Columbia Sportswear (COLM) Focuses on DTC Growth, Innovation

Columbia Sportswear COLM is witnessing favorable results from its ongoing brand-enhancement initiatives. These efforts have contributed to increased brand engagement and consumer loyalty. Additionally, the company's direct-to-consumer e-commerce operations have proven to be advantageous, providing a convenient and accessible channel for customers to purchase their products.

By leveraging these strategies, the company is effectively expanding its market reach and driving growth in the competitive outdoor and textile-apparel manufacturing industry.

Taking Time for Introspection

Columbia Sportswear is steadfast in its commitment to strategic priorities, with particular emphasis on demand-creation investments to boost brand awareness and drive sales. The company is dedicated to enhancing consumers' experiences by investing in digital capabilities across all networks and regions.

Additionally, Columbia Sportswear is actively exploring growth opportunities in the direct-to-consumer (DTC) business and streamlining support processes.

In the first quarter of 2023, overall DTC sales jumped 4% and 7% at cc from previous year. The company’s U.S. net sales rose 3%, driven by DTC brick & mortar, and wholesale strength. DTC e-commerce has been performing well, with more consumers opting to shop online. This channel is likely to continue performing well in the forthcoming periods.

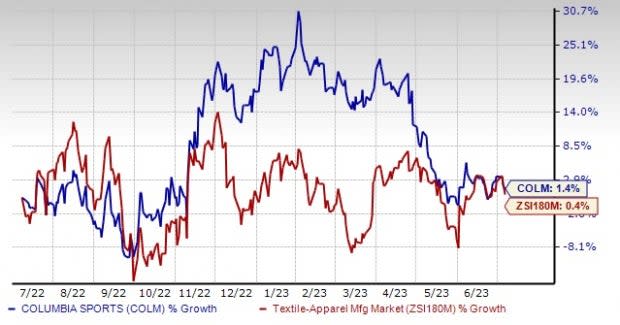

Image Source: Zacks Investment Research

What’s More?

In the first quarter, management expressed optimism regarding the innovative products slated for the summer season. The company is also directing marketing investments toward the footwear and apparel categories. Columbia Sportswear's primary objectives revolve around accelerating profitable growth, fostering brand engagement and enhancing the overall consumer experience.

Notably, the introduction of Omni-Shade Broad Spectrum in the quarter demonstrates the company's ongoing commitment to innovation. Father’s Day stands out as the prime seasonal sales period for the Columbia brand, and the performance of its PEG line truly excels during this time.

In previous endeavors, Columbia Sportswear launched its fifth annual Star Wars collection in December 2020. This collaboration, inspired by the popular Disney series, garnered a tremendous consumer response. The company's consistent focus on innovation continues to attract a growing consumer base and drive sales.

Bringing to a close

With a strong vision and strategic focus, Columbia Sportswear is well-positioned to seize growth opportunities. By investing in priorities like innovation, brand engagement, consumer experience, marketplace excellence, and talent empowerment, the company aims to drive profitable growth, and deliver differentiated, functional and innovative products, while upholding its core values.

COLM expects net sales growth of 3-6% for 2023, with the gross margin expanding 60 basis points.

SG&A expenses are likely to grow faster than sales. The company expects a rise in SG&A expenses due to increased omnichannel spend, elevated supply-chain costs, escalated compensation expenses, higher technology spend and a rise in demand spend. Foreign currency translation is predicted to adversely impact net sales growth by 20 basis points.

Shares of this Zacks Rank #3 (Hold) company have risen 1.4% in the past year compared with the industry’s growth of 0.4%.

3 Picks You Can’t Miss Out On

Here we have highlighted three better-ranked stocks, namely American Woodmark AMWD, GIII Apparel Group GIII and The Beachbody Company BODY.

American Woodmark, which is the third-largest manufacturer of kitchen and bath cabinets, currently sports a Zacks Rank #1 (Strong Buy). The expected EPS growth rate for three to five years is 13%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Woodmark’s current-quarter EPS suggests growth of 22.8% from the year-ago reported figure. American Woodmark has a trailing four-quarter earnings surprise of 26.8%, on average.

GIII Apparel Group, which is a manufacturer, designer and distributor of apparel and accessories, flaunts a Zacks Rank #1 at present. The expected EPS growth rate for three to five years is 15%.

The Zacks Consensus Estimate for GIII Apparel Groups’ current financial-year sales and earnings suggests growth of 1.9% and 0.4% from the year-ago period. GIII has a trailing four-quarter earnings surprise of 47.4%, on average.

Beachbody, which is a digital fitness and nutrition subscription company, currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 38.7%.

The Zacks Consensus Estimate for Beachbody’s current financial-year earnings suggests growth of 65.2% from the year-ago period's reported figure. BODY has a negative trailing four-quarter earnings surprise of 22.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

American Woodmark Corporation (AMWD) : Free Stock Analysis Report

The Beachbody Company, Inc. (BODY) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report