Columbia Sportswear Co (COLM) Faces Headwinds: Q4 and Full Year 2023 Earnings Analysis

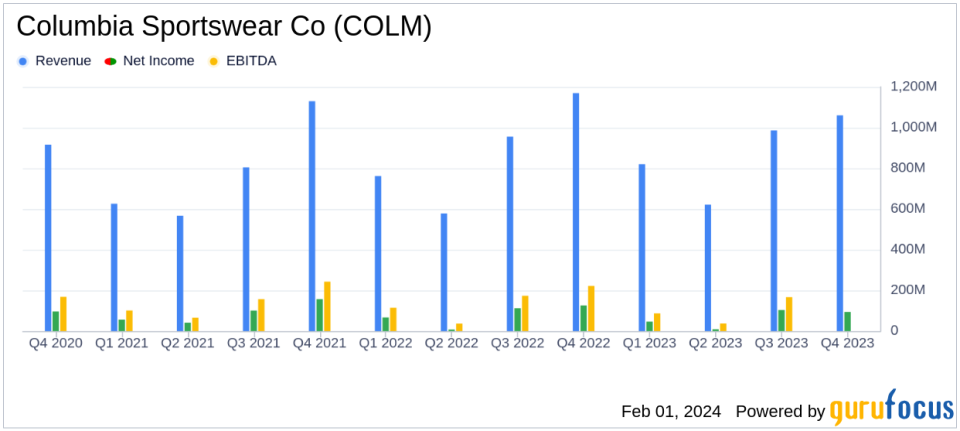

Net Sales: Q4 net sales decreased by 9% to $1.06 billion; full year saw a slight increase of 1% to $3.49 billion.

Operating Income: Operating income for Q4 fell by 27% to $113.1 million; full year operating income down by 21% to $310.3 million.

Diluted Earnings Per Share (EPS): Q4 EPS decreased by 23% to $1.55; full year EPS down by 17% to $4.09.

Inventory Levels: Year-end inventories saw a significant reduction of 27% compared to the previous year.

Stock Repurchases: The company repurchased $184.0 million of common stock during the year.

Cash Position: Strong liquidity with $764.5 million in cash, cash equivalents, and short-term investments, with no borrowings.

On February 1, 2024, Columbia Sportswear Co (NASDAQ:COLM) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. Columbia Sportswear Co, a leader in outdoor and active-lifestyle apparel and accessories, faced a challenging quarter with net sales and operating income experiencing declines. Despite these headwinds, the company maintained a strong balance sheet with significant cash reserves and no debt.

Company Overview

Columbia Sportswear Co operates under four primary brands: Columbia, Sorel, Mountain Hardwear, and prAna. With the majority of sales in the United States, the company also has a significant presence in Latin America and Asia-Pacific, Europe, Middle East, and Africa, and Canada. The company's products are sourced globally, primarily from Asia, and are sold through wholesale channels and its own branded stores.

Financial Performance and Challenges

The fourth quarter saw a decrease in net sales by 9 percent to $1,060.0 million, and operating income fell by 27 percent to $113.1 million. The full year was slightly more positive with a 1 percent increase in net sales to $3,487.2 million, though operating income still decreased by 21 percent to $310.3 million. These results reflect the difficulties faced in the U.S. market, including a warm winter that impacted sales. The company's inventory reduction plan was successfully executed, contributing to an operating cash flow of over $600 million for the year.

Financial Achievements and Industry Importance

Despite the challenges, Columbia Sportswear Co's financial achievements include a gross margin expansion of 20 basis points to 50.6 percent of net sales for Q4 and a full year gross margin of 49.6 percent. The company also repurchased a significant amount of common stock, signaling confidence in its long-term prospects. These achievements are particularly important in the competitive Manufacturing - Apparel & Accessories industry, where efficient inventory management and strong margins are critical for success.

Key Financial Metrics

Important financial metrics for Columbia Sportswear Co include:

A decrease in diluted earnings per share by 23 percent to $1.55 for Q4 and by 17 percent to $4.09 for the full year.

A strong cash position with $764.5 million in cash, cash equivalents, and short-term investments.

A significant reduction in year-end inventories by 27 percent, demonstrating effective inventory management.

These metrics are crucial as they indicate the company's profitability, liquidity, and operational efficiency.

Commentary from Leadership

"Im proud of what our global workforce was able to achieve in 2023. We successfully executed our inventory reduction plan, which contributed to operating cash flow generation of over $600 million for the year," said Tim Boyle, Chairman, President, and CEO of Columbia Sportswear Co. He also noted the challenges ahead and the company's commitment to strategic investments for long-term growth.

Financial Tables Summary

The financial tables provided in the 8-K filing offer a detailed view of the company's performance. Key takeaways include the net sales figures, operating income, and net income, all of which are essential for investors to understand the company's financial health.

Analysis of Company Performance

Columbia Sportswear Co's performance in 2023 reflects resilience in a tough market environment. The company's ability to maintain a strong cash position and reduce inventory levels while facing sales headwinds is commendable. However, the anticipated challenges for 2024, including cautious retailer ordering and economic uncertainty, suggest that the company must continue to adapt and manage costs effectively to maintain its market position.

For a detailed review of Columbia Sportswear Co's fourth quarter 2023 financial results, please refer to the CFO Commentary and Financial Review presentation available on the company's investor relations website.

Value investors and potential GuruFocus.com members interested in Columbia Sportswear Co's financial outlook can find more information and stay updated on the company's performance by visiting GuruFocus.com.

Explore the complete 8-K earnings release (here) from Columbia Sportswear Co for further details.

This article first appeared on GuruFocus.