Colgate (CL) Poised for Q3 Earnings Beat on Business Momentum

Colgate-Palmolive Company CL is expected to register top and bottom-line growth when it reports third-quarter 2023 numbers on Oct 27, before the opening bell. The Zacks Consensus Estimate for third-quarter revenues is pegged at $4.8 billion, indicating a rise of 8.3% from the prior-year quarter’s reported figure.

The consensus estimate for the company’s earnings is pegged at 80 cents per share, suggesting growth of 8.1% from the prior-year quarter’s reported figure. The Zacks Consensus Estimate for earnings per share for the quarter has been unchanged in the past 30 days.

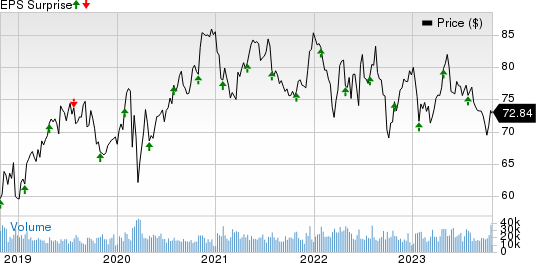

In the last reported quarter, the company's earnings beat the Zacks Consensus Estimate by 2.7%. It has delivered an earnings surprise of 1.7%, on average, in the trailing four quarters.

Colgate-Palmolive Company Price and EPS Surprise

Colgate-Palmolive Company price-eps-surprise | Colgate-Palmolive Company Quote

Key Aspects to Note

Colgate is anticipated to have benefited from solid consumer demand for personal care, hygiene and home care products. The company’s focus on innovation, premiumization and digital transformation, along with its brand strength, is likely to have driven its third-quarter performance. Its top line is likely to have benefited from its accelerated revenue growth management plans.

Colgate’s focus on the premiumization of its Oral Care portfolio through major innovations has been proving beneficial. Of late, the performance of its premium innovation products, including CO. by Colgate, Colgate Elixir toothpaste and Colgate enzyme whitening toothpaste, has been impressive. This is expected to have boosted organic sales growth for its Oral Care business in the to-be-reported quarter.

Our estimate for the company’s organic sales growth is pegged at 5.8% for the third quarter, driven by 8.5% growth in pricing, offset by a 2.6% decline in volume.

Solid momentum in the Hill's business is expected to have delivered sales growth in the third quarter. Strength in Hill's Prescription Diet and Hill's Science Diet has been aiding the segment’s sales. The company’s Prescription Diet Derm Complete brand has been gaining market share, which is likely to have augmented sales in the third quarter.

We anticipate Colgate’s Pet Nutrition business to deliver year-over-year sales growth of 11% to $967.9 million in the third quarter.

The leading global consumer products company has been aggressively expanding into faster growth channels, while extending the geographic footprint of its brands. CL’s efforts to improve product availability through enhanced distribution across existing and new markets are likely to have driven its top-line performance. Higher e-commerce demand for its products is also likely to have augmented its third-quarter sales.

However, Colgate has been witnessing near-term headwinds related to rising raw and packaging material costs, and additional pricing. The incremental pricing actions have been affecting volume trends, which are likely to have continued in the third quarter of 2023.

On the last reported quarter’s earnings call, the company anticipated a slightly heightened promotional environment in the back half of the year. Increased promotions are likely to have weighed on the company’s top and bottom-line performances in the to-be-reported quarter.

Although CL noted that there has been a gradual recovery in cost inflation across many regions, countries like Turkey, Argentina and Pakistan have been witnessing high inflation rates. These are likely to have partly offset top-line growth in the third quarter.

Given the company’s substantial international operations, foreign-currency woes are anticipated to have hurt its top line in the third quarter. We expect currency to negatively impact revenue growth by 1.1% in the to-be-reported quarter.

What the Zacks Model Unveils

Our proven model conclusively predicts an earnings beat for Colgate this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Colgate has a Zacks Rank #3 and an Earnings ESP of +0.37%.

Other Stocks Poised to Beat Earnings Estimates

Here are some other companies that also have the right combination of elements to post an earnings beat:

e.l.f. Beauty ELF currently has an Earnings ESP of +0.42% and sports a Zacks Rank #1. The company is expected to register year-over-year top and bottom-line growth when it reports third-quarter 2023 results. The Zacks Consensus Estimate for e.l.f. Beauty’s quarterly revenues is pegged at $197.3 million, calling for growth of 61.2% from the figure reported in the prior-year quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ELF’s quarterly EPS is pegged at 54 cents, indicating an improvement of 50% from the year-ago quarter. e.l.f. Beauty has an earnings surprise of 108.3% in the last reported quarter.

Church & Dwight Co. CHD currently has an Earnings ESP of +5.00% and a Zacks Rank #3. The company’s top line is expected to increase year over year when it reports third-quarter results. The Zacks Consensus Estimate for CHD’s quarterly revenues is pegged at $1.43 billion, suggesting a rise of 8.7% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Church & Dwight’s quarterly EPS is pegged at 68 cents, which indicates a 10.5% decline from the year-ago reported figure. CHD has a trailing four-quarter earnings surprise of 12.1%, on average.

Molson Coors TAP currently has an Earnings ESP of +0.89% and a Zacks Rank #3. TAP is likely to register top and bottom-line year over year growth when it reports the third-quarter 2023 numbers. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.25 billion, which suggests growth of 10.6% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Molson Coors’ quarterly earnings is pegged at $1.52 per share, suggesting an increase of 15.2% from the year-ago quarter’s reported number. TAP has delivered an earnings beat of 34.2%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report