Columbia Sportswear (COLM) Focuses on Growth of DTC Business

Columbia Sportswear COLM is poised for continued success in the outdoor and lifestyle products industry, thanks to its strategic vision and unwavering commitment to excellence of global distribution. Overcoming supply-chain challenges, Columbia has successfully restored its wholesale on-time delivery rates to the pre-pandemic levels.

To drive profitable growth, Columbia remains committed to key strategies, such as creating iconic and innovative products, enhancing brand engagement through focused demand creation investments, improving consumer experiences, amplifying marketplace excellence through digital channels, and empowering a diverse and inclusive workforce aligned with core values.

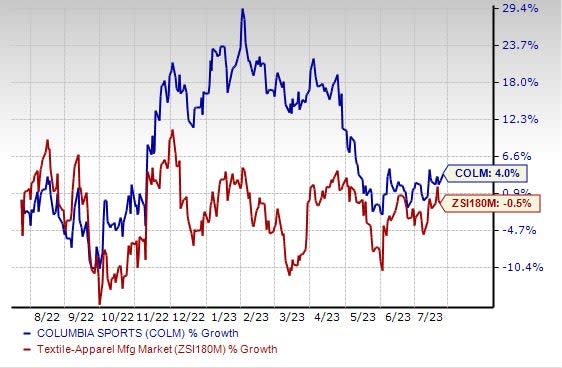

Image Source: Zacks Investment Research

Let’s Introspect

Columbia Sportswear remains resolute in prioritizing its strategic objectives, placing significant focus on demand-creation investments to elevate brand recognition and stimulate sales. Moreover, the company is unwavering in its dedication to enriching consumer experiences through substantial investments in digital capabilities across various platforms and global regions.

Columbia Sportswear is proactively exploring avenues for growth in the direct-to-consumer (DTC) sector and optimizing support processes to streamline operations. In the first quarter of 2023, overall DTC sales jumped 4% and 7% at cc from the previous year. DTC e-commerce has been performing well, with more consumers opting to shop online. This channel is likely to continue performing well in the forthcoming periods.

In the first quarter of 2023, looking ahead to the summer, the company boasts a compelling portfolio of sun protection and cooling technologies, including its latest innovation, Omni-Shade Broad Spectrum. Additionally, Columbia is making targeted marketing investments in footwear and apparel. Notably, its largest PFG campaign to date is titled "Protect What You Love."

Bringing to a close

With a solid start to 2023, Columbia Sportswear is confident about its full-year net sales outlook and aims to reduce inventory levels while prioritizing profitability. Benefiting from a strong financial position, the company is well-prepared to navigate economic uncertainties.

COLM expects net sales growth of 3-6% for 2023, with the gross margin expanding 60 basis points to 50 percent of net sales from the 49.4 percent of net sales reported in 2022.

SG&A expenses are likely to grow faster than sales. The company expects a rise in SG&A expenses due to increased omnichannel spend, elevated supply-chain costs, escalated compensation expenses, higher technology spend and a rise in demand spend. Foreign currency translation is predicted to adversely impact net sales growth by 20 basis points.

Shares of this Zacks Rank #3 (Hold) company have risen 4% in the past year against the industry’s decline of 0.5%.

3 Better-Ranked Picks You Can’t Miss

Here we have highlighted three better-ranked stocks, namely American Woodmark AMWD, lululemon athletica LULU and Ralph Lauren RL.

American Woodmark, which is the third-largest manufacturer of kitchen and bath cabinets, currently sports a Zacks Rank #1 (Strong Buy). The expected EPS growth rate for three to five years is 13%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Woodmark’s current-quarter EPS suggests growth of 22.8% from the year-ago reported figure. The company has a trailing four-quarter earnings surprise of 26.8%, on average.

lululemon athletica, which is a yoga-inspired athletic apparel company, has a Zacks Rank #2 (Buy) at present. The expected EPS growth rate for three to five years is 20%.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and earnings suggests growth of 17.1% and 18.4% from the year-ago period’s actuals. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Ralph Lauren, which is a major designer, marketer and distributor of premium lifestyle products, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 13.8%.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and earnings suggests growth of 2.8% and 13.1% from the year-ago period’s actuals. RL has a trailing four-quarter earnings surprise of 17.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

American Woodmark Corporation (AMWD) : Free Stock Analysis Report