Colgate (CL) Meets Q1 Earnings Estimates, Lowers Sales View

Colgate-Palmolive Company CL has reported first-quarter 2022 results, wherein earnings were in line with the Zacks Consensus Estimate, while sales missed the same. The top line increased year over year, while earnings per share declined. Results mainly gained from higher pricing in every region. Management has highlighted that the company witnessed strong momentum across its businesses, particularly the oral care and pet nutrition categories.

Colgate anticipates uncertainties from the COVID-19 pandemic, supply-chain disruptions, increases in raw material and logistics costs, and volatility in consumer demand and currencies to continue in 2022. Consequently, it expects funding growth and revenue growth management initiatives, including higher pricing, to be more relevant. The company updated its view for 2022.

Shares of the company slipped 4.6% in the pre-market session, following the earnings release. The soft bottom-line performance in the first quarter impacted by higher raw material and logistics costs concerned investors. Moreover, the company’s guidance for 2022 failed to impress.

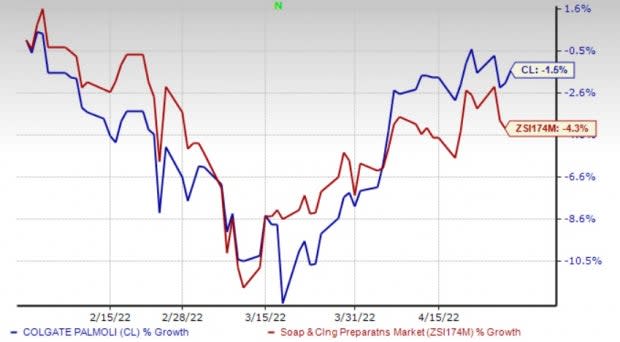

Shares of the Zacks Rank #3 (Hold) company have lost 1.5% in the past three months compared with the industry’s decline of 4.3%.

Image Source: Zacks Investment Research

Quarter in Detail

On a Base Business basis (adjusted non-GAAP), earnings of 74 cents per share declined 8% from the prior-year quarter’s levels and were in line with the Zacks Consensus Estimate. On a GAAP basis, earnings declined 18% to 66 cents per share in the quarter under review. The bottom line was mainly impacted by higher raw material and logistics costs worldwide despite sales growth.

Net sales of $4,399 million increased 1.5% from the year-ago quarter’s levels but missed the Zacks Consensus Estimate of $4,417 million. On an organic basis, the company’s sales advanced 4%. This marked the 13th successive quarter of organic sales growth within or beyond its target of 3-5%.

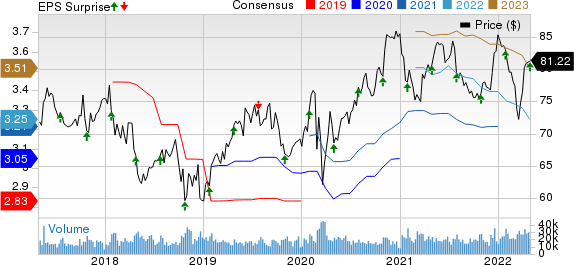

ColgatePalmolive Company Price, Consensus and EPS Surprise

ColgatePalmolive Company price-consensus-eps-surprise-chart | ColgatePalmolive Company Quote

Colgate’s top-line performance was driven by increased pricing across all regions. The company’s sales also benefited from investments in innovation and digital capabilities. Total volumes declined 1.5% on both reported and organic basis, and pricing was up 5.5%. Unfavorable currency impact was 2.5%.

The gross profit of $2,572 million declined 2.5% year over year. The gross profit margin contracted 220 basis points (bps) to 58.5%, both on a GAAP and an adjusted basis.

Selling, general & administrative (SG&A) expenses increased 2.2% year over year to $1,641 million. As a percentage of sales, SG&A expenses expanded 40 bps to 37.3%.

The adjusted operating profit was $923 million, down 8% year over year, while the adjusted operating margin contracted 210 bps to 21%.

Colgate’s global market share in the manual toothbrushes category has reached 30.7% year to date. The company continued with its leadership position in the global toothpaste market, with a market share of 39.2% year to date.

