Comcast Corp (CMCSA) Reports Record Results and Dividend Increase for Q4 2023

Revenue Growth: Q4 revenue increased by 2.3% year-over-year to $31.25 billion.

Net Income Surge: Annual net income attributable to Comcast soared by 186.5% to $15.38 billion.

Adjusted EPS: Q4 Adjusted EPS rose by 2.4% to $0.84, with a full-year increase of 9.3%.

Free Cash Flow: Q4 Free Cash Flow jumped by 28.5% to $1.7 billion.

Dividend Hike: Dividend increased by 6.9% to $1.24 per share for 2024, marking the 16th consecutive annual rise.

Share Repurchase: New share repurchase program authorized at $15 billion.

Peacock Growth: Peacock paid subscribers surged nearly 50% year-over-year to 31 million.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 25, 2024, Comcast Corp (NASDAQ:CMCSA) released its 8-K filing, showcasing a robust financial performance for the fourth quarter and full year of 2023. The company, which is composed of a core cable business, NBCUniversal, and Sky, demonstrated resilience and growth across its diverse portfolio.

Comcast's core cable business serves nearly half of the U.S. with television, internet, and phone services, with NBCUniversal and Sky further expanding the company's reach in content and international markets. The company's strategic investments and operational excellence have led to significant financial achievements, particularly in its Connectivity & Platforms businesses and Theme Parks, which reported the highest Adjusted EBITDA on record.

Financial Performance Overview

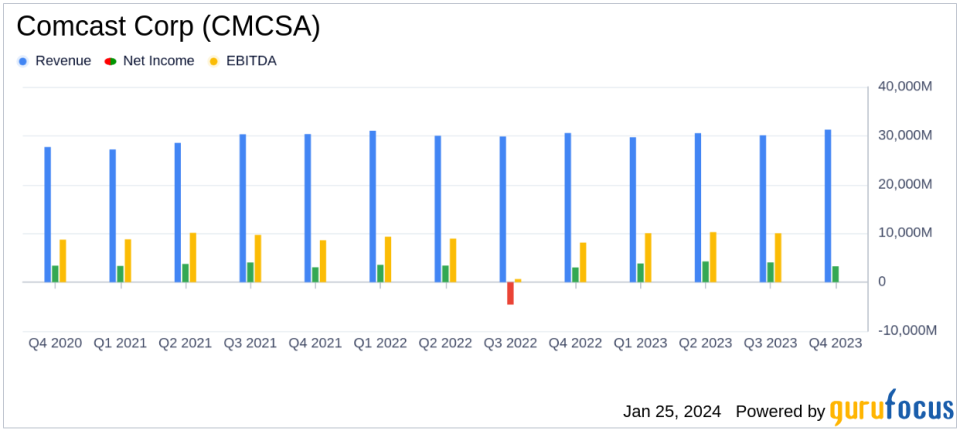

Comcast's financial results reflect a company that is not only growing but also efficiently managing its operations. The 2.3% increase in Q4 revenue to $31.25 billion and the substantial 186.5% increase in annual net income to $15.38 billion underscore the company's ability to scale and monetize its offerings effectively. Adjusted EBITDA saw a modest 0.1% increase in Q4, but a more substantial 3.2% growth for the full year, indicating consistent operational profitability.

The company's Adjusted EPS for Q4 grew by 2.4% to $0.84, with a full-year increase of 9.3% to $3.98, reflecting prudent cost management and a focus on high-margin areas. Free Cash Flow in Q4 showed a remarkable 28.5% increase to $1.7 billion, demonstrating Comcast's strong cash generation capabilities.

Capital Allocation and Shareholder Returns

Comcast's commitment to shareholder returns is evident in its increased dividend and share repurchase program. The dividend increase to $1.24 per share represents a 6.9% rise from the previous year, marking the 16th consecutive year of dividend growth. The new $15 billion share repurchase authorization further underscores the Board's confidence in the company's future prospects.

Operational Highlights and Strategic Initiatives

Operationally, Comcast has continued to expand and upgrade its network, fueling broadband growth and driving a 3.9% increase in domestic broadband average rate per customer. The company's wireless segment also saw robust growth, with a 24% year-over-year increase in domestic wireless lines, reaching 6.6 million.

Peacock's performance stands out, with paid subscribers nearing 50% growth compared to the previous year, reaching 31 million. This growth in subscribers, coupled with a 57% increase in Q4 revenue surpassing $1 billion, positions Peacock as a rapidly growing player in the streaming market.

Comcast's Studios segment achieved the #1 rank in worldwide box office for the year, driven by hits like "Super Mario Bros. Movie," "Oppenheimer," and "Fast X." Theme Parks also contributed to the company's success, generating record Adjusted EBITDA for both Q4 and the full year.

Financial Tables and Metrics

Key financial details from the Income Statement, Balance Sheet, and Cash Flow Statement highlight Comcast's solid financial position. Important metrics such as the Adjusted EBITDA margin, which increased by 90 basis points to 37.1% for Connectivity & Platforms, reflect the company's operational efficiency. The consistent growth in revenue and Adjusted EBITDA across various segments, despite challenges such as severance costs and currency fluctuations, demonstrates Comcast's robust business model.

"We capped off 2023 and the fourth quarter with excellent operational and financial performance," said Brian L. Roberts, Chairman and Chief Executive Officer of Comcast Corporation. "For the third consecutive year, we generated the highest Revenue, Adjusted EBITDA and Adjusted EPS in our company's history."

In conclusion, Comcast Corp (NASDAQ:CMCSA)'s latest earnings report reveals a company that is not only thriving in a competitive landscape but also strategically investing in future growth while delivering substantial returns to shareholders. The company's diversified portfolio, coupled with its operational strengths, positions it well for continued success in the dynamic telecommunications and media industries.

Explore the complete 8-K earnings release (here) from Comcast Corp for further details.

This article first appeared on GuruFocus.