Is Cognizant Technology Solutions (CTSH) Modestly Undervalued? An In-Depth Analysis

On August 03, 2023, Cognizant Technology Solutions Corp (NASDAQ:CTSH) saw a 5.49% gain, bringing the stock price to $68.93. With an Earnings Per Share (EPS) of 4.49, it's worth asking: Is the stock modestly undervalued? This article delves into the company's valuation analysis to answer this critical question. Read on for a comprehensive understanding of Cognizant Technology Solutions (NASDAQ:CTSH).

A Snapshot of Cognizant Technology Solutions

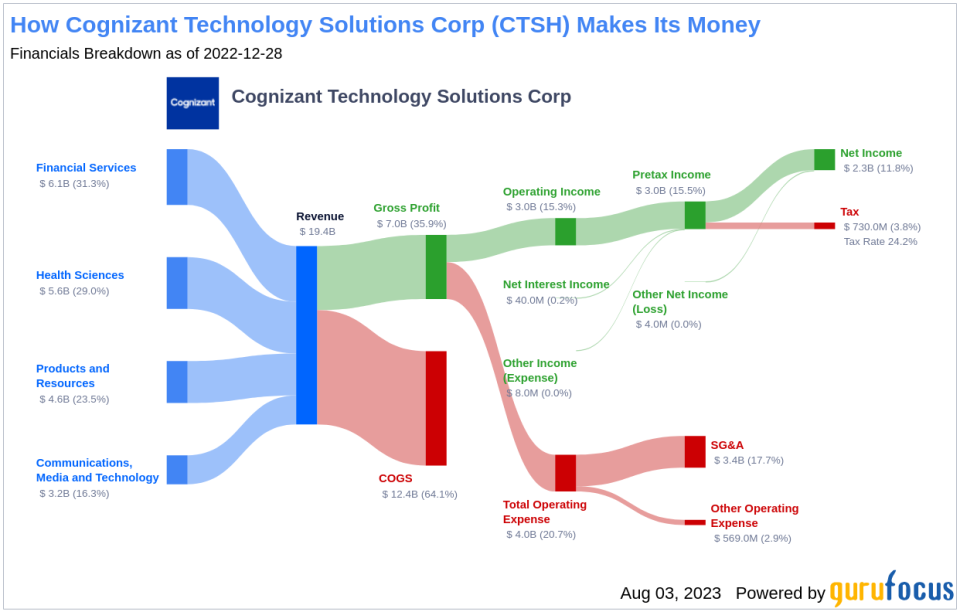

Cognizant Technology Solutions is a global leader in IT services, offering consulting and outsourcing services to some of the world's largest enterprises. These industries range from financial services, media and communications, healthcare, natural resources, to consumer products. Headquartered in Teaneck, New Jersey, the company employs nearly 300,000 people globally, with approximately 70% based in India.

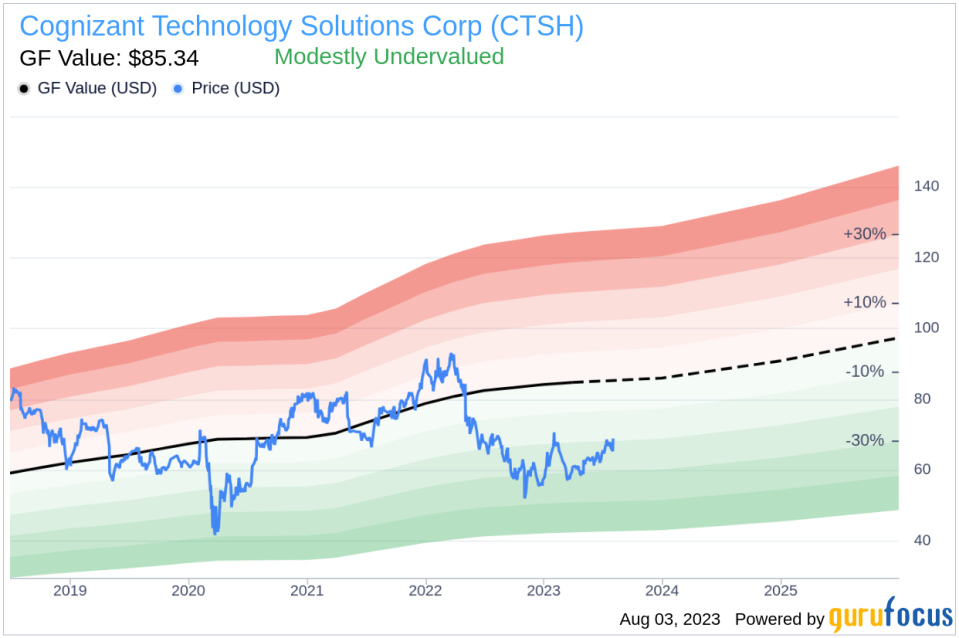

The company's current stock price stands at $68.93, with a market cap of $35 billion. However, the GF Value, an estimate of the fair value, is $85.34. This discrepancy suggests that the stock might be modestly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, computed by considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value.

