Columbia Sportswear's (COLM) DTC Sales Aid Amid High SG&A Costs

Columbia Sportswear Company COLM has been on track with its strategic priorities in a tough operating landscape. On its last earnings call, management stated that consumer demand for soft goods, including apparel and footwear, remains sluggish.

The company has been focused on lowering its inventory. Also, considering the near-term volatility, management is focused on undertaking measures to manage costs and offer innovation to its customers. Columbia Sportswear’s brand-enhancement initiatives bode well.

Factors Working Well

As part of its strategic priorities, Columbia Sportswear has been continuing with its demand creation investments, which are aimed at driving brand awareness and aiding sales. Further, the company is committed to enhancing consumers’ experience and its digital capacity in all networks and regions.

Columbia Sportswear has been exploring growth opportunities in the direct-to-consumer (DTC) business and improving support processes. Finally, the company has been keen on investing in its people and optimizing its organization across its brand portfolio.

COLM has been expanding its global DTC business through accelerated investments. In the third quarter of 2023, overall DTC sales jumped 4% to $321.4 million. Within the DTC channel, brick-and-mortar sales have been outdoing e-commerce due to a competitive and promotional landscape. DTC brick-and-mortar sales increased in the mid-single digits in the third quarter due to sales from the new stores opened last year and higher sales from temporary outlet stores.

The company’s brand-enhancing and unique marketing initiatives have been strengthening its presence in the apparel industry. COLM has been undertaking regular innovation for a while now. Its Omni-Heat Infinity remains one of the fastest-growing parts of its business.

Columbia Sportswear is on track to launch its latest Star Wars collection and is also making expansions to Omni-Heat Helix. On its third-quarter 2023 earnings call, the company stated that it is gearing up for its crucial selling season by undertaking brand enhancements and marketing activations to drive sales.

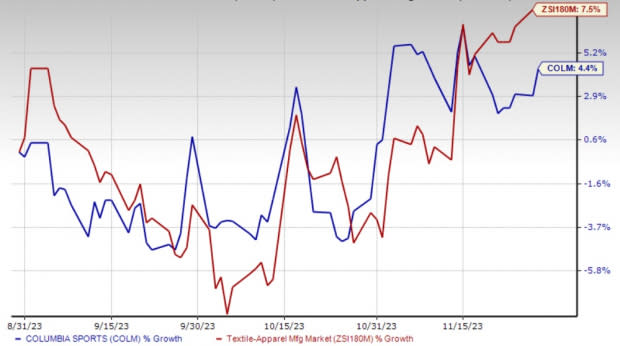

Image Source: Zacks Investment Research

Is All Rosy for COLM?

Due to a soft start to the fall season and a cautious view for the rest of the year, the company expects a decline in fourth-quarter sales. For the fourth quarter of 2023, management expects net sales to decline 10-5% to the $1,054-$1,106 million range. For 2023, Columbia Sportswear now expects net sales to grow 0.5-2% to the $3.48-$3.53 billion band. The metric was earlier anticipated to rise 2-3.5% to the $3.53-$3.59 billion band.

Columbia Sportswear has been seeing higher SG&A costs for a while now. In the third quarter of 2023, SG&A expenses escalated by 10% to $351.6 million. As a percentage of sales, the same expanded 230 bps to 35.7%. The year-over-year rise in SG&A expenses can be attributed to elevated costs related to the supply chain, demand creation and DTC. As a percentage of net sales, SG&A expenses are anticipated in the range of 40.2-40.6% now compared with the 40.1-40.5% expected earlier. In 2022, the metric came in at 37.7%.

Although management raised its earnings per share (EPS) guidance for 2023, it still suggests a decline from 2022. The company envisions EPS for 2023 in the range of $4.45-$4.70 now compared with the prior view of $4.40-$4.65. This compares with $4.95 recorded in 2022. The fourth-quarter EPS is envisioned in the band of $1.93-$2.18 compared with $2.02 reported in the year-ago period.

Management also anticipates economic and geopolitical uncertainty for 2024. It expects the first half of 2024 to remain challenging, including a low-double-digit decline in wholesale net sales. However, a focus on brand enhancement and cost-containment efforts are likely to work well for this Zacks Rank #3 (Hold) company.

Shares of COLM have increased 4.4% in the past three months compared with the industry’s rise of 7.5%.

3 Solid Bets

The apparel company, PVH Corp. PVH, currently carries a Zacks Rank #2 (Buy). PVH has a trailing four-quarter earnings surprise of 22.8%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

The Zacks Consensus Estimate for PVH Corp.’s current financial-year sales and earnings indicates growth of 3.7% and 15.3%, respectively, from the year-ago reported numbers.

American Eagle Outfitters, Inc. AEO, which is a specialty retailer providing clothing, accessories and personal care products, currently carries a Zacks Rank #2. AEO has a trailing four-quarter earnings surprise of 23%, on average.

The Zacks Consensus Estimate for American Eagle’s current financial-year sales and earnings indicates growth of 3.7% and 37.1%, respectively, from the year-ago reported numbers.

Abercrombie & Fitch ANF, a specialty retailer, currently has a Zacks Rank #2.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 12.3% from the year-ago reported number. ANF’s bottom line has outpaced the Zacks Consensus Estimate by a wide margin in the trailing four quarters, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report