Columbia Sportswear (COLM) Down More Than 15% YTD: Here's Why

Columbia Sportswear Company COLM appears troubled by high SG&A costs. Economic aspects like inflation, supply-chain headwinds and changing consumer behavior are also weighing on the company’s performance. In addition to this, volatile currency movements have been a downside.

These aspects were witnessed in the company’s second-quarter 2023 results, wherein management lowered its overall guidance for 2023. The Zacks Consensus Estimate for the third quarter and 2023 earnings per share (EPS) has gone down from $1.95 to $1.68 and from $5.23 to $4.60, respectively, over the past 30 days.

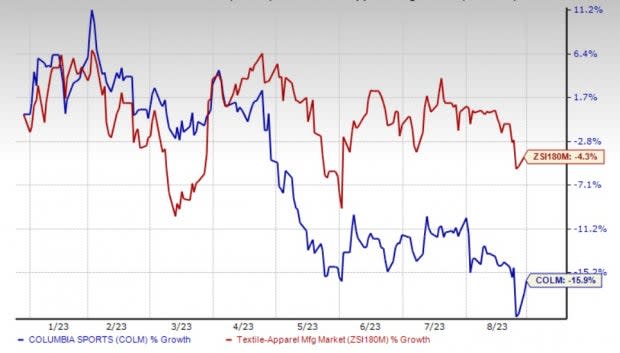

Shares of this Zacks Rank #4 (Sell) company have tumbled 15.9% year to date compared with the industry’s decline of 4.3%.

Columbia Sportswear Company Price, Consensus and EPS Surprise

Columbia Sportswear Company price-consensus-eps-surprise-chart | Columbia Sportswear Company Quote

Lowered 2023 View

Columbia Sportswear operated amid a dynamic landscape in the second quarter. While some International markets like China performed well, the company battled increased hurdles in the United States. Due to year-to-date results and ongoing business trends, management remains conservative about the rest of the year.

Management’s guidance for the full-year 2023 considers estimates as of Aug 1, 2023 related to the impact of economic conditions. These include inflation, supply-chain headwinds, geopolitical tensions, changing consumer behavior and increased marketplace inventories. For 2023, Columbia Sportswear now expects net sales to grow 2-3.5% to the $3.53-$3.59 billion band. The metric was earlier anticipated to rise 3-6% to the $3.57-$3.67 billion range.

Management envisions EPS for 2023 in the range of $4.40-$4.65 now compared with the prior view in the band of $5.15-$5.40. The third-quarter EPS is envisioned in the band of $1.60-$1.70 compared with $1.80 reported in the year-ago period.

High SG&A Costs to Hurt Operating Margin

Columbia Sportswear has been seeing higher SG&A costs for a while now. In the second quarter of 2023, the company’s SG&A expenses escalated by 11% to $312.5 million. As a percentage of sales, the same expanded from 48.7% to 50.3%. The year-over-year rise in SG&A expenses can be attributed to elevated costs related to the supply chain, direct-to-consumer (DTC) and technology. As a percentage of net sales, SG&A expenses are anticipated in the range of 40.1-40.5% now compared with the 39-39.2% expected earlier.

For 2023, the operating income is expected in the band of $348-$368 million, with the operating margin expected at 9.8-10.3%. Earlier, the operating income was expected in the range of $413-$432 million, with the operating margin expected at 11.6-11.8%. In 2022, the company reported an operating margin of 11.3%.

In the third quarter of 2023, the operating income is likely to come in the range of $132-$138 million, with the operating margin expected at 13.2-13.6%. This suggests a decline from the operating margin of 15.2% reported in the third quarter of 2022.

Image Source: Zacks Investment Research

Currency Volatility

Due to exposure in international markets, Columbia Sportswear is prone to currency fluctuations. The weakening of foreign currencies against the U.S. dollar may require the company to either raise prices or contract profit margins in locations outside the United States. Therefore, unfavorable currency movements remain a threat to the company’s profitability.

COLM expects foreign currency translation to hurt net sales growth by roughly 30 bps in 2023. It expects foreign currency translation to hurt earnings by 3 cents in 2023.

While Columbia Sportswear’s diversified business model and brand strength bode well, we cannot ignore SG&A cost hurdles and concerns surrounding the economic landscape in the near term.

Take a Look at These Solid Picks

Three better-ranked stocks include Guess?, Inc. GES, Crocs, Inc. CROX and American Eagle Outfitters, Inc. AEO.

Guess?, which designs, markets, distributes and licenses lifestyle collections of apparel and accessories, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GES’ current financial-year revenues and EPS suggests growth of 3.3% and 8.8%, respectively, from the year-ago reported figure. Guess? has a trailing four-quarter earnings surprise of 43.4%, on average.

Crocs, which offers casual lifestyle footwear and accessories, carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Crocs’ current financial-year sales and earnings suggests growth of 12.9% and 11.2% from the year-ago period. CROX has a trailing four-quarter earnings surprise of 19.9%, on average.

American Eagle, a specialty retailer, currently carries a Zacks Rank #2. AEO has a trailing four-quarter earnings surprise of 9.2%, on average.

The Zacks Consensus Estimate for American Eagle’s current financial-year earnings suggests growth of 8.3% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report