Columbus McKinnon Corp Reports Robust Operating Income and Sales Growth in Q3 FY2024

Net Sales Growth: 10.3% increase to $254.1 million in Q3 FY2024.

Operating Income Surge: 33% rise to $26.9 million, reflecting operational leverage and efficiency.

Gross Margin Expansion: Improved by 130 basis points to 36.9%.

Net Income: Decreased by 19.1% to $9.7 million, with diluted EPS at $0.34.

Cash Flow Strength: Net cash from operating activities up 69% in the first nine months of FY2024.

Future Outlook: Q4 FY2024 net sales expected to be between $260 million and $270 million.

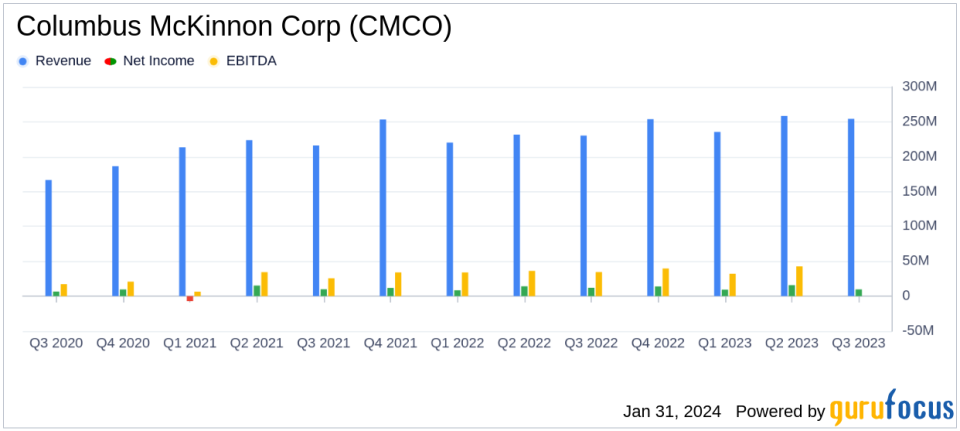

On January 31, 2024, Columbus McKinnon Corp (NASDAQ:CMCO) released its 8-K filing, detailing a strong performance for the third quarter of fiscal year 2024, which ended on December 31, 2023. The company, a leader in intelligent motion solutions for material handling, reported a significant 33% increase in operating income and a 10% rise in net sales, with the latter reaching $254.1 million. This growth was primarily driven by robust sales across all product platforms, particularly the precision conveyance segment.

Financial Highlights and Company Performance

Columbus McKinnon's financial achievements this quarter are particularly noteworthy given the challenges in the global economic environment. The company's strategic focus on operational initiatives has resulted in improved productivity, reduced lead times, and an enhanced customer experience. The 130 basis point expansion in gross margin to 36.9% underscores the company's ability to leverage its Columbus McKinnon Business System (CMBS) and 80/20 process to drive year-over-year improvements.

Despite the positive trends in sales and operating income, net income saw a decrease of 19.1% to $9.7 million, with diluted earnings per share (EPS) falling to $0.34. This decline is attributed to various factors, including the amortization of intangible assets related to acquisitions. However, the company's adjusted diluted EPS, which excludes these amortization effects, stood at $0.74, representing a 2.8% increase from the prior-year period.

Operational and Strategic Developments

The quarter also saw Columbus McKinnon complete the construction and occupancy of a new state-of-the-art manufacturing center of excellence in Mexico, which is expected to provide significant growth capacity and cost savings over time. The company's strong order book, coupled with an encouraging funnel for both short cycle and large projects, positions it well to continue executing its strategy to become a leader in intelligent motion solutions.

President and CEO David J. Wilson commented on the results, stating:

"We are pleased with the strong orders, sales, operating income and cash flow generation we delivered in the quarter. Our team continued to execute commercial and operational initiatives, improving productivity, reducing lead times, and enhancing our customer experience. Our top-line growth translated to expanded operating margin demonstrating the incremental leverage of our business as we continue to drive year-over-year improvements leveraging CMBS and the 80/20 process."

Looking Ahead

For the fourth quarter of fiscal 2024, Columbus McKinnon anticipates net sales to be in the range of approximately $260 million to $270 million, signaling a year-over-year growth of 4% at the midpoint. This guidance reflects the company's confidence in its strategic direction and its ability to generate meaningful shareholder value.

Value investors and potential GuruFocus.com members interested in the farm and heavy construction machinery industry may find Columbus McKinnon's performance indicative of the company's resilience and strategic acumen in navigating a complex market landscape. The company's commitment to operational excellence and strategic growth through acquisitions, such as montratec, positions it as a compelling investment consideration.

For a detailed analysis of Columbus McKinnon's financials and future prospects, readers are encouraged to visit GuruFocus.com for comprehensive investment insights and tools.

Explore the complete 8-K earnings release (here) from Columbus McKinnon Corp for further details.

This article first appeared on GuruFocus.