Coherus BioSciences Inc (CHRS) Reports Growth in Net Revenue for Q4 and Full Year 2023 Despite ...

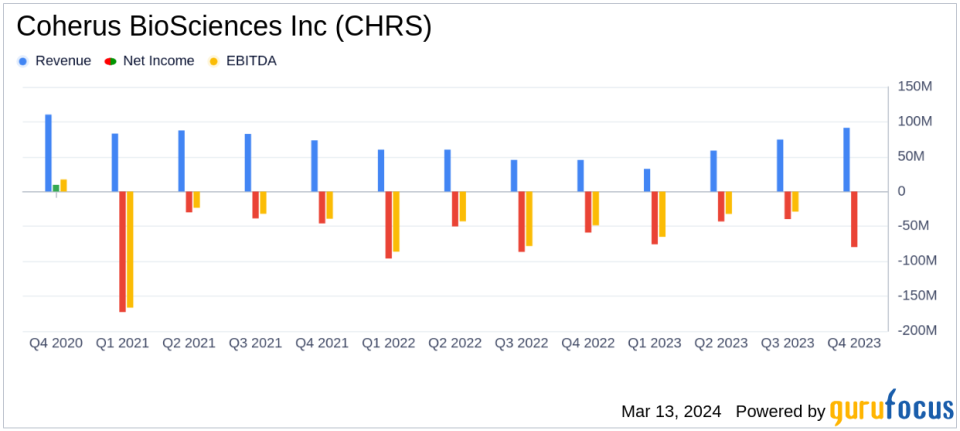

Net Revenue: Coherus BioSciences Inc (NASDAQ:CHRS) reported a significant increase in net revenue to $91.5 million in Q4 and $257.2 million for the full year 2023.

Product Sales: UDENYCA and CIMERLI drive revenue with net sales of $36.2 million and $52.4 million in Q4, respectively.

Net Loss: The company experienced a net loss of $79.7 million in Q4 and $237.9 million for the full year 2023.

Cost of Goods Sold (COGS): COGS increased significantly due to inventory write-downs and increased royalty costs.

Research and Development (R&D): R&D expenses decreased to $26.4 million in Q4 and $109.4 million for the full year 2023.

Cash Position: Cash, cash equivalents, and investments in marketable securities stood at $117.7 million as of December 31, 2023.

Corporate Restructuring: Coherus initiated a workforce reduction of 30% to streamline operations and focus on oncology.

On March 13, 2024, Coherus BioSciences Inc (NASDAQ:CHRS) released its 8-K filing, detailing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, known for its commercial-stage biopharmaceutical innovations, particularly in immuno-oncology, reported a substantial increase in net revenue driven by product sales, despite facing a net loss for both periods.

Coherus BioSciences Inc (NASDAQ:CHRS) is a commercial-stage biopharmaceutical company building an innovative immuno-oncology franchise funded with cash generated by its diversified portfolio of FDA-approved therapeutics. The company markets UDENYCA, a biosimilar of Neulasta in the United States, and expects to launch the FDA-approved Humira biosimilar YUSIMRY in the United States in 2023. The company is also developing CHS-305, a biosimilar of Avastin. The company generates revenue primarily from the United States.

Financial Performance and Challenges

Coherus BioSciences Inc (NASDAQ:CHRS) reported a robust increase in net revenue, reaching $91.5 million in the fourth quarter, a significant jump from $45.4 million in the same period last year. For the full year 2023, net revenue rose to $257.2 million from $211.0 million in 2022. The growth in revenue is attributed to the successful launches of CIMERLI and YUSIMRY, and the return to growth of UDENYCA throughout the year.

However, the company faced challenges, including a substantial net loss of $79.7 million in the fourth quarter and $237.9 million for the full year. The net loss was primarily due to increased Cost of Goods Sold (COGS), which included a $47.0 million charge for the write-down of slow-moving YUSIMRY inventory and related purchase commitments. The company also incurred increased royalty costs and product costs associated with CIMERLI sales.

Strategic Focus and Cost Management

In response to these challenges, Coherus has undertaken a strategic focus on oncology, as evidenced by the recent launch of LOQTORZI and UDENYCA ONBODY in Q1 2024. The company has also initiated a workforce reduction of 30% to streamline operations and reduce costs. These measures are part of Coherus' commitment to driving revenues, reducing costs, and advancing its pipeline, with a focus on long-term shareholder value.

Throughout 2023, Coherus demonstrated significant progress in transforming the Companys business model and product portfolio for long-term sustainable growth, said Denny Lanfear, Coherus Chairman and Chief Executive Officer. We are clearly focused on driving our revenues, reducing our costs, and advancing our pipeline, with constant attention to long-term shareholder value. The divestiture of CIMERLI and debt paydown improves our capital structure and sharpens our focus on oncology. With a robust portfolio of FDA-approved products and a promising immuno-oncology pipeline, we are now better positioned than ever to execute on our mission of extending the lives of cancer patients.

Financial Metrics and Importance

Key financial metrics from the income statement include a decrease in R&D expenses to $26.4 million in Q4 2023 from $29.0 million in Q4 2022, and a full-year reduction to $109.4 million from $199.4 million in the previous year. SG&A expenses also saw a decline, indicating effective cost management. The company's cash position, with cash, cash equivalents, and investments in marketable securities totaling $117.7 million, remains strong despite the net losses.

These financial achievements are critical for Coherus as it continues to invest in its immuno-oncology pipeline and prepare for the launch of new products. The company's ability to manage costs effectively while growing revenue is essential for sustaining its operations and funding future research and development efforts in the competitive biotechnology industry.

Coherus BioSciences Inc (NASDAQ:CHRS) is navigating a complex financial landscape with strategic initiatives aimed at long-term growth and value creation. The company's focus on immuno-oncology and its efforts to optimize its product portfolio and operational efficiency are key to its future success. Investors and stakeholders will be watching closely as Coherus continues to execute on its strategic plan in the dynamic biopharmaceutical market.

Explore the complete 8-K earnings release (here) from Coherus BioSciences Inc for further details.

This article first appeared on GuruFocus.