Cognizant (CTSH) Q3 Earnings Beat Estimates, Revenues Up Y/Y

Cognizant Technology Solutions CTSH reported third-quarter 2023 non-GAAP earnings of $1.16 per share, which beat the Zacks Consensus Estimate by 7.41% but decreased 0.9% year over year.

Revenues of $4.897 billion lagged the consensus mark by 0.14%. The top line increased 0.8% year over year but declined 0.2% at constant currency (cc). On a sequential basis, revenues increased 0.2%.

Acquisitions contributed 110 basis points (bps) to top-line growth.

Bookings increased 9% year over year, which benefited from the mix-shift toward larger deals. Roughly 30% of Cognizant’s third-quarter bookings were large deals and three of these deals exceeded $100 million each. The company continued to witness weakness in smaller, shorter-duration contracts, primarily due to sluggish discretionary spending.

On a trailing twelve-month basis, bookings increased 16% year over year to $26.9 billion, which represented a book-to-bill of approximately 1.4 times.

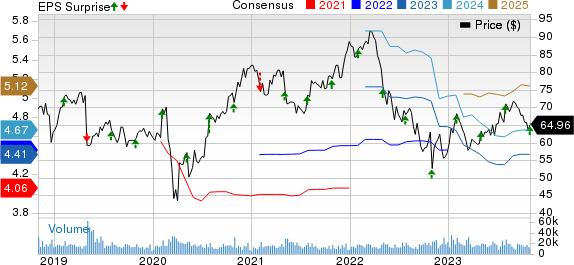

Cognizant Technology Solutions Corporation Price, Consensus and EPS Surprise

Cognizant Technology Solutions Corporation price-consensus-eps-surprise-chart | Cognizant Technology Solutions Corporation Quote

Top-Line Details

Financial services revenues (30.1% of revenues) decreased 3% year over year (down 4% at cc) to $1.475 billion. The decline was attributed to a challenging demand environment.

Our model estimate for Financial Services revenues was pegged at $1.546 billion.

Health Sciences revenues (28.7% of revenues) were unchanged year over year (down 0.8% at cc) to $1.405 billion. Soft discretionary spending negatively impacted top-line growth.

Our model estimate for Health Services revenues was pegged at $1.45 billion.

Products and Resources revenues (23.9% of revenues) increased 1.9% year over year (up 0.6% at cc) to $1.17 billion. The segment benefited from acquisitions, solid performance from utility clients driven by their grid modernization investments and growth among automotive clients in Europe.

Our model estimate for Products and Resources revenues was pegged at $1.17 billion.

Communications, Media and Technology revenues (17.3% of revenues) were $847 million, which increased 17.3% from the year-ago quarter (up 7.3% at cc). The segment benefited from new acquisitions and contract awards.

Our model estimate for Communications, Media and Technology revenues was pegged at $722.6 million.

Region-wise, revenues from North America decreased 0.6% year over year (down 0.6% at cc) and accounted for 73.5% of total revenues. The decline was primarily attributed to weakness in Financial Services, as well as the Health Sciences segment.

Revenues from Europe increased 9.7% from the year-ago quarter (up 3% at cc) and made up 19.8% of total revenues. Revenues from the U.K. and Continental Europe increased 9% (up 2% at cc) and 10.5% year over year (up 3.7% at cc), respectively.

The Rest of the World revenues decreased 6.8% year over year (down 3.4% at cc) and represented 6.7% of total revenues.

Operating Details

Selling, general & administrative expenses, as a percentage of revenues, decreased 90 bps year over year to 16.4%.

Total headcount at the end of the third quarter was 346,600, down 2,800 year over year but up 1,000 sequentially.

Voluntary attrition - Tech Services, on a trailing 12-month basis, declined to 16.2% from 19.9% in the second quarter of 2023 and 29.2% in the third quarter of 2022.

Cognizant reported a GAAP operating margin of 14%, down 240 bps on a year-over-year basis.

The company incurred $72 million in costs related to the NextGen program, negatively impacting the GAAP operating margin by 150 bps.

Non-GAAP operating margin (adjusted for NextGen charges) of 15.5% contracted 100 bps year over year.

Balance Sheet

Cognizant had cash and short-term investments of $2.37 billion as of Sep 30, 2023 compared with $2.1 billion as of Jun 30, 2023.

As of Sep 30, 2023, the company had a total debt of $647 million, down from $793 million reported as of Jun 30, 2023.

It generated $828 million in cash from operations compared with $36 million in the previous quarter.

Free cash outflow was $755 million compared with free cash flow of $32 million reported in the prior quarter.

In the third quarter of 2023, the company returned $300 million through share repurchases. As of Sep 30, 2023, it had $2.075 billion remaining under the current share repurchase program.

Cognizant raised its dividend payout by 7% to 29 cents per share, payable on Nov 30 to shareholders of record as of Nov 21.

Guidance

The company expects fourth-quarter 2023 revenues between $4.69 billion and $4.82 billion, indicating a decline of 3.1% to an increase of 0.3% (a decline of 4-1.2% on a cc basis). Acquisitions are expected to contribute 100 bps.

In the Financial Services segment, Cognizant continues to expect the challenging macro environment to hurt spending rates, thereby negatively impacting top-line growth.

For 2023, revenues are expected to be $19.3-$19.4 billion, indicating a decline of 0.7% to flat growth both on a reported and cc basis.

Adjusted operating margin for 2023 is expected to be 14.7%. Adjusted earnings for 2023 are expected between $4.39 and $4.42 per share.

The company anticipates interest income of $115 million in 2023. Moreover, it now expects to incur $300 million in NextGen charges, out of which $200 million will be recognized in 2023.

Cognizant expects to return $1.6 billion to shareholders through share repurchases ($1 billion) and regular quarterly dividends.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

NetEase NTES, Ballard Power Systems BLDP and Model N MODN are some better-ranked stocks that investors can consider in the broader Zacks Computer and Technology sector, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NetEase shares have declined 33.8% year to date. NTES is set to report its third-quarter 2023 results on Nov 16.

Ballard Power shares have declined 1.8% year to date. BLDP is set to report its third-quarter 2023 results on Nov 7.

Model N shares have returned 12.2% year to date. MODN is set to report its fourth-quarter fiscal 2023 results on Nov 9.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cognizant Technology Solutions Corporation (CTSH) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Ballard Power Systems, Inc. (BLDP) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report