Coinbase Q2 Preview: Rebound Quarter Inbound?

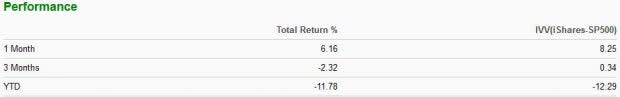

The Zacks Finance Sector has been more defensive than the S&P 500 year-to-date, but over the last month, the sector’s 6.2% return has lagged the S&P 500’s 8.3% gain. Below is a table illustrating the sector’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

A widely-recognized company in the sector, Coinbase Global COIN, is slated to release Q2 2022 results after the market closes on Tuesday, August 9th.

Although the company has just recently executed its IPO, Coinbase has been a hot topic in the market thanks to being the largest U.S. cryptocurrency exchange. The quarterly report will undoubtedly be watched like a hawk, as it’ll give us a small gauge on the state of the cryptocurrency market.

How does the crypto titan stack up heading into its quarterly print? Let’s take a closer look.

Share Performance & Valuation

Since the company’s IPO on April 14th, 2021, Coinbase shares have plummeted, losing more than 70% in value and extensively underperforming the general market. Shares broke off near the beginning of 2022.

Image Source: Zacks Investment Research

However, take a look at the chart below.

Image Source: Zacks Investment Research

Over the last month, COIN shares have exploded for a nearly 80% gain, making the S&P 500’s performance appear minuscule.

With a somewhat clearer economic outlook, buyers have finally reappeared in stocks that tend to carry a much higher level of risk, and COIN shares precisely fit those parameters.

Coinbase shares trade at high valuation multiples, typically something seen within high-growth stocks. The company’s 5.2X forward price-to-sales ratio is nicely beneath its median of 6.9X since IPO and represents a 55% discount relative to its Zacks Sector.

Coinbase sports a Style Score of a C for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have primarily been bearish for the quarter to be reported, with three of the four earnings estimate revisions coming in over the last 60 days being downwards. The Zacks Consensus EPS Estimate of -$3.04 pencils in a sizable 150% decrease in earnings year-over-year.

Image Source: Zacks Investment Research

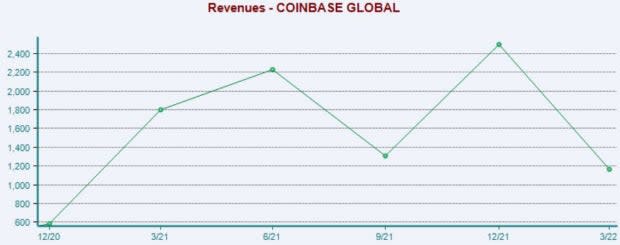

In addition, the company’s top-line projections reflect softening as well – Coinbase is forecasted to have generated $877 million in revenue for the quarter, registering a 60% decrease from year-ago quarterly sales of $2.2 billion.

Quarterly Performance & Market Reactions

Bottom-line results have primarily been reported below expectations since the company’s IPO, with three bottom-line misses over its five quarterly prints. Just in its latest quarter, Coinbase missed the Zacks Consensus EPS Estimate of $0.35 by a massive 660%.

Top-line results have primarily been reported below expectations as well, with the company registering two top-line beats over its five quarterly releases. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, expect shares to be highly volatile following the company’s quarterly print – following its latest earnings release, shares plummeted 35%.

Putting Everything Together

Coinbase shares have struggled since their initial direct listing, but over the last month, the story has been quite the opposite – shares have rallied nearly 80%. In addition, the company’s shares trade at expensive levels, typical of stocks in growing markets.

Analysts have primarily been bearish for the quarter to be reported, and the company’s top and bottom lines are expected to shrink notably. Since its direct listing, quarterly results have typically been reported below expectations.

Heading into the print, Coinbase Global COIN carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 53%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research