Segmental Discussion

North America’s net sales (21% of total sales) rose 0.5% year over year. The unit gained from a 1.5% increase in volume, offset by a 1% negative impact on pricing. Organic sales also grew 0.5% on gains in oral care and personal care, offset by an organic sales decline in home care. Year to date, the company’s share in the toothpaste market is 33.5% and in the manual toothbrush market is 44.4% in the United States.

Latin America’s net sales (21% of total sales) advanced 5.5% year over year on 10% pricing gains, offset by a 3.5% decline in volume and a 1% impact from adverse currency. On an organic basis, sales were up 6.5%, led by growth in Mexico, Argentina, Colombia and Brazil.

Europe’s net sales (15% of total sales) declined 9% year over year on a reported basis. The unit was affected by a 5% decline in volume and a 6% negative currency impact, offset by a 2% pricing gain. Organic sales and volumes were down 3% and 5%, respectively. Organic sales were adversely impacted by declines in the Filorga duty-free business, and soft sales in Spain and France, partially offset by organic sales growth in Germany.

The Asia Pacific segment’s net sales (17% of total sales) declined 1.5% year over year, owing to a 3.5% volume decline and a 2.5% impact from adverse currency, offset by a 4.5% increase in pricing. Volumes also declined 3.5% on an organic basis. Organic sales improved 1%, driven by gains in Australia, the Philippines and Indonesia, partly negated by organic sales declines in the Greater China region and Thailand.

Africa/Eurasia’s net sales (6% of total sales) dipped 2% year over year due to a 6.5% decline in volume and a 9.5% unfavorable currency impact, offset by a 14% increase in pricing. Organic sales for the segment grew 7.5%, driven by growth in Turkiye and South Africa.

Hill’s Pet Nutrition’s net sales (20% of total sales) improved 11% from the year-ago quarter’s levels on a reported basis and 13% on an organic basis. Results gained from a 4% increase in unit volumes (both reported and organic) and 9% pricing growth, offset by a 2% adverse currency impact. Organic sales were aided by gains in the United States and Europe.

Other Financial Details

Colgate ended first-quarter 2022 with cash and cash equivalents of $877 million, and total debt of $7,607 million. Net cash provided by operating activities was $386 million as of Mar 31, 2022.

Outlook

Following the first-quarter results, management updated its guidance for 2022. It now anticipates net sales growth toward the higher end of the previously mentioned 1-4% growth. This continues to include a low-single-digit unfavorable currency impact. Organic sales are expected to increase 4-6% compared with 3-5% growth mentioned earlier.

Colgate expects a gross margin decline on both GAAP and adjusted basis for 2022 versus the prior mentioned gross margin expansion. Advertising investments are expected to increase year over year, on both GAAP and adjusted basis, in 2022.

The company continues to anticipate earnings growth in double-digits on a GAAP basis. On an adjusted basis, earnings are expected to decline in the mid-single digits compared with low to mid-single-digit growth stated earlier.

Consumer Staples Picks You Can’t Miss

We have highlighted three better-ranked companies in the Consumer Staples sector, namely Archer Daniels Midland ADM, Inter Parfums IPAR and Sysco SYY.

Archer Daniels, one of the leading producers of food and beverage ingredients as well as goods made from various agricultural products, presently flaunts a Zacks Rank #1 (Strong Buy). The ADM stock has rallied 23.3% in the past three months.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Archer Daniels’ sales and EPS for the current financial year suggests growth of 5.4% and 7.7%, respectively, from the year-ago levels. ADM has a trailing four-quarter earnings surprise of 22.3%, on average. ADM has an expected EPS growth rate of 5.5% for three to five years.

Inter Parfums, engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products, presently has a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 46.7%, on average.

The Zacks Consensus Estimate for Inter Parfums’ sales and EPS for the current financial year suggests respective growth of 12.5% and 10.9% from the year-ago period’s reported figures. Shares of IPAR have declined 16.2% in the past three months.

Sysco, a leading manufacturer and distributor of clinically-proven healthy living products and programs, presently carries a Zacks Rank #2. Shares of SYY have risen 13% in the past three months. The company has an expected EPS growth rate of 11% for three to five years.

The Zacks Consensus Estimate for Sysco’s sales and EPS for the current financial year suggests respective growth of 30.4% and 120.1% from the year-ago period’s reported figures. MED has a trailing four-quarter earnings surprise of 3.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

ColgatePalmolive Company (CL) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research