Comcast Is a Free Cash Flow Machine

While Comcast Corp. (CMSCA) has long faced pressure from cord-cutting, the company has continued to grow and generates a lot of cash, allowing it to be one of the most shareholder-friendly around.

Company profile

Comcast is a cable TV and media company. Through its Connectivity & Platform business, it offers cable TV, broadband, phone, wireless and security services for both residential and business customers under the Xfinity brand.

The company's Content & Experience business, meanwhile, includes its broadcast and cable TV network assets, its NBCUniversal and Sky film and TV production studios as well as the Peacock streaming service. The business also houses its Universal theme parks in the U.S., Japan and China.

Opportunities and risks

When you think of cable TV, one of the first things that comes to mind is cord-cutting and the impact it is having on the business. Not surprisingly, Comcast continues to lose video subscribers. In the third quarter, it lost 561,000 video subscribers, while in the fourth quarter it lost 389,000. It ended 2023 with 14.1 million video customers, so it is still seeing meaningful losses each quarter.

This has also started to bleed over into losing broadband customers as well. Comcast saw an unexpected decline in broadband customers in the third quarter, when it lost 18,000 customers. The decline accelerated in the fourth quarter as it lost 34,000 broadband subscribers. It ended the year with 32.25 million broadband subscribers. Now while cord cutting is pretty much a given at this point, it does appear the company is losing some business to its competitors, which is not something that was expected to happen.

Comcast expects the broadband market to be more stable in 2024, but any accelerated cord-cutting and continued loss of broadband customers remain its biggest risks. To counteract the latter, it has invested in connectivity to both pass through more homes and businesses, as well as increase speeds and lower latency through its DOCSIS 4.0 technology. It began rolling out this new technology last fall and will continue to roll it out across the country over the next few years.

One area where the company has been doing well with adding subscribers, meanwhile, is with wireless services. The company is a mobile virtual network operator that uses Verizon's (NYSE:VZ) wireless network. Like most MVNOs, it plans are cheaper than the major carriers, but unlike most MVNOs, it comes with the Xfinity brand name and can be bundled with its other services. This has been helping drive subscribers, with Comcast adding 294,000 subscribers in the third quarter and 310,000 in the fourth quarter. It ended the year with 6.58 million subscribers.

Comcast's Peacock streaming service has also been growing the top line nicely, and it will look to turn the business Ebitda positive in the next couple of years. The streaming service accounted for $2.7 billion in Ebitda losses in 2023, so turning this business profitable is a big opportunity. Peacock grew revenue 57% in the fourth quarter, hitting $1 billion in quarterly revenue. It added 3 million net subscribers, bringing the total up to 31 million with an average revenue per user of $10.

Sports, including having an exclusive NFL playoff game and college events from the Big 10, have helped drive results for Peacock. The streaming platform also has exclusive WWE premium live events, while its movie studio gives it access to top movies, including "Oppenheimer." The summer Olympics will also be on the platform, along with being on its linear networks, in 2024.

Outside of its cable and streaming businesses, Comcast's theme parks and movie studio businesses have been very strong. It was the number one studio in worldwide box office for the full year following several hit movies. Meanwhile, its theme parks had a record year in 2023 with strength both in the U.S. and abroad.

What Comcast does best, however, is generate a lot of cash, which it then returns to shareholders. It generated $13 billion in free cash flow in 2023 even after investing $12.20 billion in capital expenditures. In total, it returned $15.80 billion in capital to shareholders. It bought back $11 billion in stock in 2023, and then re-upped its buyback authorization to $15 billion. Since mid-2021, when it started buying back stock, it has repurchased about 15% of its shares outstanding.

At the same time, Comcast increased its dividend for the 16th straight year. It raised it by 8 cents on an annualized basis, or 6.90%, to $1.24. The stock currently yields about 3%.

Valuation

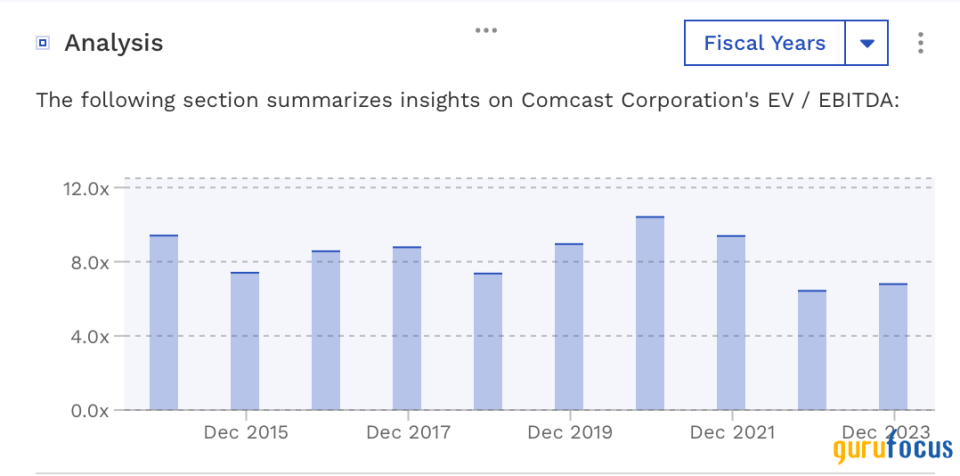

Comcast currently trades at about 6.60 times 2024 Ebitda estimates of $39 billion. Based on the current 2025 Ebitda consensus of $39.9 billion, the stock trades at a 6.4 multiple.

Revenue is projected to grow 2.30% in 2024 and be somewhat flat in 2025.

The company currently has a free cash flow yield of about 8% based on the free cash flow of $13 billion it generated in 2023.

Comcast has generally traded between 7 and 10 times Ebitda over the past several years. If the company were to buy back $10 billion in shares in 2024, it would reduce its share count by about 240 million.

Given its low revenue growth, but solid balance sheet (2.40 times leverage), strong free cash and opportunity to scale and leverage Peacock, I think a 7 to 8 times multiple is fair. Taking into account the share reduction over the next year and placing a 7 to 8 times multiple on 2025 Ebitda would value the stock between $51 and $61.50 in about a year.

Conclusion

Despite facing cord-cutting headwinds for a while now, Comcast has done a nice job of steadily growing its revenue over the years. Peacock should continue to drive revenue growth going forward and eventually get enough scale to turn Ebitda profitable. Meanwhile, I expect the broadband business to be remain steady and for it to continue to gain wireless subscribers.

As such, I think Comcast is a solid choice for dividend growth investors. The company has steadily grown its dividend for over a decade and a half, while more recently it has been aggressively using cash to reduce its share count. With a solid balance sheet and ample free cash flow, I would expect this to continue.

This article first appeared on GuruFocus.