Will Colgate's (CL) Innovation Efforts Boost Its Stock?

Colgate-Palmolive Co. CL has been witnessing near-term headwinds related to rising raw and packaging material costs, as well as additional pricing. The incremental pricing actions have been affecting volume trends, which are likely to continue in the near term. Also, the company anticipates a slightly heightened promotional environment in the back half of the year.

Although the company noted that there has been a gradual recovery in cost inflation across many regions, countries like Turkey, Argentina and Pakistan continue to witness high inflation.

These factors are expected to continue posing an uncertain macro environment for the company, thus, hurting sentiment. The effects of these concerns are well evident from the company’s recent price performance.

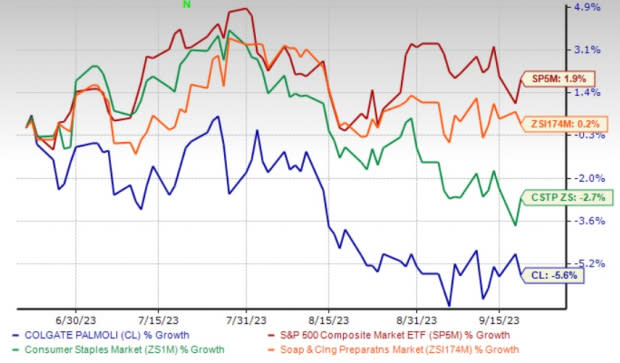

Shares of this Zacks Rank #3 (Hold) company have declined 5.6% in the past three months against the industry’s growth of 0.7%. The company’s shares have also underperformed the sector’s decline of 3.8% and the S&P 500’s growth of 1% in the same period.

Image Source: Zacks Investment Research

Can Innovation Plans Aid?

Innovation and in-store implementation have been the guiding principles for Colgate’s growth strategy over the years. The company’s innovation strategy is focused on growing in adjacent categories and product segments. It is also focused on the premiumization of its Oral Care portfolio through major innovations.

Its innovation efforts are highlighted by the recent relaunch of the Soupline business in France and the launch of Suavitel — the Soupline Hearts. The company is on track with the relaunch of Sanex across Europe. Its Oral Care business has also been performing well, particularly in Africa. Some other notable efforts include the continued expansion of the Naturals and Therapeutics divisions, as well as the Hello Products LLC buyout.

The company recently partnered with Philips to introduce electric toothbrushes in Latin America, where the use of electric toothbrushes is low. This long-term deal will bring together the world’s number one oral care brand and number one manufacturer of sonic toothbrushes under a co-brand, namely Philips Colgate. This product line will come with a variety of electric toothbrushes at different prices. Further, the new brand will be available in limited countries in the said region.

Backed by premium innovation, products like CO. by Colgate, Colgate Elixir toothpaste and Colgate enzyme whitening toothpaste have been performing well. The company is on track to launch Optic White Renewal and Optify Pro Series in the United States to drive long-term growth. Also, CL’s at-home whitening and professional whitening products bode well.

Another trait that puts Colgate on the growth track is its efforts to expand the availability of products through enhanced distribution to newer markets and channels. This is one of Colgate’s priorities and has been the key reason to improve organic sales in recent years. The company is aggressively expanding into faster growth channels, while extending the geographic footprint of its brands.

In 2019, the company expanded its portfolio by introducing pharmacy brands like elmex and meridol to newer markets. Colgate has been witnessing positive customer feedback for its elmex and meridol brands, driven by increased investment. Moreover, it is impressed with the performance of professional skincare businesses — Elta MD and PCA Skin — in spas and dermatologists.

The company expanded its premium skincare portfolio with the buyout of the Filorga skincare business. Further, it is witnessing strong market share gains in North America and China, its two largest markets, with increased share gains across all other regions.

Wrapping Up

Although cost and inflation headwinds are likely to persist in the near term, the company’s product innovation, pricing efforts and expansion plans are expected to bring renewed momentum in the stock. Notably, the Zacks Consensus Estimate for CL’s 2023 sales and earnings per share suggests year-over-year growth of 7.9% and 6.7%, respectively.

Stocks to Consider

We have highlighted some better-ranked stocks from the broader Consumer Staples space, namely Inter Parfums IPAR, Procter & Gamble PG and e.l.f. Beauty ELF.

Inter Parfums, engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products, currently sports a Zacks Rank #1 (Strong Buy). IPAR has a trailing four-quarter earnings surprise of 45.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial year’s sales and earnings suggests growth of 19.7% and 14.6%, respectively, from the year-ago reported numbers.

Procter & Gamble is a branded consumer products company with a Zacks Rank #2 (Buy) at present. PG has a trailing four-quarter earnings surprise of 2.4%, on average.

The Zacks Consensus Estimate for PG’s current financial-year sales and earnings suggests growth of 4.4% and 8.1%, respectively, from the year-ago reported figures.

e.l.f. Beauty, which operates as a cosmetic company, currently carries a Zacks Rank #2. ELF has a trailing four-quarter earnings surprise of 108.3%, on average.

The Zacks Consensus Estimate for ELF’s current financial-year sales and earnings indicates growth of 64.7% and 42.8%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company (The) (PG) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report