Columbia Banking System Inc (COLB) Reports Mixed Q4 Results Amid Integration Success

Net Income: Reported at $94 million, or $0.45 per diluted common share.

Operating Net Income: Stood at $91 million, or $0.44 per diluted common share.

Net Interest Margin: Decreased to 3.78%, a 13 basis point drop from the previous quarter.

Provision for Credit Losses: Increased to $55 million, reflecting changes in economic forecasts and portfolio trends.

Capital Ratios: Estimated CET1 and total capital ratios were 9.6% and 11.8%, respectively.

Dividends: A quarterly cash dividend of $0.36 per common share was declared and paid.

Branch Consolidation: Five branches were consolidated in January 2024.

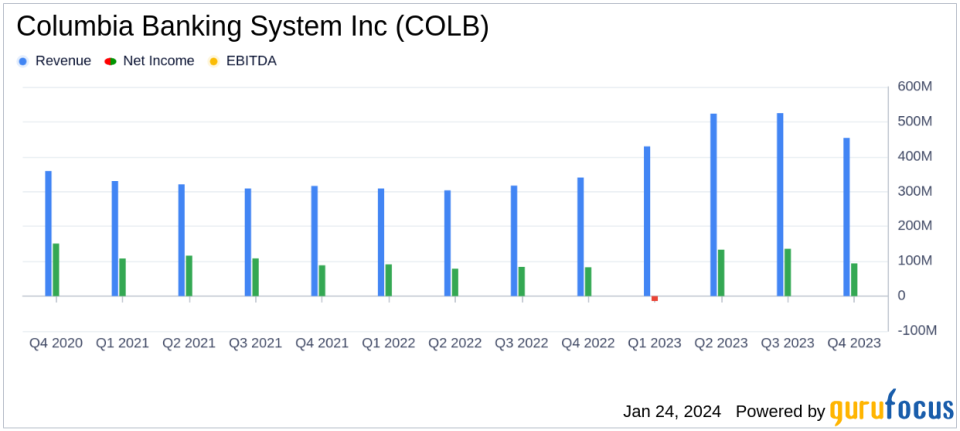

On January 24, 2024, Columbia Banking System Inc (NASDAQ:COLB) released its 8-K filing, detailing the fourth quarter and full-year financial results for 2023. Columbia Banking System Inc, a registered bank holding company, operates through its subsidiary Columbia State Bank, offering a wide range of banking services to small and medium-sized businesses, professionals, and individuals across several Western states. The company also provides wealth management services through its subsidiary Columbia Trust Company.

Financial Performance Overview

The company reported a net income of $94 million, or $0.45 per diluted common share, and an operating net income of $91 million, or $0.44 per diluted common share. The net interest income for the quarter was $454 million, a decrease from the previous quarter's $481 million, primarily due to higher deposit costs. The net interest margin contracted to 3.78%, down 13 basis points from the prior quarter, influenced by higher earning asset yields being offset by increased deposit costs.

Challenges and Achievements

Despite the decrease in net interest income, Columbia Banking System Inc achieved significant milestones in its integration with Umpqua Bank. President and CEO Clint Stein highlighted the historic year, stating:

"It was a historic year for Columbia Banking System and Umpqua Bank. We closed and integrated the transformational combination of the Northwest's premier banking organizations, expanding our footprint to encompass eight Western states as we achieved our cost-savings targets ahead of schedule and above our original projections."

Stein also noted the challenges faced during the quarter, including the FDIC special assessment and one-time expense items, as well as the impact of higher-rate environment on the cost of funds.

Balance Sheet and Credit Quality

Total consolidated assets remained stable at $52.2 billion. Loan balances increased slightly to $37.4 billion, while total deposits held steady at $41.6 billion. The provision for credit losses rose to $55 million, reflecting changes in economic forecasts and portfolio migration trends. Non-performing assets to total assets increased marginally to 0.22%.

Capital and Dividends

The company's capital ratios remained robust, with an estimated total risk-based capital ratio of 11.8% and an estimated common equity tier 1 risk-based capital ratio of 9.6%. A quarterly cash dividend of $0.36 per common share was declared and paid in December 2023.

Operational Highlights

Columbia Banking System Inc consolidated five branches in January 2024 as part of its integration process. The company also reported $143 million in annualized net merger-related cost-savings, surpassing the $135 million target.

As Columbia Banking System Inc moves past its integration phase, the focus shifts to optimizing performance and driving shareholder value. The company's scale and range of products and services position it to win business and drive consistent performance over the long term.

For a more detailed analysis and additional information, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Columbia Banking System Inc for further details.

This article first appeared on GuruFocus.