According to GuruFocus valuation, Cognizant Technology Solutions (NASDAQ:CTSH) is modestly undervalued. The GF Value estimates the stock's fair value based on three key factors: historical multiples, an internal adjustment based on the company's past business growth, and analyst estimates of future business performance. If the stock's share price is significantly above the GF Value Line, the stock may be overvalued and have poor future returns. On the other hand, if the stock's share price is significantly below the GF Value Line, the stock may be undervalued and have high future returns.

Given that Cognizant Technology Solutions is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

These companies may deliver higher future returns at reduced risk.

Financial Strength of Cognizant Technology Solutions

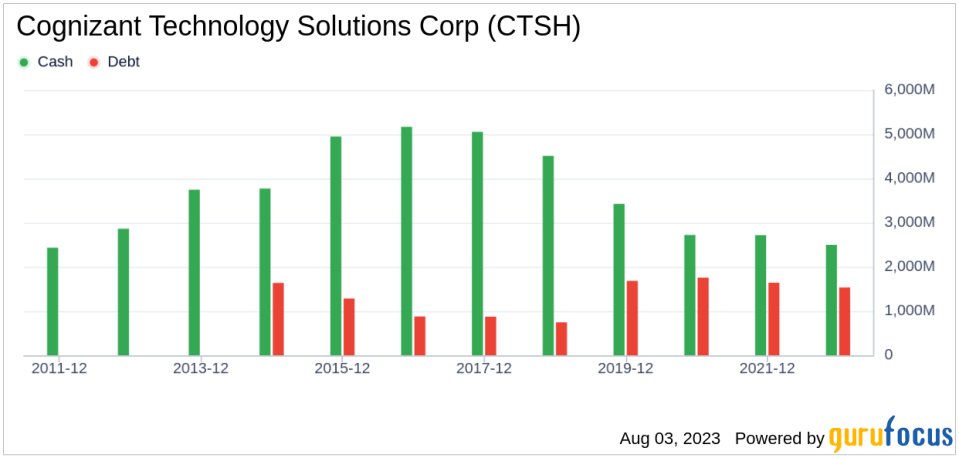

Before investing in a company, it's crucial to assess its financial strength. Investing in companies with poor financial strength carries a higher risk of permanent loss. The cash-to-debt ratio and interest coverage offer valuable insights into a company's financial strength. Cognizant Technology Solutions has a cash-to-debt ratio of 1.65, worse than 58.7% of companies in the Software industry. However, the overall financial strength of Cognizant Technology Solutions is 9 out of 10, indicating strong financial health.

Profitability and Growth of Cognizant Technology Solutions

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. A company with high profit margins is usually a safer investment than those with low profit margins. Cognizant Technology Solutions has been profitable 10 times over the past 10 years. Over the past twelve months, the company had a revenue of $19.4 billion and an Earnings Per Share (EPS) of $4.49. Its operating margin is 15.17%, ranking better than 83.36% of companies in the Software industry. Overall, the profitability of Cognizant Technology Solutions is ranked 9 out of 10, indicating strong profitability.

One of the most important factors in the valuation of a company is its growth. Long-term stock performance is closely correlated with growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of Cognizant Technology Solutions is 7.7%, ranking worse than 50.99% of companies in the Software industry. The 3-year average EBITDA growth is 7.9%, which ranks worse than 52.71% of companies in the Software industry.

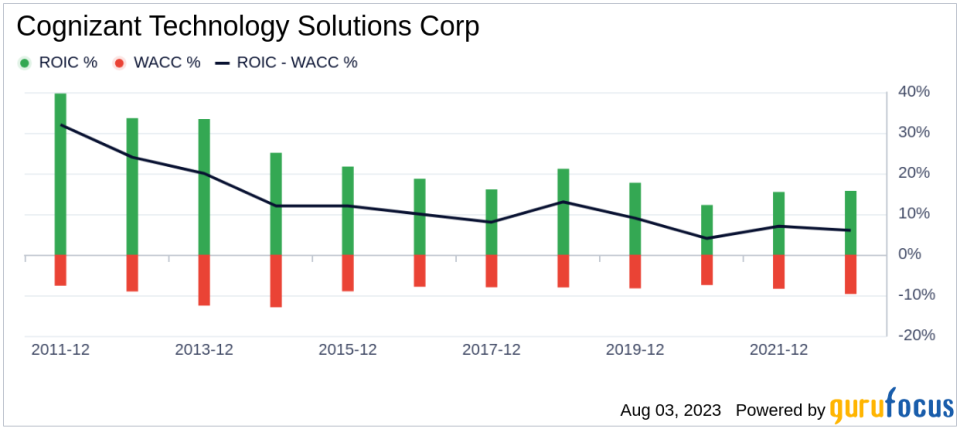

ROIC vs WACC

Another way to assess a company's profitability is to compare its return on invested capital (ROIC) with the weighted average cost of capital (WACC). ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. The ideal scenario is to have the ROIC higher than the WACC. For the past 12 months, Cognizant Technology Solutions's ROIC is 15.86, and its WACC is 9.3.

Conclusion

In summary, Cognizant Technology Solutions (NASDAQ:CTSH) stock is believed to be modestly undervalued. The company's financial condition is strong, and its profitability is robust. However, its growth ranks worse than 52.71% of companies in the Software industry. To learn more about Cognizant Technology Solutions stock, check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.