Colgate-Palmolive: A Time-Tested Dividend Aristocrat

Investors seeking long-term income often gravitate toward Dividend Aristocrats, which are companies distinguished by their longstanding practice of consistently distributing dividends and raising their dividend payments annually for a minimum of 25 consecutive years. In my series examining Dividend Aristocrats, I have analyzed several notable companies, including Dover (NYSE:DOV), Procter & Gamble (NYSE:PG), American States Water (NYSE:AWR), Genuine Parts (NYSE:GPC), Emerson Electric (NYSE:EMR), Parker-Hannifin (NYSE:PH), 3M (NYSE:MMM) and Coca-Cola (NYSE:KO). Remarkably, each of these companies has an impressive record, having raised their dividends every single year for more than six decades.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

This analysis will explore another Dividend Aristocrat: Colgate-Palmolive Co. (NYSE:CL), one of the largest global consumer conglomerates. The company has been paying uninterrupted dividends since 1895 and has raised its dividend payments every single year for the past 61 years. Let's investigate if Colgate-Palmolive is a viable option for long-term dividend investors.

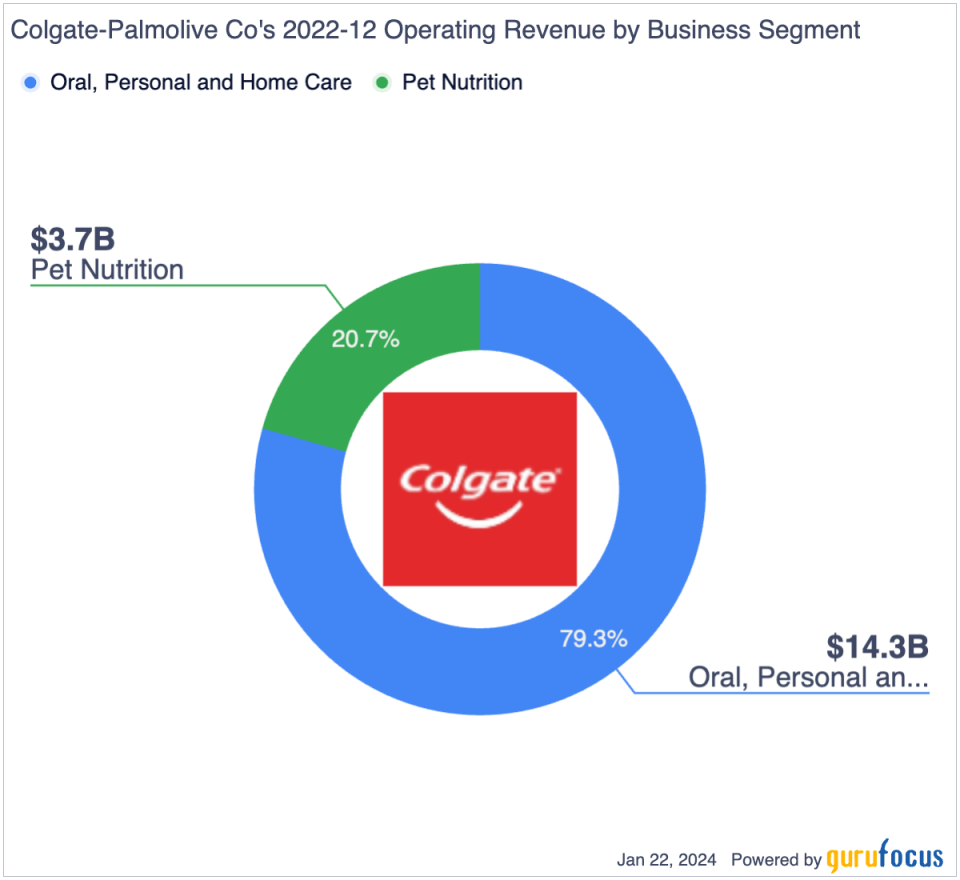

Global leadership and revenue breakdown

Colgate-Palmolive boasts a rich history dating back to 1806 and has established a significant presence in over 200 countries and territories. The company operates mainly in two segments: Oral, Personal and Home Care and Pet Nutrition. It is leading in the global oral care market, particularly in the toothpaste and manual toothbrush categories, with brands like Colgate, Darlie, meridol and Sorriso. In 2022, the Oral, Personal and Home Care segment was its primary revenue generator, bringing in $14.3 billion, which constituted 79.3% of its total revenue. The Pet Nutrition segment contributed $3.7 billion, accounting for 20.7% of revenue.

