU increased due to higher sales of 100- and 400-gigabit connections.

Off-net revenues increased 181% year over year to $102 million, primarily due to the acquisition of the wireline business of Sprint.

Other Details

GAAP gross profit was $49.8 million, down from $68.9 million in the year-ago quarter for margins of 20.8% and 46.4%, respectively. Operating loss was $34.6 million, down from an operating income of $29.6 million. EBITDA totaled $24.2 million compared with $58.5 million in the year-ago quarter for respective margins of 10.1% and 39.4%. The year-over-year decline was due to Sprint acquisition costs. Cogent increased its dividend for the 44th consecutive quarter. It raised its quarterly dividend by 1 cent per share to 94.5 cents.

Cash Flow & Liquidity

In the first six months of 2023, Cogent generated $118.5 million from operating activities compared with $83.8 million in the prior-year period. As of Jun 30, 2023, the company had $192.4 million in cash and cash equivalents and finance lease obligations (net of current maturities) of $311.4 million.

Cogent currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Key Picks

Model N, Inc. MODN, sporting a Zacks Rank #1, has delivered an earnings surprise of 21.3% in the trailing four quarters.

San Mateo, CA-based Model N provides revenue management solutions for life sciences and technology companies including applications for configure, price, quote, rebates management and regulatory compliance. Model N has significant growth opportunity in the revenue management market, as it continues to replace legacy processes that were labor intensive, error prone, inflexible and costly.

Akamai Technologies, Inc. AKAM, carrying a Zacks Rank #2, delivered an earnings surprise of 4.9%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 10%.

Akamai is a global provider of content delivery network and cloud infrastructure services. The company’s solutions accelerate and improve the delivery of content over the Internet, enabling faster response to requests for web pages, streaming of video & audio, business applications, etc. Akamai’s offerings are intended to reduce the impact of traffic congestion, bandwidth constraints and capacity limitations on customers.

T-Mobile US, Inc. TMUS, carrying a Zacks Rank #2, delivered an earnings surprise of 8.8% in the last reported quarter. It has a VGM Score of B.

Headquartered in Bellevue, WA, T-Mobile is a national wireless service provider. The company offers its services under the T-Mobile, Metro by T-Mobile and Sprint brands. T-Mobile, through its subsidiaries, provides wireless services for branded postpaid and prepaid, and wholesale customers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report