With its global market leadership and extensive distribution network, Colgate-Palmolive has maintained double-digit operating margins. Within the Oral, Personal and Home Care segment, the North American region reported the lowest operating margin at approximately 19.90%. In contrast, Latin America, the region with the highest operating margin, achieved an impressive 27.80%. The Pet Nutrition segment also performed well, with an operating margin of around 22.90% in 2022.

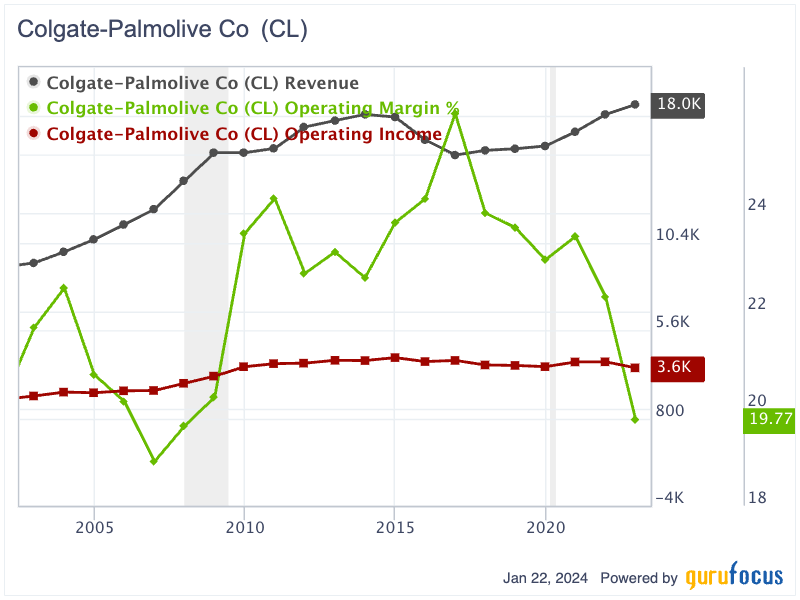

Sustained growth and high return on invested capital

Colgate's business demonstrates sustainability, marked by a gradual growth in revenue and operating income over the past two decades. From 2002 to 2022, the company's revenue steadily rose, escalating from nearly $9.3 billion to almost $18 billion. Concurrently, its operating profit increased from $2 billion in 2002 to $3.55 billion in 2022. Throughout these 20 years, Colgate's operating margin has maintained a robust performance, fluctuating within the high double-digit range, varying from 18.90% to 26%.

Over the past two decades, Colgate has demonstrated a remarkable ability to generate consistently high returns on invested capital, a key indicator of its financial health and operational efficiency. The company's ROIC has remained impressively within the range of 23.3% to 34.6% during this period. This high return rate signifies that Colgate has successfully deployed its capital in various aspects of its business operations.

A consistently high ROIC is a strong indicator of a sustainably profitable business. It suggests that the company effectively allocates its financial resources and excels in extracting value from its investments. This ability to sustain high returns over an extended period is a testament to Colgate's robust business model, strategic decision-making and operational excellence, all of which contribute significantly to its longstanding success in the market.

Share purchases and prudent debt management

Some investors might express concern regarding Colgate's balance sheet, particularly noting the low shareholders' equity relative to its debt. As of September, Colgate's shareholders' equity was reported at only $406 million, with cash and cash equivalents amounting to $951 million. In contrast, the company's long-term debt was substantially higher, reaching $8.70 billion, resulting in a notably high debt-to-equity ratio of 23.20.

However, a closer examination reveals that Colgate's consistent practice of repurchasing its shares over the years is the primary reason for the low shareholders' equity. The total value of these share repurchases, recorded as treasury stock, has exceeded $28.30 billion. While impacting shareholders' equity, this strategy indicates the company has also committed to returning money to shareholders via share purchases.

Moreover, in the past 10 years, Colgate's interest coverage ratio has fluctuated between 18.80 and 33, indicating the wide margin between its earnings and debt obligations. This high level of profitability has been crucial for Colgate, enabling it to meet its debt obligations comfortably despite the high debt-to-equity ratio. This aspect of Colgate's financial performance is important for investors to consider, as it demonstrates the company's ability to manage its debt sustainably while continuing to perform effectively in the market.

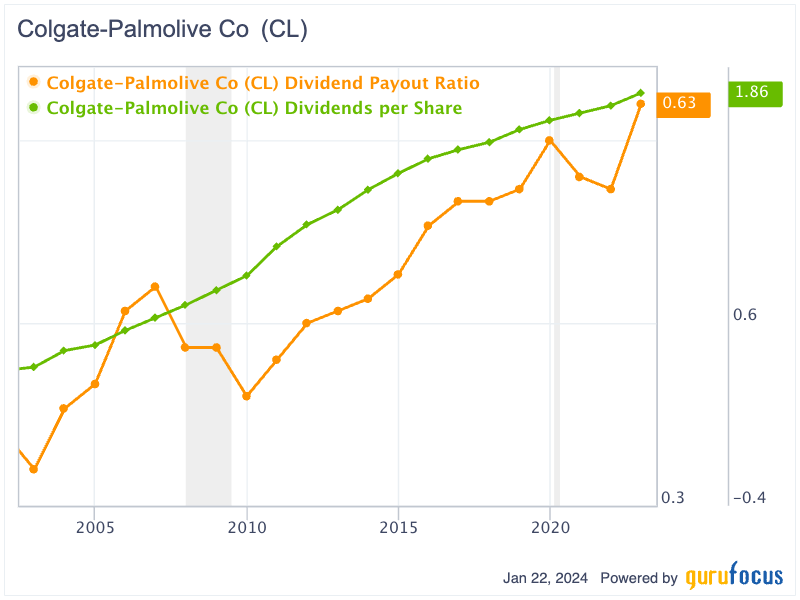

The legacy of consistent dividend growth

Colgate is renowned for its remarkable record of increasing dividends annually for over 60 years. In the past two decades, the company's dividend per share has seen a significant rise, growing from 36 cents in 2002 to $1.86 in 2022. This growth translates into a compounded annual growth rate of 8.56%. Alongside these consistent dividend increases, Colgate has maintained a cautious approach to its earnings and dividend payments. Since 2002, the company's payout ratio has remained within a prudent range of 0.33 to 0.63, reflecting a balanced and sustainable dividend policy.

Potential upside

The Gordon Growth Model, an effective tool for assessing companies with a consistent track record of growing dividends, is particularly relevant for evaluating Colgate-Palmolive, given its impressive history of increasing dividends annually for 61 consecutive years. To determine the intrinsic value of the stock using this model, I will assume the company will keep growing its dividend at a reduced rate of 6.50%. By applying a discount rate of 8%, I can estimate the stock's intrinsic value as follows:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= $1.86 *(1+6.50%) / (8%-6.50%)

= $132

Applying the Gorden Growth Model, Colgate's intrinsic value is estimated at around $132 per share, indicating a potential 65% upside from the current trading price.

Key takeaway

Colgate-Palmolive stands out as a compelling choice for long-term income investors. With its extensive global presence, leadership in key market segments and steady financial growth, the company demonstrates remarkable resilience and profitability. Despite concerns about its debt-to-equity ratio, the company's strategic share repurchases and strong interest coverage ratio highlight its adept financial management. The company's impressive track record of increasing dividends for over six decades and a sustainable payout ratio reinforces its status as a reliable dividend payer. Further, applying the Gordon Growth Model suggests a significant potential upside in its stock, making Colgate-Palmolive an attractive investment for those seeking long-term, stable income.

This article first appeared on GuruFocus.